Last week, the Federal Reserve (Fed) increased its benchmark rate by 50 bp to 0.75%-1.00%, the largest single hike since May 2000 in an attempt to tackle a 40-year high in US inflation. In addition to reducing asset holdings, Fed Chair Powell signaled a couple of rate hikes by 50 bp in the coming meetings. He also reiterated that the central bank will go down to rate hikes of 25 bp “if inflation comes down”.

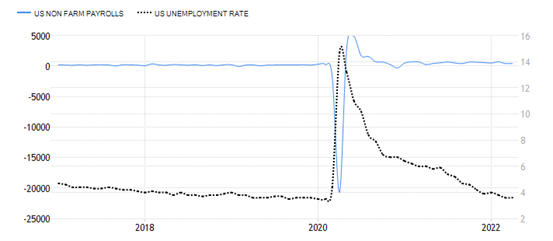

Fig.1: US Non Farm Payrolls and Unemployment Rate. Source: Trading Economics

On the other hand, the Non-Farm Payrolls in April 2022 recorded an increase of 428K in employment, marking job gains above 400K for twelve consecutive months. The unemployment rate stayed flat at the previous level of 3.6%, slightly higher than consensus estimates at 3.5%. Labor force participation marked its lowest level since January, at 62.2%. In addition, average hourly wage hits new low since March 2021, at 0.3% – this may be an indication of inflation slowing down. Regardless of the results, the CME watch tool shows that the Fed’s decision for tightening monetary policy remains unchanged.

Tightening of monetary policy may not be friendly to the stock market. In this circumstance, its fairly essential to locate stocks that could possibly withstand a rising-rate environment. Mastercard Inc. may be one of the candidates. Being one of the conglomerates in the global payment space, Mastercard facilitates payment transactions in more than 200 countries with more than $7 trillion flow through its network and over 2.5 billion cards in circulation. Following the central bank’s rate hike, Mastercard will collect higher fees for each transaction by serving as a middleman between sellers and consumers.

However, it is also worth noting that the economic conditions plays a great role in determining the outlook for the company. If economies fall into recession, reduced demand and spending may inevitably hurt the business of all global payment companies. On a positive note, collaboration with Microsoft and Zeta offers a more competitive edge for Mastercard in aspects such as safety, security, convenience of e-commerce, online banking and contactless transactions.

Technical Overview:

The daily chart shows #Mastercard trading within an ascending wedge, currently testing the lower line at $341.30, or FR 38.2% extended from the highest point ($399.90) in February’22 to the lowest point ($305.15) in March’22. Breaking below the level would indicate bearish possibilities for the company’s share price to test the next support zone $324.00 – $327.50, and $300.15 – $305.15. On the other hand, $352.50 (FR 50.0%) serves as the nearest resistance to watch. A strong candlestick close above the said level as well as the 100-day SMA may suggest more buying pressures towards the next resistance at $363.70 (FR 61.8%) $379.60 (FR 78.6%) and the highest point seen this year at $399.90.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.