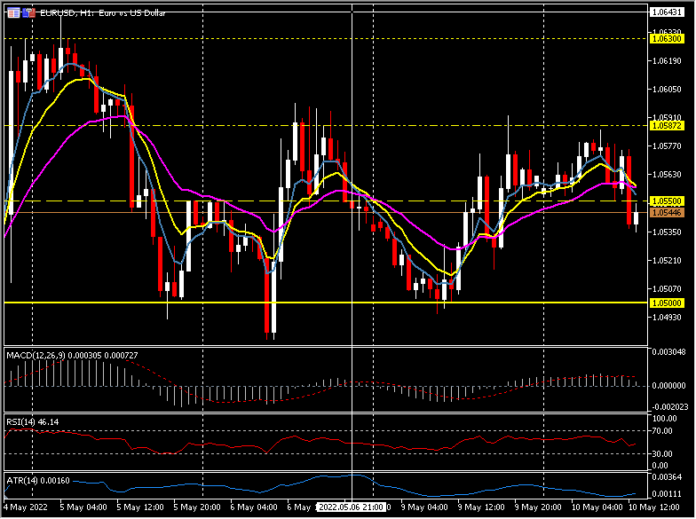

EURUSD, H1

The May German ZEW Investor Sentiment expectations number lifted to -34.3 from -41.0 in April. The current conditions indicator came in weaker than expected at -36.5, down from -30.8 in the previous month, but the improvement in the headline is still a positive surprise, even if the negative reading still flags that pessimists clearly outnumber optimists. Nevertheless, this is the first improvement since February, i.e. the first improvement since the start of the Ukraine war and the data suggests that investors are slowly adjusting to the “new normal”. Readings for short term interest rates in the Eurozone have risen sharply, but respondents seem somewhat more optimistic on the outlook for local stock markets. Hardly a brilliant report, but one that suggests confidence may have passed the nadir – at least for now. Indeed, the ZEW headline reading for the Eurozone also rose sharply to -29.5 in May of 2022, from the more than two-year low of -43.0 in April. Nothing that will really ease concern that the fallout from the Ukraine war is leaving the Eurozone heading for recession once again, but maybe more ammunition for the hawks at the ECB, who are pushing for an early rate hike in July.

The recovery of EURUSD from 1.0500 yesterday held over 1.0550 during the Asian and early European session today ahead of the ZEW data, before dipping. EURGBP pivots around 0.8550 and holds the break of 0.8500 from Thursday, whilst EURJPY holds over 137.00 but again, has not been able to break and hold 138.00, copying moves on both Friday and yesterday.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.