USD started the week off its 20-year highs. China data disappointed –industrial production down -2.9% y/y in April, while retail sales plunged -11.1% y/y. China kept MLF and repo rate rates unchanged. The PBOC disappointed hopes for further easing in light of lockdown measures and kept the MLF policy rate unchanged once again. Stock markets mostly managed gains, but mainland China bourses struggled, after a weak data round that highlighted the negative impact of the country’s zero Covid policy (CSI300 -1% but Nikkei -0.3%). Yields had fallen to their lowest levels in a couple of weeks, which was seen as overdone given inflation remains elevated and the Fed will be maintaining a hawkish policy stance to bring pressures under control. Oil corrected to $108 whilst Gold dipped to $1804.

- USDIndex steady at 104.60.

- Equities – USA500 turned lower (–0.6%) at 3984 now, USA100 fell 0.5%. EUROSTOXX 50 and UK100 futures both eased 0.3%.

- Yields corrected, with a -1.3 bp correction in the 10-year Treasury rate, which is currently at 2.906%.

- Oil also corrected as China jitters clouded over the demand outlook, and USOIL dropped back to currently $108.10 from levels over $111 earlier in the session.

- Gold slump continued with a test of the key $1800 floor.

- Bitcoin languishes at $29K now, after bouncing to $31K early in the morning.

- FX markets – EURUSD sideways between 1.0390 to 1.0415, USDJPY eased to 128.70 and Cable continues to struggle; returned to 1.2200 area. AUD lower in Asia.

Overnight – Shanghai aiming to reopen broadly and allow normal life to resume from June 1. Markets in Thailand, Malaysia and Indonesia were closed for holidays.

Today – The calendar includes the second reading for Eurozone Q1 GDP, which is likely to confirm the quarterly growth rate at 0.2% q/q. BoE Monetary Policy Report Hearings. NY Fed’s Williams will take part in a moderated discussion. The Empire State is expected to fall to 16.0 in May after surging 36.4 points to 24.6 in April.

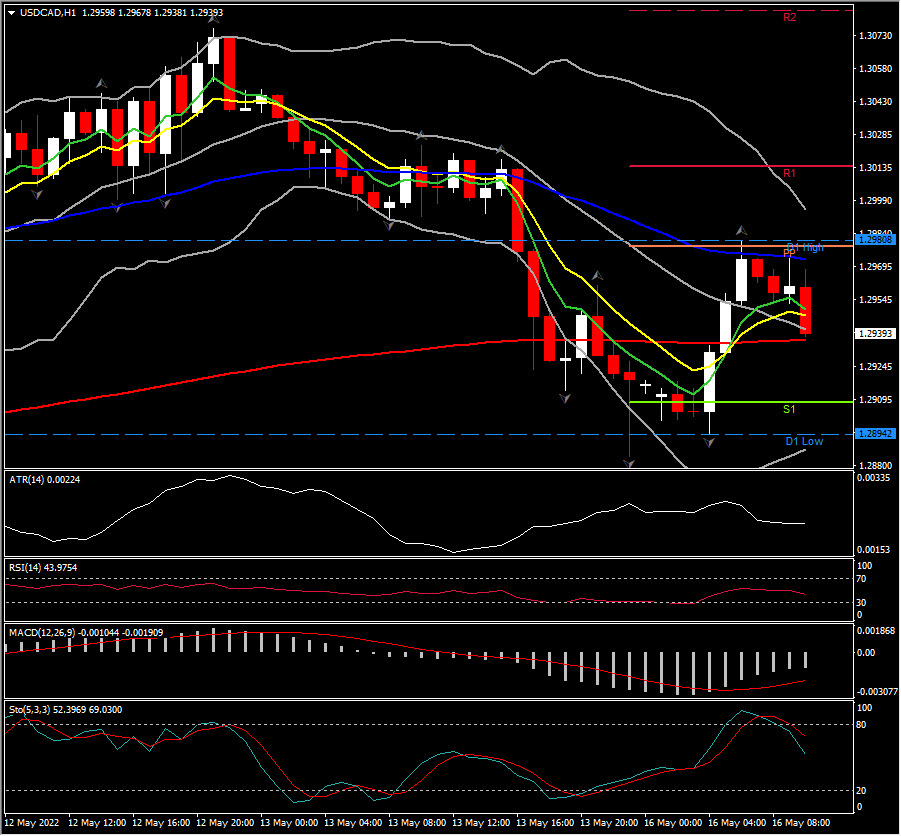

Biggest FX Mover @ (06:30 GMT) CADJPY (+1.44%) Rallied to 1.2980 before pulling back again to 1.2900 lows. Now back to 1.2938. MAs aligning lower but not bearishly crossed yet, MACD signal line & histogram holds below 0, RSI 44 & declining, H1 ATR 0.00225, Daily ATR 0.01077.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.