The stock market rally on Friday last week was quite good, but not enough to give a strong indication that the correction to the March 2020 gains has been completed. However, the attempted rebound that started on Thursday turned into a broad rally into the week’s close, setting the stage for a potentially good start to this week. That puts additional emphasis on this week’s earnings report from major retailer Walmart.

Walmart Inc. will report Q1 2022 earnings on Tuesday, before the market open. This report comes amid rising prices of basic goods against consumer demand. Markets expect Walmart to earn $1.48 per share, down 12%, with revenue largely unchanged at $138.8 billion. Target earnings per share are forecast to fall 17% to $3.06, with earnings up 0.9% to $24.4 billion.

Walmart Inc.’s exposure to low-income buyers who felt inflationary pressures throughout Q1 is causing concern. Coupled with the reduced government stimulus and the recent performance of stocks, it will be quite difficult to generate additional gains from current levels. However, Wall Street is currently posting slightly faster growth across all metrics, suggesting the market believes Walmart has been conservative given the uncertain outlook.

Meanwhile, based on Zacks Investment Research with 12 analyst forecasts, the consensus EPS forecast for the quarter is $1.46. The reported EPS for the same quarter last year was $1.69. Shares are ranked at #4 (SELL).

Technical Overview

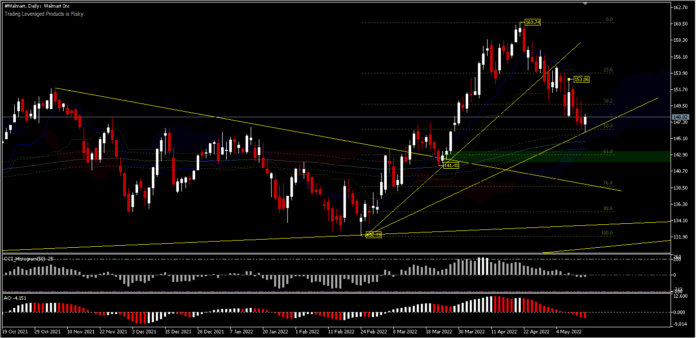

Walmart traded at $148.00 last week, up 0.67% on Friday. Looking back, Walmart stock soared to a new all-time high of $160 last month, but has since fallen back more than 7%.

Trading volume has steadily increased over the past 30 days, suggesting the downtrend could gain momentum and push the stock back towards the 61.8% FR ($143) retracement level, even to the 2022 low of $132. Meanwhile, the closest resistance level is at $153. A better report will support stock prices, while a worse report will send prices down. Technically, Friday’s price bounce is still above the 200 EMA and Kumo, while the 2 oscillation indicators are both in the selling area.

In general, the stock trend is still up, and the current decline is still a correction to the uptrend that has been going on for 2 years.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.