AUDNZD and NZDUSD

The Dollar has been lacking direction so far today, overall, though gained about 1% versus an underperforming New Zealand Dollar, which dropped sharply on the lead of RBNZ’s dovish guidance after the central bank left the official cash rate unchanged. Reserve Bank New Zealand held rates steady at 1.75%, matching widespread expectations. They offered very dovish guidance, saying they expect to keep the OCR at the current level through 2020, longer than projected in the May statement.

NZDUSD is down 1%, making 29-mth low at 0.6664, after RBNZ pushed back its rate hike timeline. As stated on Tuesday’s post, NZD is sharply weaker on the low for long guidance. “Concerns that the deepening Sino-US trade dispute will negatively impact the Chinese economy, which is the biggest market for both Australian and New Zealand exports, have seen market participants demand a higher discount for the antipodean currencies, i.e. AUD, NZD. Actually there are good reasons to expect the trade confrontation to worsen.”.

As mentioned: “The pair has been seen ranging below 50-day SMA within the 0.6713-0.6850 area since the beginning of July, unable to show any gains above it. This keeps the overall outlook strongly to the bearish side, with immediate Support at the bottom of the range, at 0.6713. Hence as long as the trade tensions between US and China ratchet higher along with lack of any change to RBNZ monetary policy on Thursday, NZDUSD is expected to remain in the “trend-following” mode. The initial Support holds at 2-week low, at 0.6713, while on the break of it, the next Support area comes at 0.6675-0.6687 (May 2016 low and 2-year low). Further losses could trigger the movement towards the lower weekly Bollinger Bands line at the round 0.6600 level.”. – Therefore next level to be watched is the round 0.6600 level, while further losses from this level would retest the 0.6550, which is the 76.4 Fibonacci retracement since 2015 dip. The next Support holds down to 0.0.6518 which is the 100.00 Fibonacci extension from the correction to the upside in May.

Hence fundamentals along with geopolitics are expected to hold the NZD in a broadly lower range relative to the USD, while there may be justifiable reason to fade AUDNZD gains, which is at richly priced levels relative to price history over the last 5 years and given the Aussie Dollar’s own vulnerability to an escalating Sino-US trade war.

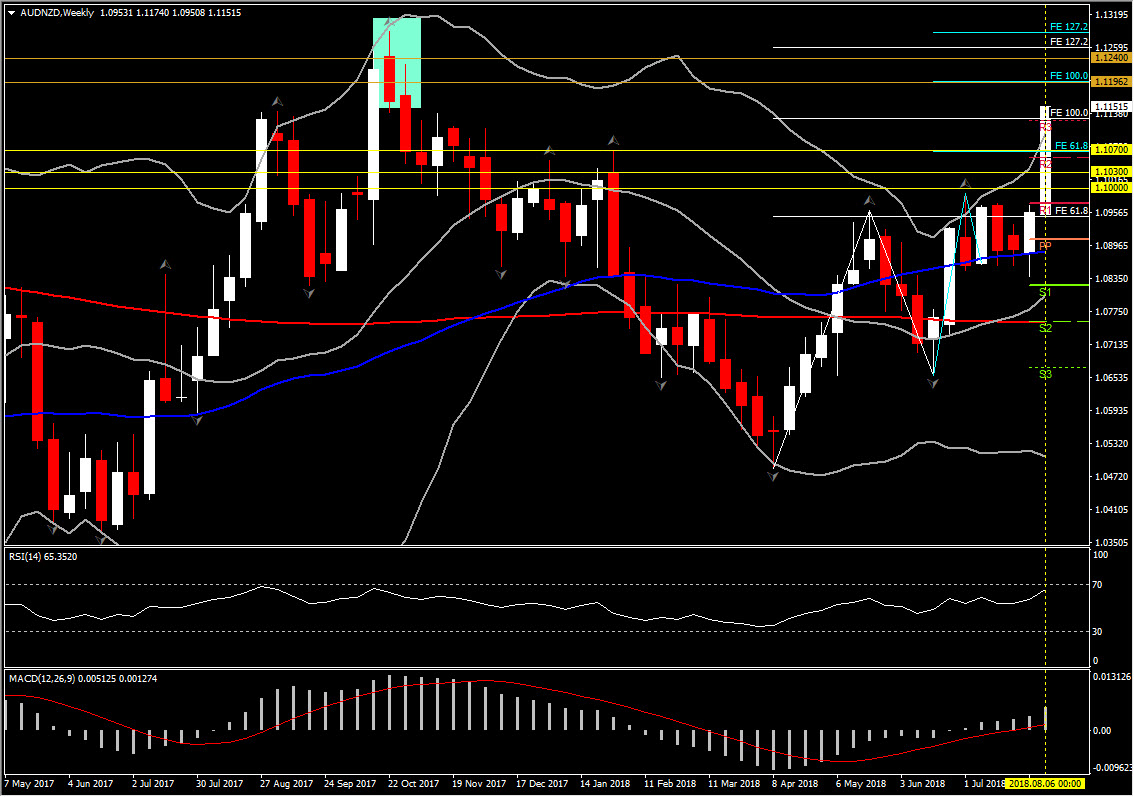

AUDNZD has lifted today to November 2017 levels at 1.1170,after breaking 2018’s Resistance at 1.1070. A Significant trigger for positive reaction of the pair was Tuesday’s close above the round psychological 1.1000 area, which is also the 61.8% Fibonacci level since October 2017 decline, something that traditionally suggest consolidation or retracement reaction. This never happened but oppositely the pair remained on the upside path.

The pair is currently trading at 1.1158, retesting the next immediate Resistance level at 1.1195, which is the 100.00 FE set since the retracement seen on July 3. The next Resistance comes at the 1.1240 which is mid way between the 100.0 and the 127.1 FE set on the big retracement seen at the end of May.

However as the pair presents being overbought in the intraday and daily timeframe, it is likely to see bias turning from bullish to neutral, below the 1.1195 level. The AUDNZD is trading outside the upper Bollinger Bands pattern, while the 200-Day SMA has been flattened, both suggesting consolidation below 1.1195 in the near future. Further gains above it would imply the rest of 1.1240.

The daily momentum indicators are mixed, as RSI is overbought at 77, while MACD lines increase above signal line presenting bullish technical picture. Support area holds at the 2-day peaks and today’s open at 1.1030-1.1070.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/08/09 15:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.