USDCAD, H4 and Daily

The Greenback has also posted gains against most other currencies, most notably the Turkish Lira, which has tumbled to fresh record lows. The Dollar’s ascent has been concomitant with a bout of risk aversion on investor concerns about an escalating trade war, and the impact of US sanctions on Turkey and Iran.

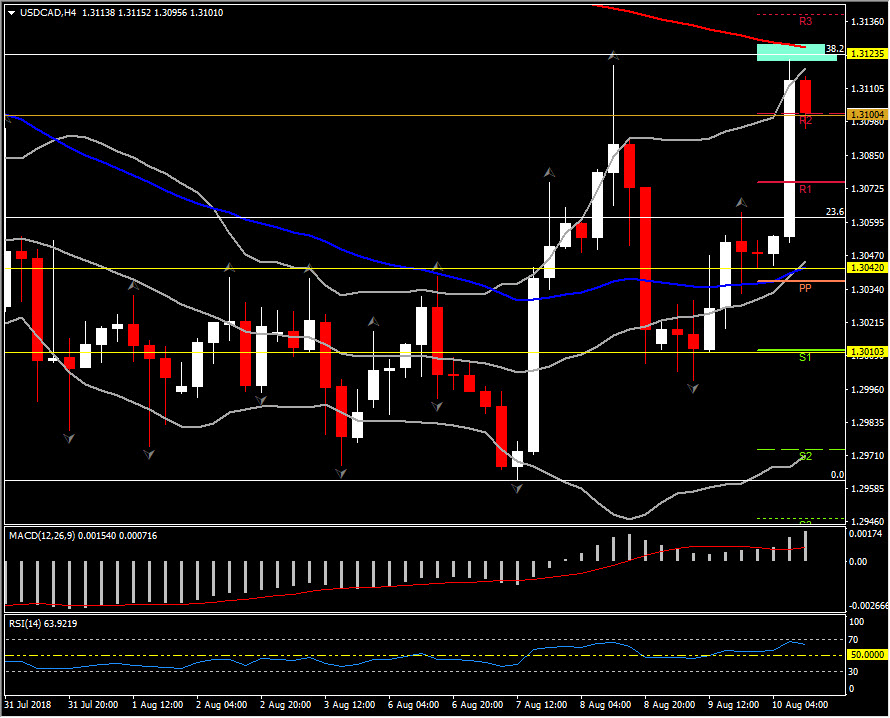

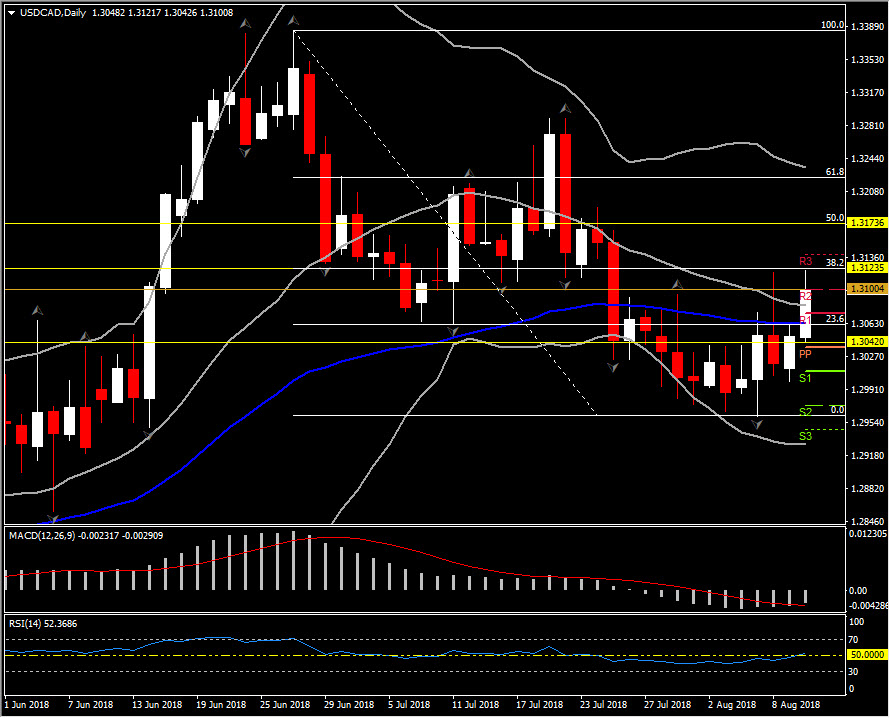

Amid a broad rally in the Greenback and a sharp retreat in Oil prices, USDCAD has lifted for a 2nd day, providing a bearish lead for the Canadian Dollar. The pair is trading in the upper Bollinger Bands pattern, while it managed to extend gains up to 1.3121 above the 50-day SMA, at 1.3115. In the last hourly session, the pair moved southwards, rejecting the latest swing high and the Resistance area at 1.3123-1.3126, which comes between the 38.2% Fibonacci retracement level since 1.3385 peak on July 27 and the 200-period SMA in the 4-hour chart.

Hence the pair still holds a daily Resistance at the significant 1.3100 level. A closing today above this level along with the positive daily momentum indicators would suggest a further move to the upside and a possible retest of the 50.0 Fib. level, around 1.3170 level. RSI just crossed 50 level, while MACD oscillator decreases above its signal line within the negative area, suggesting decline of the negative momentum. Daily Support comes at the confluence of 50-day EMA and the day’s open price at 1.3042.

Intraday, the pair is currently moving below R2, hence next Support holds at R1 at 1.3075. Further losses below 23.6 Fibonacci retracement could suggest a swing further to the downside at 1.3008-10.

Focus will now turn to Canada as it releases its July employment report today, which is widely expected to come in at a 15.0k headline gain following the 31.8k gain in June. The unemployment rate is seen slipping to 5.9% after perking up to 6.0% in June from the 40-year low 5.8% in May. Total average hourly earnings are seen rising at a 3.7% y/y rate in July from the 3.6% clip in June, but still short of the 3.9% growth rate of May.

On the NAFTA front, both Canadian and Mexican officials have been expressing cautious optimism this week. Canada’s ambassador to the US MacNaughton said yesterday that the US and Mexico are getting close on NAFTA auto issues, but that the sunset clause is a sticking point for Canada, and that to get a deal everyone must show flexibility.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/08/14 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.