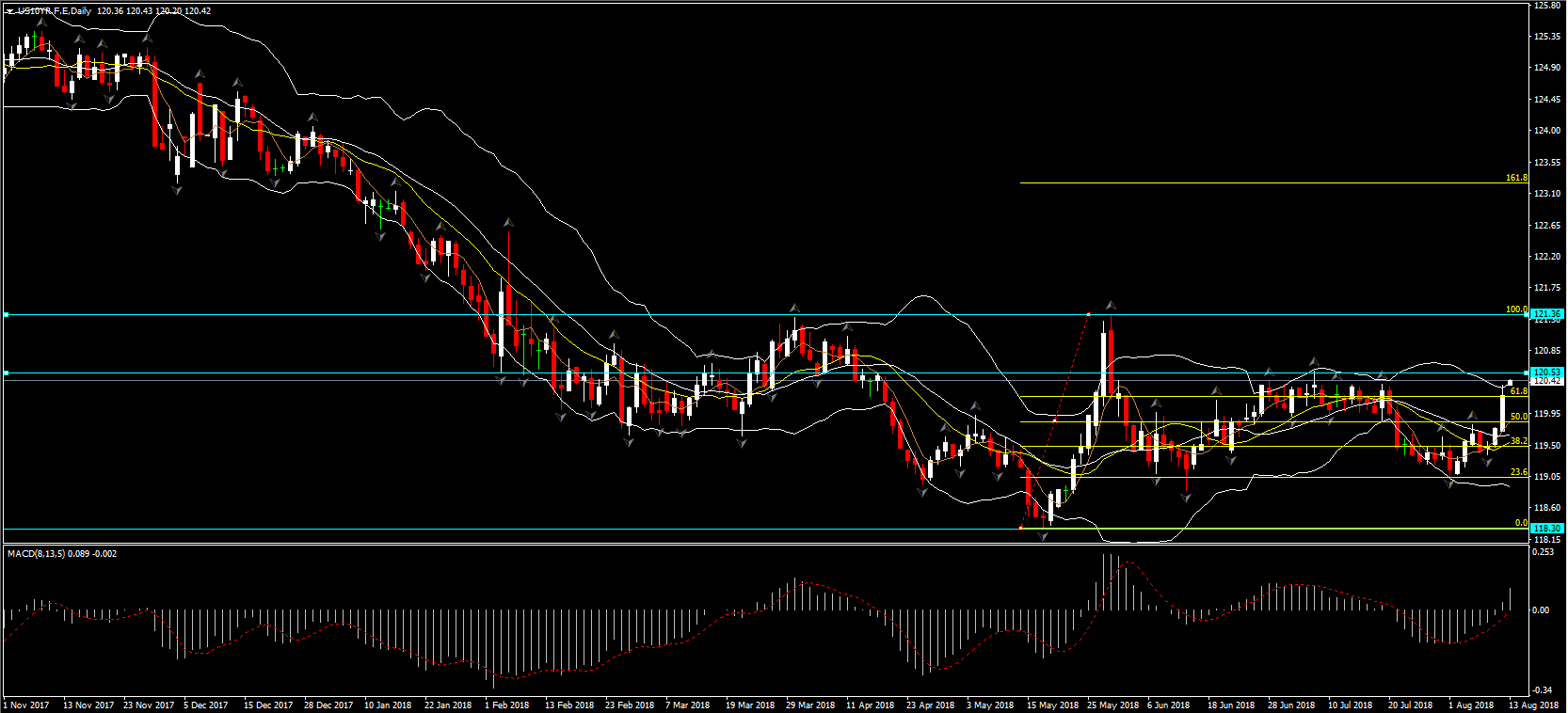

US10YR.F, D1

The US economy appears to have been on a steady increasing trend, and developments in the 10-year bond are supportive. The decline in the bond price and the corresponding increase in the yield since 2017 suggest a reduction in demand for safe assets, a theme which persisted through the crisis, substituting them with riskier assets such as stocks. Reflecting the stability of growth in the US economy, and despite the occasionally turbulent political developments in the country, the 10-year bond future has been fluctuating in the 118.30 – 121.40 range for the last 6 months, not able to break these levels.

In the past days, the bond yield has traded close to the resistance level of 120.18 (Fib 61.8%), during the European trading session, breaking the resistance level at the start of the session, but trading at mildly lower levels since. If the price manages to persist above the Fib 61.8%, then the next resistance point, at approximately 120.50 would be indicative of whether the highs of May could be reached, or whether the price could retract back to what would become the support level. At the moment, the MACD indicator is supportive of a price outbreak. If the price does not cross the Resistance level, then a possible reversal could be expected, with the next Support level standing at 119.80 (Fib 50.0%), also in line with the suggestions of the 5-period Moving Average (orange line) and the most recent Fractal movement.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/08/14 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.