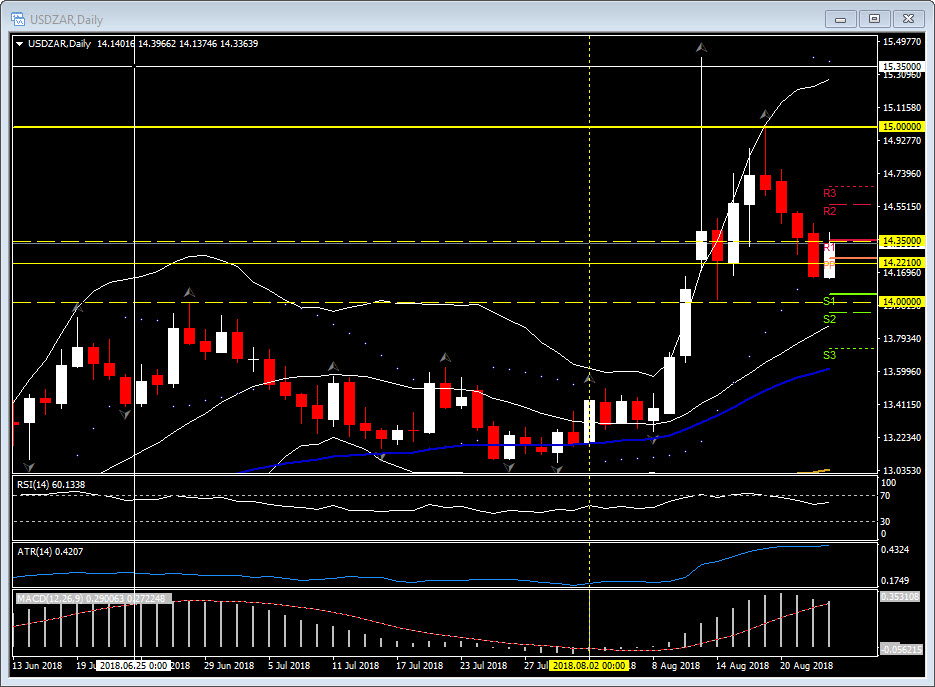

USDZAR, Daily

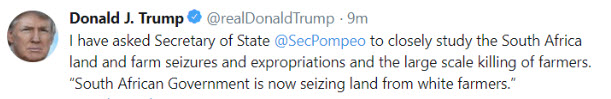

The South African Rand snapped its 4-day bid as President Trump tweeted his thoughts on the land and farm issues swirling in the country.

The tweet brings the USDZAR back into focus following the spike to 15.0000 last week. Last night’s close had suggested more down side as the pair had closed significantly below key Daily (14.3500) and Weekly (14.2210) Support levels. The pair is up over 16% so far this year, and with a USD debt mountain to deal with and deteriorating economic data (CPI rose to 5.1% this week, Retail Sales slipped significantly to 0.7% last week and Unemployment rose to over 6 million last month) the government and South African Reserve Bank (SARB) have plenty on their plate. The SARB meets next month and pressure to raise interest rates will persist, especially following the FOMC minutes last night which more or less confirmed a rise in US rates next month.

Technically, Support sits at the key 14.000 psychological level, S3 at 13.7000 and the 50 day moving average at 13.6000. Currently, with contagion from the crisis in Turkey rippling out a return to 15.0000 cannot be ruled out and beyond that is the Winter 2015/16 highs around 16.0000.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/08/23 15:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Head Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made b