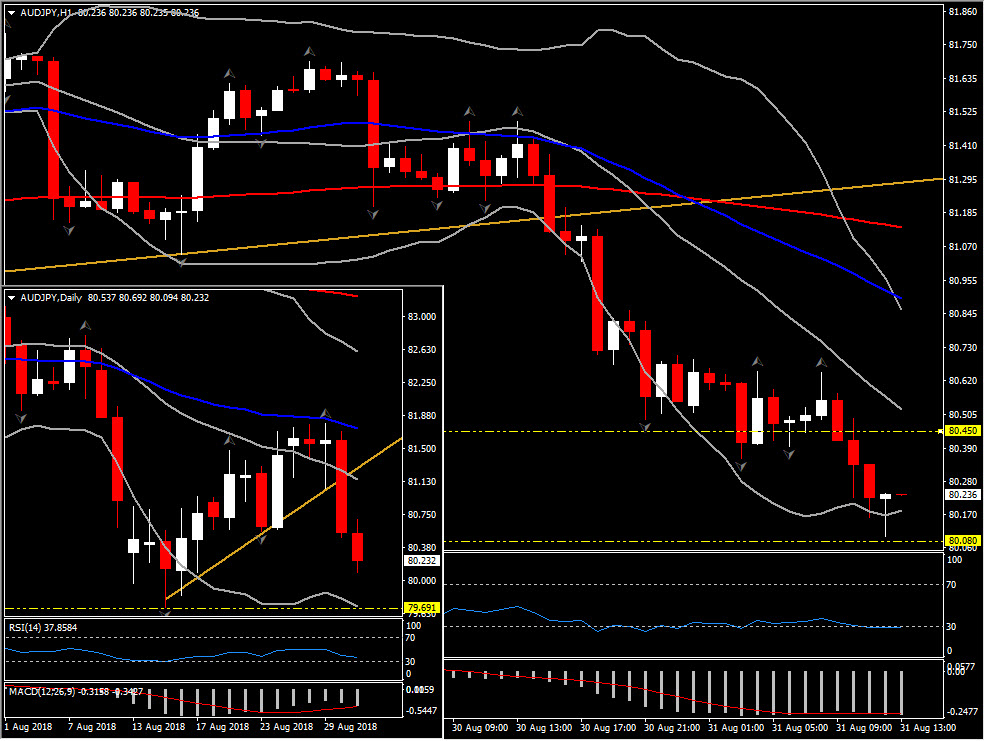

AUDJPY, H1

The Australian Dollar is down sharply amid global risk aversion and Australia’s exposure to China.

Aussie is the biggest mover so far today out of the main currencies, with a loss of 0.6% against the Yen and the Swiss Franc. AUDJPY trades has a relatively high beta characteristic relative to main dollar pairings and cross rates, and losses today are symptomatic of risk aversion in global markets, with the Australian dollar particularly sensitive to Trump’s intentions to proceed with the plan to raise tariffs on $200 Bln of Chinese imports into the US, which is sure to be met with equivalence by Beijing on US imports. China accounts for 35% of the demand for Australian exports, making Australia the most China-dependent developed-world economy. AUDUSD is presently down by 0.3%, and the Aussie Dollar is showing losses of varying degrees to the likes of the Euro and other currencies, with the New Zealand and Canadian Dollars being exceptions, as these are also underperforming.

AUDJPY is trading at 2-week lows, and is near to 22-month low territory. Therefore the overall bearish performance suggests that the trend is likely to continue to the downside, on the anticipation that President Trump could take the Sino-US trade war to the next level.

Resistance Levels: 80.30, 80.45, 80.70

Support Levels: 80.08, 79.95, 79.69

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/04 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.