FX News Today

Asian Market Wrap: Treasury and JGB yields are little changed at 2.86% and 0.10% respectively, as stocks drifted during the Asian session after yesterday’s holiday in the US. Trade concerns and emerging market jitters remain in focus, with the difficult Canada and US talks, and Trump’s latest round of China tariffs high on the agenda. The latter could be announced as early as Thursday. Argentina and Turkey meanwhile are still struggling to regain investor confidence. Turkey’s central bank yesterday vowed to take action, as inflation hit 18%, sparking hopes that the long awaited rate hike will finally come. Argentina, meanwhile, launched fresh measures to stem the crisis. RBA left rates unchanged as expected, but estimated that the economy grew above trend in the first six months of the year and suggested inflation will pick up from 2019.

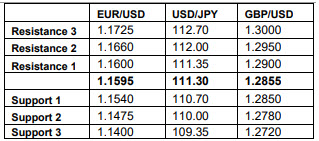

FX Update: The Dollar has traded generally firmer. EURUSD has dipped back under 1.1600, while the Cable has fallen to a one-week low of 1.2843, extending the Pound-driven losses of yesterday after the EU’s Brexit negotiator Barnier all-but rejected the British government’s proposed plan for a new trading deal. The Sterling has also posted fresh lows against the Euro and other currencies. USDJPY has lifted to a three-session high of 111.37, flipping back above the midway mark of the recent range, while AUDJPY, which was a big loser yesterday, has bounced back amid a 1%-plus rally in Chinese equity markets. The Australian Dollar, which has been correlating strongly with Chinese stocks, outperformed the US Dollar, posting a two-session high at 0.7235. Overall, market conditions have been calm today, though there a feeling that a storm is bearing down. Concerns remain about vulnerable foreign-currency indebted emerging market countries, while President Trump looks set to make a big ratchet up in the Sino-US trade war with the imposition of tariff hikes on a further $200 bln of Chinese imports, which, unless he has a sudden change of heart, could happen as soon as Thursday. Canada-US talks on trade will resume tomorrow.

Charts of the Day

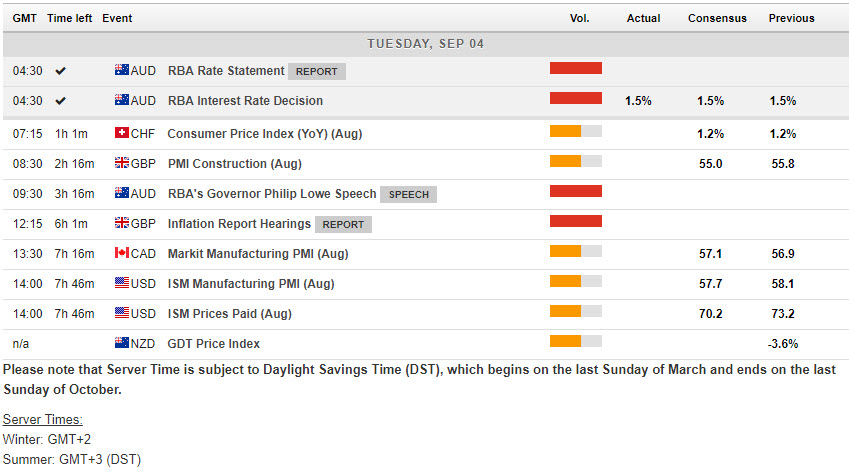

Main Macro Events Today

- UK Construction PMI – Expectations – It is anticipated to dip to 55.0, following July’s 55.8.

- UK Inflation Report Hearings – The BOE Governor and several MPC members testify on inflation and the economic outlook before the Parliament’s Treasury Committee.

- RBA Gov Lowe Speech

- US ISM Manufacturing PMI – Expectations – It is estimated to slip to 58.0 in August, from 58.1 in July, which will still leave the index close to a 14-year high of 60.8 in February.

Support and Resistance Levels

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/04 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.