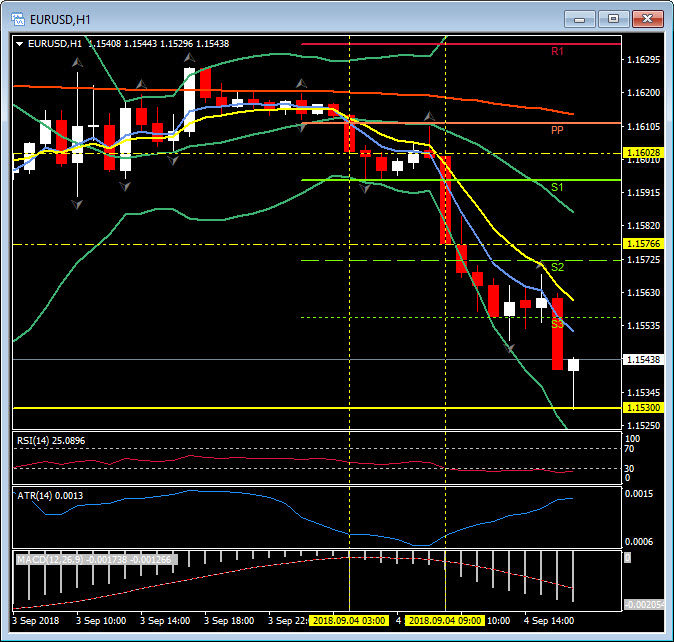

EURUSD, H1

The ISM manufacturing index bounced 3.2 points to 61.3 in August, more than retracing the 2.1 point drop to 58.1 in July. This is a new 14-year high and is the second highest going back over two decades. It was at 59.3 last August. Strength was broad based. The employment gauge rose to 58.5 from 56.5, with new orders at 65.1 from 60.2. New export orders were little changed at 55.2 from 55.3. Imports were 53.9 from 54.7. Price paid slipped to 72.1 from 73.2. This is a much stronger than expected report. Additionally, US construction spending rebounded 0.1% in July, after tumbling 0.8% in June (revised up from -1.1%), while the 1.3% May gain was revised down to 0.7%. Residential construction spending was up 0.6% versus the prior 1.0% decline (revised from -0.5%). Nonresidential spending fell 0.3% versus the prior -0.6% (revised from -1.6%). Private construction spending dipped 0.1% after the 0.5% June slide (revised from -0.4%). Public spending climbed 0.7% from -1.7% (revised from -3.5%).

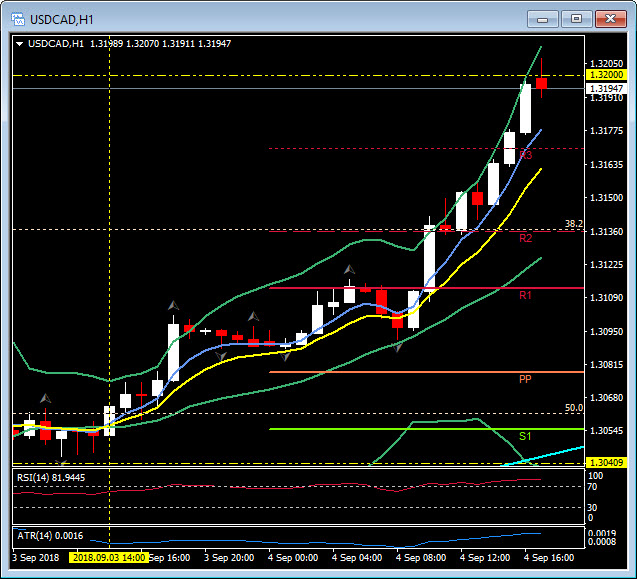

The Dollar rallied after the much better manufacturing ISM outcome, taking EURUSD to near two-week lows of 1.1530 from 1.1545, USDJPY up to 111.41 from 111.15 and USDCAD breached the key 1.3200. US Equity markets remain well underwater on trade concerns.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/05 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Head Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.