FX News Today

Asian Market Wrap: Stock markets remained under pressure during the Asian session, with trade woes and as the EM crisis saw market pressure shifting from currencies to stocks. IMF reported progress in talks with Argentina but contagion fears continue to weigh on sentiment also in developed markets. Treasury yields still backed up from overnight lows and are up 0.3 bp on the day at 2.909%, while 10-year JGB yields fell back -0.5 bp to 0.104%. Australia’s 10-year yields jumped more than 4 bp after higher than expected GDP numbers. US stock futures are moving down Oil prices are also slightly lower and the WTI future is trading at USD 69.38 per barrel.

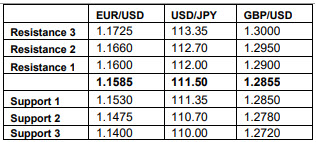

FX Update: The Dollar majors are near net unchanged on the day so far, into the arrival of the London interbank market, while emerging market currencies have enjoyed some reprieve. EURUSD has been holding near to 1.1600 after recouping from the 2-week low that was seen yesterday at 1.1530, with reports of good selling interest above 1.1600 helping cap the pairing. The Yen underwent a bout of weakness before firming back. USDJPY lifted to a 111.71 high earlier in Tokyo, before ebbing back under 111.50. In news out of Japan today, BoJ is reportedly happy with its recent tweaks to its yield curve control policy, which allows for greater flexibility, according to sources cited by Bloomberg. AUDJPY, a cross which came under heavy pressure last week, correlating with Chinese stock markets, lifted to a three-session high today, aided by strong Q2 GDP data out of Australia (which showed the best annual growth rate, at 3.4% y/y, since Q3 2012). The cross, like USDJPY, has fallen back from the highs as the Yen picked up some support amid a backdrop of fragile stock market sentiment in Asia and globally. The threat of a marked escalation in the Sino-US trade war continues to hang over markets, while most expect more unravelling in the nascent emerging market currency crisis.

Charts of the Day

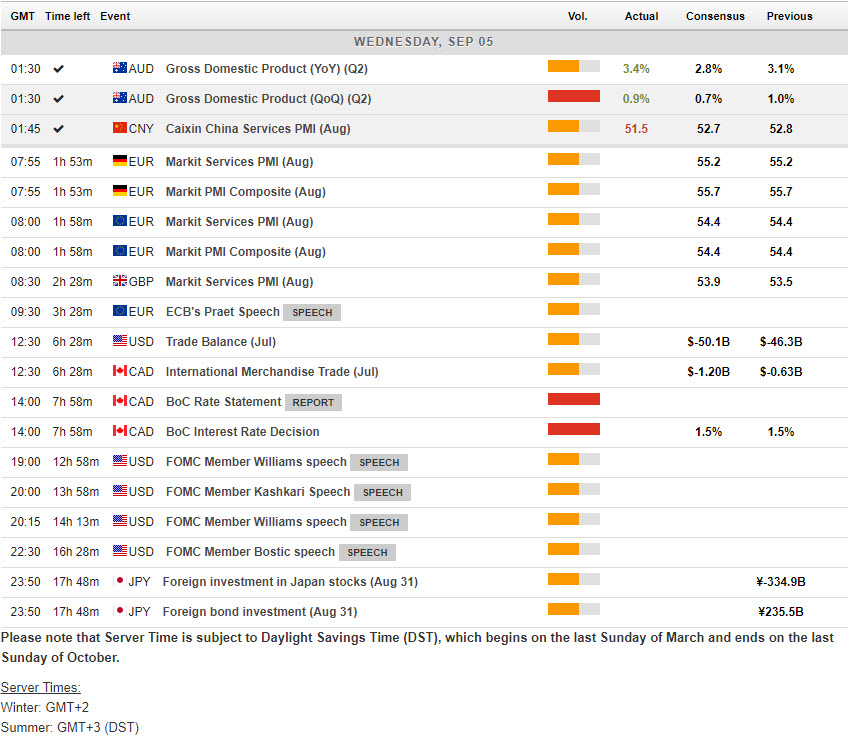

Main Macro Events Today

- UK Services PMI – Expectations – It is anticipated to rise to 53.8 from July’s 55.5 reading.

- Eurozone Services PMI – Expectations – They are likely to confirm overall Eurozone readings at 54.6 and 54.4 respectively, leaving the Composite at 54.4.

- Canadian Trade Balance & Labor Productivity – Expectations – The July trade report is anticipated to show a widening to -C$1.6 bln from -C$0.6 bln in June. Exports are seen falling 1.0% after the 4.1% surge in June. Productivity is expected to rise 0.3% in Q2 (q/q, sa) after the 0.3% drop in Q1.

- BOC Rate Statement – Expectations – No change to the current 1.50% rate setting, is expected, as BoC Governor Poloz was dovish on the pop to 3.0% y/y CPI growth in July, saying it was in line with their projection and due to “transitory factors.”

Support and Resistance Levels

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/05 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.