FX News Today

Asian Market Wrap: Treasury yields are little changed at 2.902%, JGB yields are down -0.4 bp at 0.100%. BoJ boosted buying five 10-year bonds in a bid to offset a cut in frequency of operations this month, which ties in with the bank’s intention not to make major changes after the last policy tweak and dampen speculation that it wants to taper at a faster pace. BoJ Board member Kataoka criticized the forward guidance and suggested the bank should have specified inflation rates, the output gap or inflation expectations. At the same time, he took fault with the added flexibility on the 10-year yield as it made the zero percent target unclear. Stock markets meanwhile remained under pressure amid ongoing emerging market concerns. A stronger Yen and a powerful earthquake added pressure on Japanese markets, as did a tumble in US tech stocks. Some markets, including Indonesia and Malaysia, managed modest gains, but most markets are firmly in negative territory. US Futures are also down, as are oil prices, with the WTI future trading at USD 68.59 per barrel.

FX Action:USDJPY and especially Yen crosses are softer, amid a risk-off themed session in pre-Europe trading in Asia and concerns about emerging market fragility and the next round of US tariffs on Chinese imports. Tech sector underperformance and reports of a powerful earthquake in Japan have also been in the mix. USDJPY dipped to a low of 111.17, down from a peak at 111.75, and subsequently settling above 111.30. The biggest mover, once again, has been the AUDJPY cross, which lost nearly 0.5% in making a 79.81 low and returning focus on the 22-month low that was seen on Monday at 79.52. BoJ ultra-dove Kataoka criticized the recent policy tweak by the central bank, to allow greater flexibility in its yield curve control, arguing that it made the zero percent target unclear while calling for additional monetary stimulus. His remarks had little impact on the Yen.

Charts of the Day

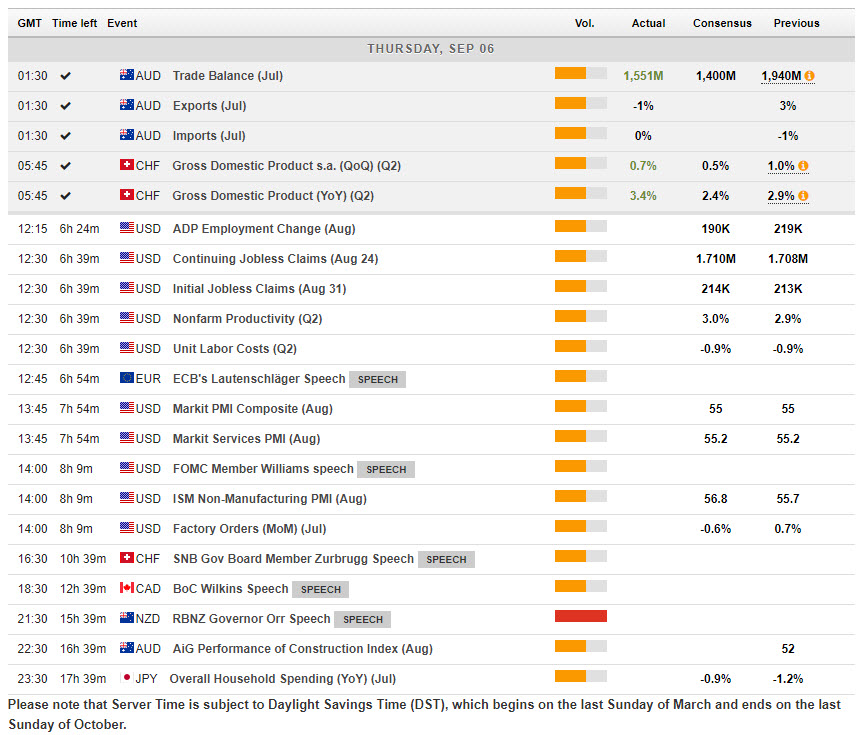

Main Macro Events Today

- US ADP Non-Farm Employment Change – Expectations – It is forecast to rise 205k in August vs 219k in July.

- US ISM Non-Manufacturing PMI & Jobless claims – Expectations – ISM-NMI index should rise to 57.0 in August, after dipping to 55.7 in July. Initial jobless claims are estimated to rise 2k to 215k in the week ended September 1, following a 213k reading in the week of August 25.

- Canadian Building permits – Expectations – Building permits values are projected to gain 3.0% in July (m/m, sa) after the 2.3% drop in June.

- Crude Oil Inventories

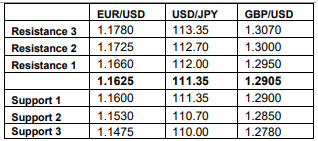

Support and Resistance Levels

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/06 15:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.