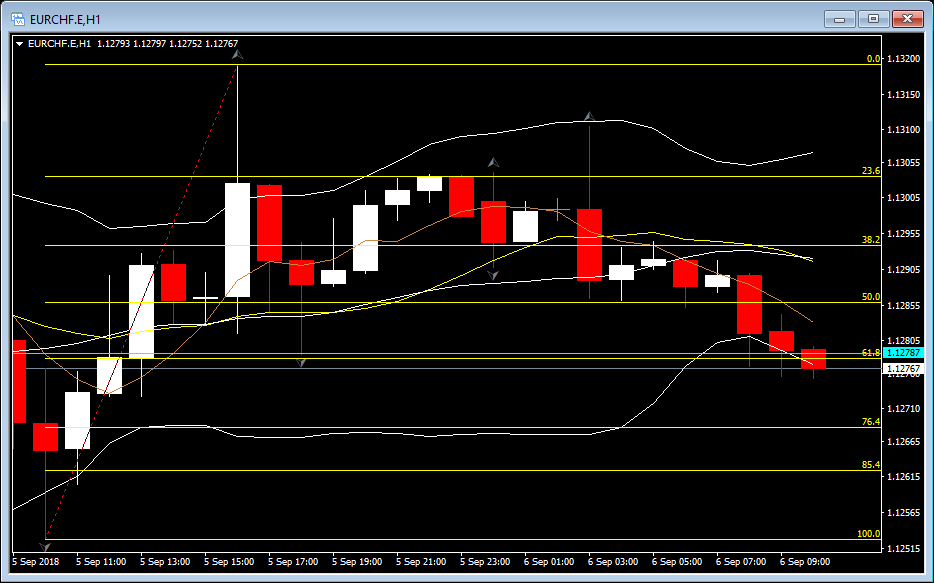

EURCHF, H1

Swiss GDP came out 1% higher than expectations, at 3.4% compared to forecasts of 2.4%. The Swiss economy expanded at an above-average rate for the fifth quarter in a row. This expansion was largely supported by manufacturing, which has been in a strong upturn since spring 2017. The main growth sector was energy production, which registered growth rates of 4.8%, stemming mainly from hydropower and nuclear power plants. As a result, exports of industrial products and energy rose sharply. However, a slowdown was observed in various production sectors with domestic focus, domestic final demand ran out of steam somewhat, which caused a fall in imports of goods and services by -0.7 %.

The Swiss economy now grows at a faster rate than the Euro area (3.4% compared to 2.2% in Q2), something which is reflected in the EURCHF behaviour. The small downwards trend was reinforced by the GDP results, closing 8 pips lower than the previous hour. At the time of writing, the Swissy broke the 1.1278 2-day support level which is also the 61.8% Fib level. If maintained below this level, it could lead to re-testing the 76.4% Fib. level at 1.1268. Otherwise, it would most likely return to 50% Fib. level at 1.1286.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/11 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.