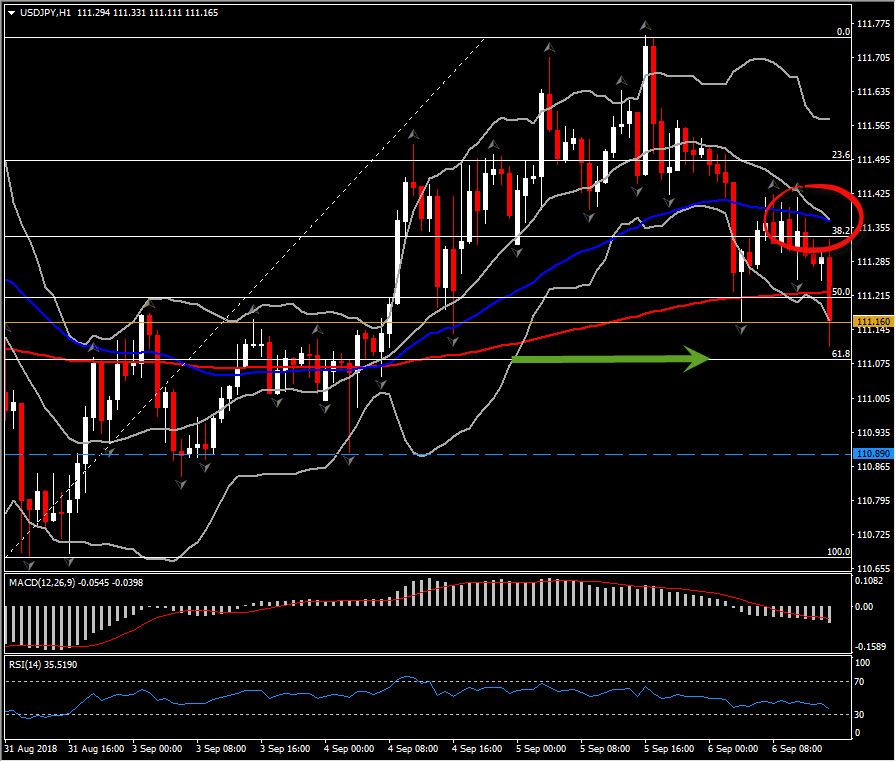

USDJPY, H1

The Dollar eased after the mix of data, following the big miss on ADP employment number, while jobless claims fell to the lowest since December, 1969 and Q2 revised productivity was unchanged at 2.9%. EURUSD rallied to highs of the week at 1.1654, as USDJPY slipped to 111.11. Next Support for USDJPY comes at the 61.8 Fibonacci retracment since the rebound on August 31, just few pips lower at 111.08. A close at the bottom of the hour below this barrier could retest the 50-day EMA at 111.89. Resistance is at 111.35.

US initial jobless claims fell 10k to 203k in the week ended September 1, after the 3k bounce to 213k in the August 25 week. This is the lowest level since December 1969. The 4-week moving average dropped to 209.5k from 212.25k. Continuing claims slid 3k to 1,707k in the August 25 week after falling 18k to 1,710k. US Q2 productivity growth remained at 2.9%, as it was in the Advance report (and 0.3% in Q1 and -0.3% in Q4).

Meanwhile earlier, the US ADP reported private employment rose 163k in August, a little shy of forecasts, after a revised 217k increase in July (was 219k). The ADP rise in August suggests downside risk for our 205k private BLS payroll estimate with a 210k total BLS nonfarm payroll increase, following a slight trimming in the July ADP rise to 217k from 219k that narrowed the gap to the 170k private payroll increase reported for that month. ADP restraint defied tight August claims levels that enter the calculation, with weakness for small and large firms but a solid gain for medium size firms. We saw a restrained 24k August rise for goods jobs that under-performed robust factory sentiment readings, alongside a lean 139k service sector jobs increase. The “as reported” ADP figures have overshot private payrolls by 21k per month on average since the methodology change of October 2016.

US data releases highlighted by tomorrow’s August employment report, while at the same time are keeping a weather eye on Canada-US trade discussions and the possibility for an embattled President Trump to raise tariffs on a further $200 bln of Chinese imports after the public consultation period ends at midnight today. China pre-emptively threated reciprocal tariff retaliation should the U.S. make good on its threat (Trump said yesterday that the stage for agreement has not yet been reached, but that talks would continue).

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/11 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.