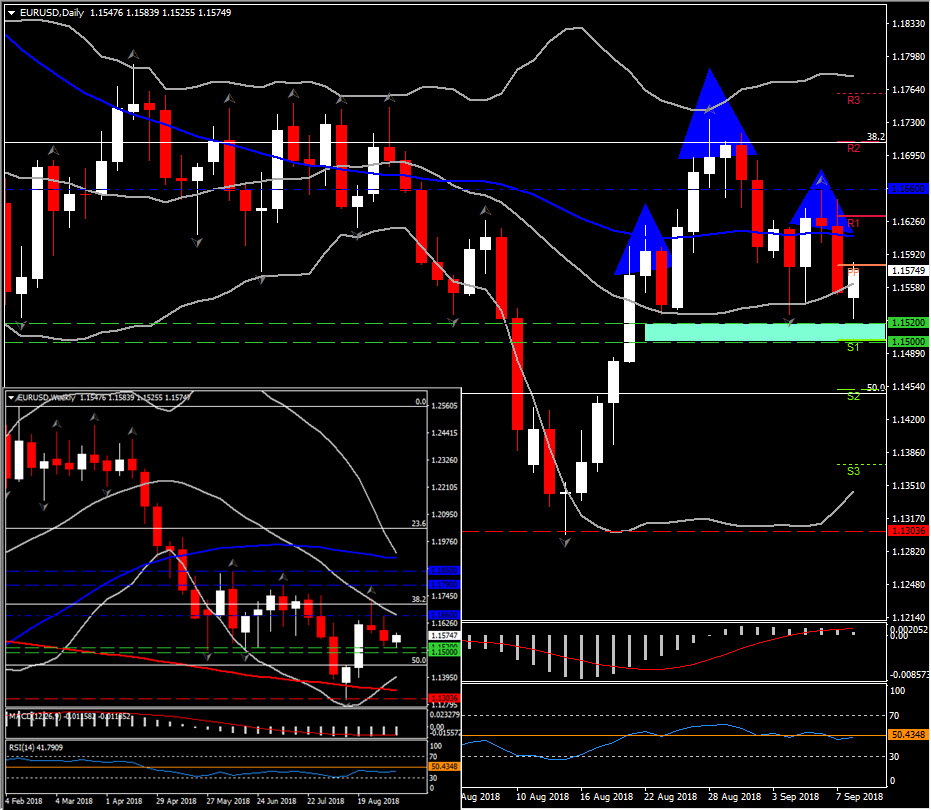

EURUSD, Daily and weekly

In Europe this week, focus is on Thursday’s BoE MPC meeting and ECB meeting, along with the ongoing Brexit affairs.

Official rates are likely to be left untouched and Draghi is expected to confirm the guidance on rates, which foresees no change through the summer of next year. That leaves the focus on QE and the future of net asset purchases. Back in June, Draghi said that ECB anticipates to cut back net asset purchases to EUR 15 bln from October and phase out purchases in December. Since then pressure on Italian assets in particular intensified emerging market contagion risks, but the concerns were mainly about the policies of the populist government as it prepares its first budget. Italian officials have been quite vocal in trying to get Draghi to continue to buy bonds, if necessary, under a different guise than the QE program.

With no sign of wider stress in Eurozone peripheral markets, however, and with some council members already dragging their feet on rate hikes, ECB President Draghi is to confirm the phasing out of QE as scheduled. However, while even dovish leaning council members, such as Nowotny, would like to see rate hikes earlier rather than later, President Draghi is likely to remain very vague on rates and focus on ruling out any move in the near future, while acknowledging that downside risks are becoming more visible. Hence confirmation of a hawkish policy move is widely expected, but likely balanced by a dovish leaning press conference, especially as the lack of progress on Brexit talks still leaves a real risk that the UK crashes out in the absence of a deal.

As has consistently been the case, anything that points towards an unchanged guidance from ECB, along with rates remaining on hold at least through the summer of 2019, would leave the Euro unaffected. EURUSD remains amid an overall bear trend since mid-April, as the possibility of a rate hike in September and December from FOMC has been fully priced, with US data supporting Fed hike. On the other hand, US Dollar is expected to continue being appreciated in the scenario of sustained risk aversion in global markets, while the Euro is likely to remain underpinned by downside risks from global trade jitters and Brexit uncertainties.

EURUSD remains above the key level at 1.1500 after the strong drift seen on Friday on the NFP report release. However, as there has been decisive move to the upside in September and as EURUSD is expected to be weighed by politics and by the Dollar strength, downside pressure is likely to continue with immediate Support at 1.1500-1.1520 area.

From a technical perspective, outlook is neutral to bearish, as daily RSI remains below 50 and MACD has been straggled at neutral zone. Therefore the pair is at critical point, as a decisive close below the 1.1500-1.1520 area, would form a Head and Shoulders bearish pattern and hence could confirm the continuation of the long-term decline for the pair. This case would alert the retest of August low at 1.1300, with an immediate Support holding at 50.0 Fibonacci level since January 2017, at 1.1450.

On the upside, only a break above September’s peak at 1.1660, could imply to a switch of the long-term outlook to positive. Further gains could open the way towards 1.1710-1.1733 (weekly R2 and 38.2 Fib. level). Meanwhile, a move further to the upside, brings in focus July’s and June’s peaks.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/11 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.