UK100, Daily and H4

Stock market sentiment stabilized during the European morning, after a largely weaker session in Asia, where Trump’s latest trade threats put fresh pressure on markets in Hong Kong and China in particular. With dwindling room for China to match tariff threats, in the same way there is speculation that it may focus on alternative measures such as a weakening of the Yuan or restrictions for US companies in China. Trump now has also expressed displeasure about the large US trade deficit with Japan.

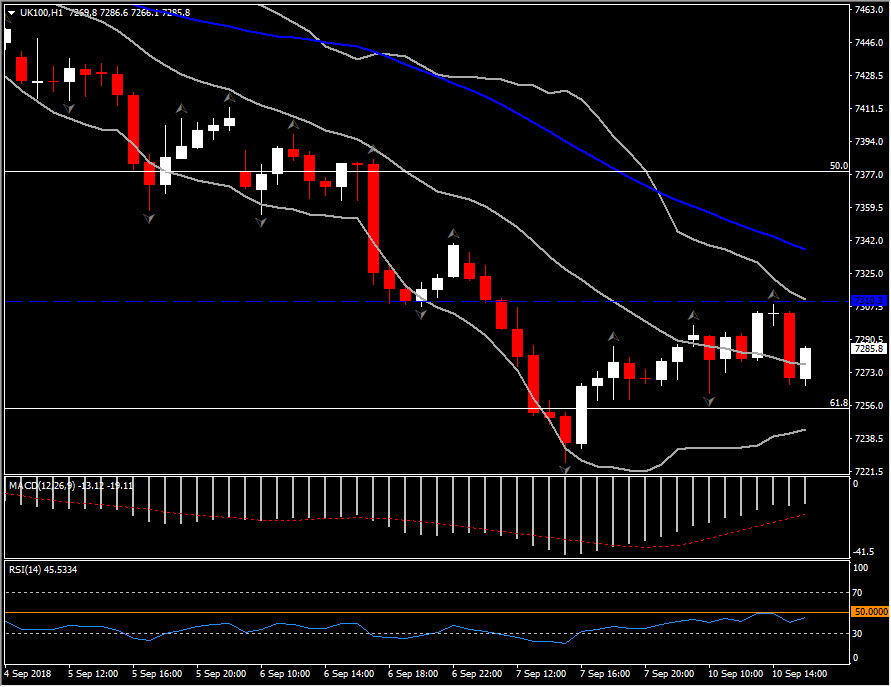

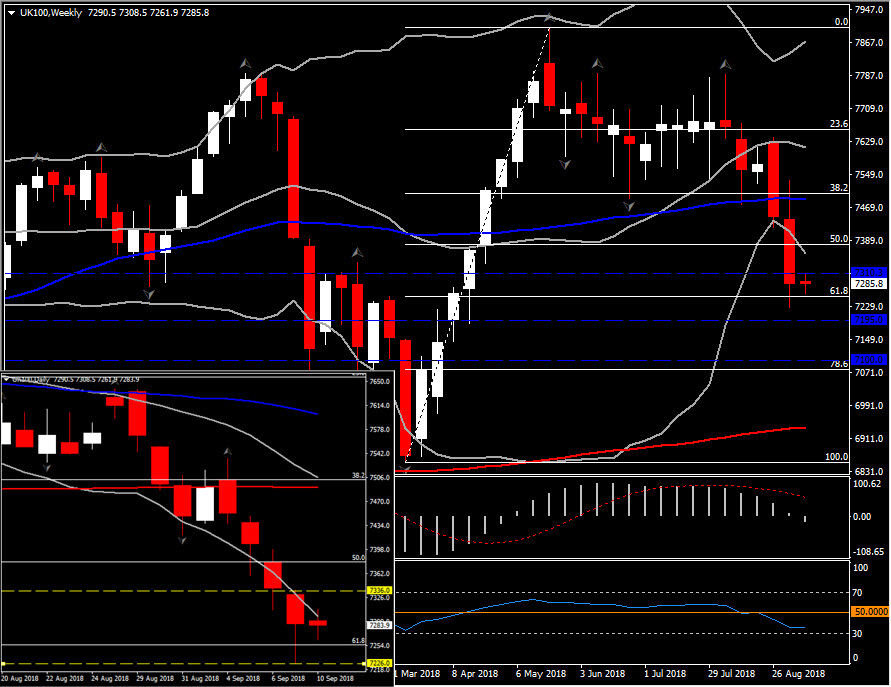

In Europe, soothing words from Italian Finance Minister Tria meanwhile helped to lift sentiment and saw the MIB rising 2.2%, with GER30 and UK100 up 0.31% and 0.27% respectively. The UK100 has been into a sharp fall since early August, dipping to a 5-month low on Friday. Interestingly, today, it managed to rebound up to 7308.05 level, signalling that we might see a pause into this strong decline in the near future, especially if today’s candle closes above Friday’s high, at 7336.00. This will open the way to the upside, towards Resistance 7490.00, which is at the 200-day SMA and a breath below the 50% retracement of the decline seen since August 8. However, for the long-term bias to turn positive, a decisive break above 7490.00 zone, is required.

In the bigger view, UK100 remains in the negative outlook, with medium-term and long-term momentum indicators supporting the continuation of the negative bias. In both time-frames, RSI moves around oversold barrier, unable to sustain any move higher and with further space to the downside. MACD lines extend to the downside well below the signal line, detecting downside momentum as well.

A close today below Friday’s close price at 7280.00, could suggest in the near future, the retest of immediate Support at 7226.00, but also further lower to April’s Support at 7190.00 level. If the bears pierce below it, the next area to be watched is the round 7100.00 level and 7076.00 which coincides with the 78.6% Fibonacci level.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/11 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.