One of the things economists agree on is that you cannot really have everything. Take, for example, the impossible trinity. Basically, it suggests that countries are faced with three options: an independent monetary policy, a fixed exchange rate, and free movement of capital. While authorities can have two out of three, they cannot really have them all. Hence, most developed countries opt for monetary policy independence and free movement of capital at the expense of a floating exchange rate.* As a result, capital moves around the world fast.

Remember that an influx of capital has important effects on the exchange rate: a higher influx of foreign currency in Europe means that people are willing to exchange their own currencies for the Euro. In economic terms, demand for the Euro increases which is usually translated as an increase in price, i.e. the exchange rate. The issue with this is that, depending on the extent of the Euro appreciation, it may actually hurt European exports given that they will now be more expensive compared to those of other countries’. If, for some reason, the exchange rate appreciation gets exceedingly large, then this inflow of capital can actually hurt the economy, especially one which is export-oriented.

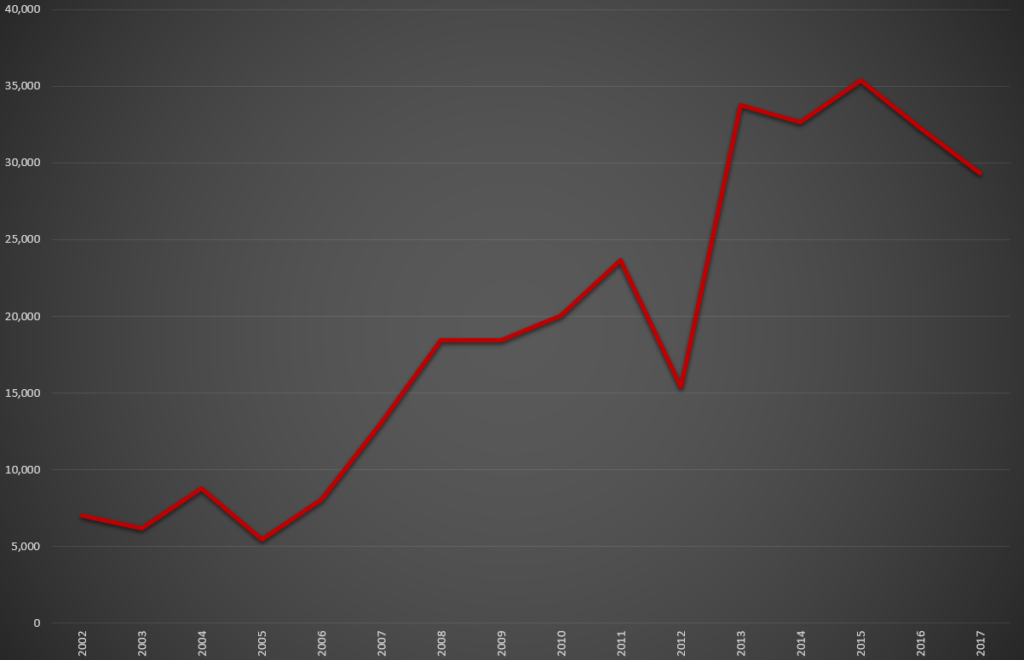

Take Switzerland for example: its economy is heavily dependent on exports with a trade surplus (i.e. exports being higher than imports) recorded every year since 2002 (see figure below). Despite the fact that Swiss exports mainly consist of higher-end goods, which tend to be more price inelastic, there still exists at least some reaction to a CHF appreciation. As such, the Central Bank can assess that it is to the economy’s best interest not to allow the exchange to rise.

Source: Swiss Federal Customs Administration, MT4 Data

Source: Swiss Federal Customs Administration, MT4 Data

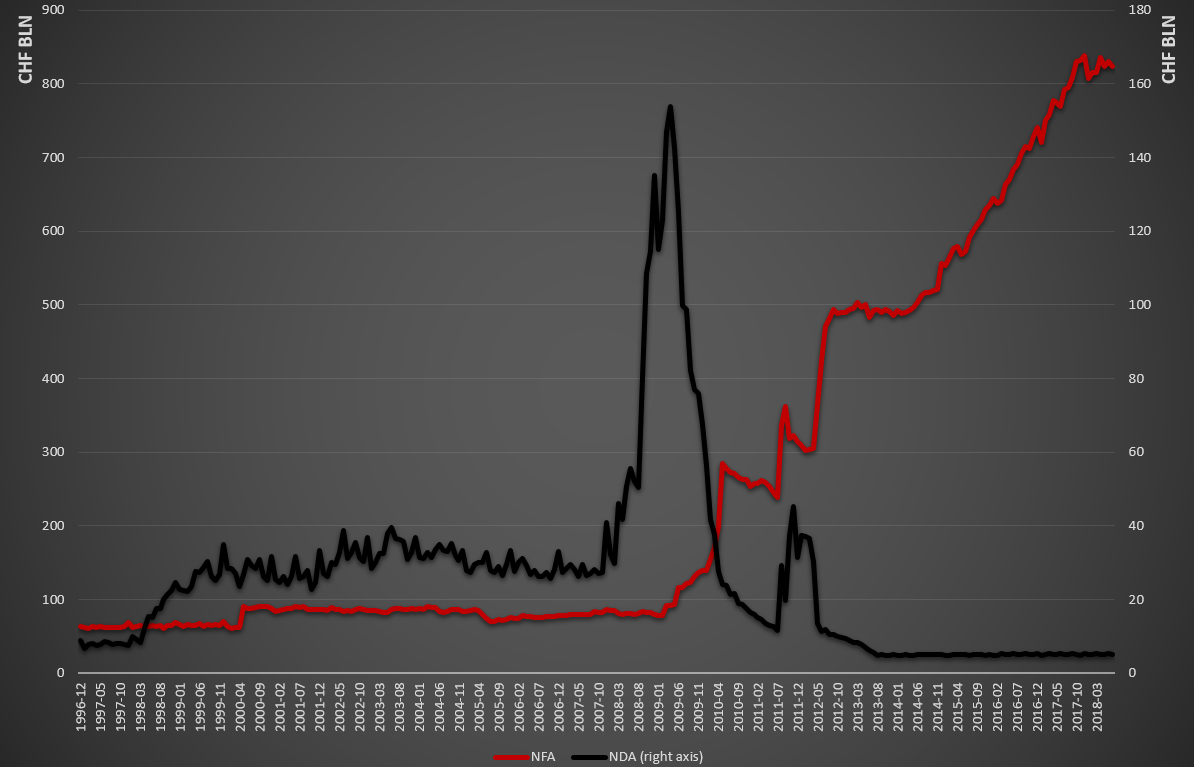

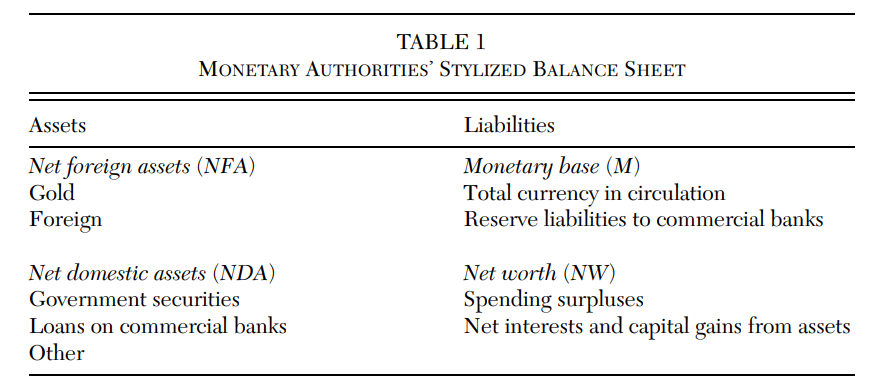

How are interventions conducted then? In essence, the Central Bank simply purchases or sells foreign currency, normally against its own currency. In the Switzerland case, if the SNB is buying foreign currency against its own, this means that it increases demand for, say, Euro, and simultaneously increases the supply of CHF. This would suggest that the Euro price would increase against the CHF. The big question here is how we can understand whether a Central Bank is actually intervening in the FX market. The essence is that interventions have an effect on the Central Bank balance sheet. In particular, in the case of purchase (sale) of foreign assets, the NFA part on the asset side increases, with an equivalent increase (decrease) in the monetary base part of the liabilities side. This happens because, in order to purchase, say Euros, SNB would need to issue new money for the purchase and hence increase the monetary base. In economic parlance, this is called a ‘non-sterilised’ FX intervention. The effect of a sterilised intervention is similar to the effect that Quantitative Easing would have had, although in the latter case the change in the monetary base would be met with a change in net domestic assets.

Source: Sarno, L. and Taylor, M.P. (2001) “Official intervention in the foreign exchange market: is it effective and, if so, how does it work?”, Journal of Economic Literature, Vol. XXXIX, pp. 839-868

Source: Sarno, L. and Taylor, M.P. (2001) “Official intervention in the foreign exchange market: is it effective and, if so, how does it work?”, Journal of Economic Literature, Vol. XXXIX, pp. 839-868

In today’s digital economy there is no need to print physical money to create it and hence the first part of the monetary base, i.e. currency in circulation would not be affected. Thus, all that is left to be affected is reserve liabilities to commercial banks, which mainly includes bank deposits. This makes life easier for the interested investor as he could gauge the extent of FX interventions by observing whether deposits have increased over the previous period. SNB actually provides this information on a weekly basis, allowing us to observe whether interventions have been conducted over the previous week. Note that small changes in the figures should not raise any alarms for intervention as these can occur for various other reasons.

As the reader may have guessed, there also exist ‘sterilised’ interventions, which aims at keeping the monetary base stable, even when foreign currencies are purchased. This is usually done through a sale (purchase) of government securities when purchasing (selling) foreign assets. The idea is that by using the proceeds from the sale of government securities to fund the purchase of foreign assets would leave overall money supply unaffected. As such, as theory suggests, there will not be an increase in the money supply which could potentially lead to an increase in the inflation rate.

How can investors monitor sterilised interventions then? One-off sterilised interventions, or sterilised interventions which aim mostly to maintain a currency between some bounds (e.g. such as the DKK) and include both purchases and sales of FX are very difficult to identify given that they will only appear on the Central Bank balance sheet if they are large enough. There are some good news however: if interventions are only pointed to a certain direction (i.e. only sales or only purchases) then they are much easier to be identified. This is because the Central Bank would, at some point, run out of available NDA. This has already happened in Switzerland where the potential for sterilised interventions is currently at almost zero given that NDA has been very small since 2012 (see first figure – Source: SNB).

Figuring out that interventions take place is one thing, and assessing their impact on the exchange rate is another. To do this, we have opted to use the NFA part which is non-sterilised, so as not to reach erroneous conclusions.** Following this, and given that there is no way to know which currencies the SNB buys or sells, we have chosen to pool together the four major CHF pairs, i.e. EUR, USD, GBP, and CAD. As such, the result reached can only be interpreted as the average reaction of all four pairs and hence it should not be employed for specific trading purposes. The sample ranges from January 1997 to August 2018, at a monthly frequency. In general, we find that an FX intervention of CHF 1 bln would lead to approximately a 5% change in the exchange rate. Interestingly, a reversal is observed on the following month of the intervention, by approximately 2%. Again, please note that this effect is the average response of the four major currencies and hence should not be relied upon for trading purposes. This should serve only as a reminder that Central Bank interventions can have an effect on currencies and that successful traders should always keep an eye out for them.

*Note that this does not hold in the Euro area: members have selected a fixed exchange rate amongst them (the euro) and free movement of capital at the expense of handing monetary policy to ECB instead of National Central Banks setting interest rates independently.

**This was done by substracting the change in (NDA-NW) from the change in NDA.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/12 15:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.