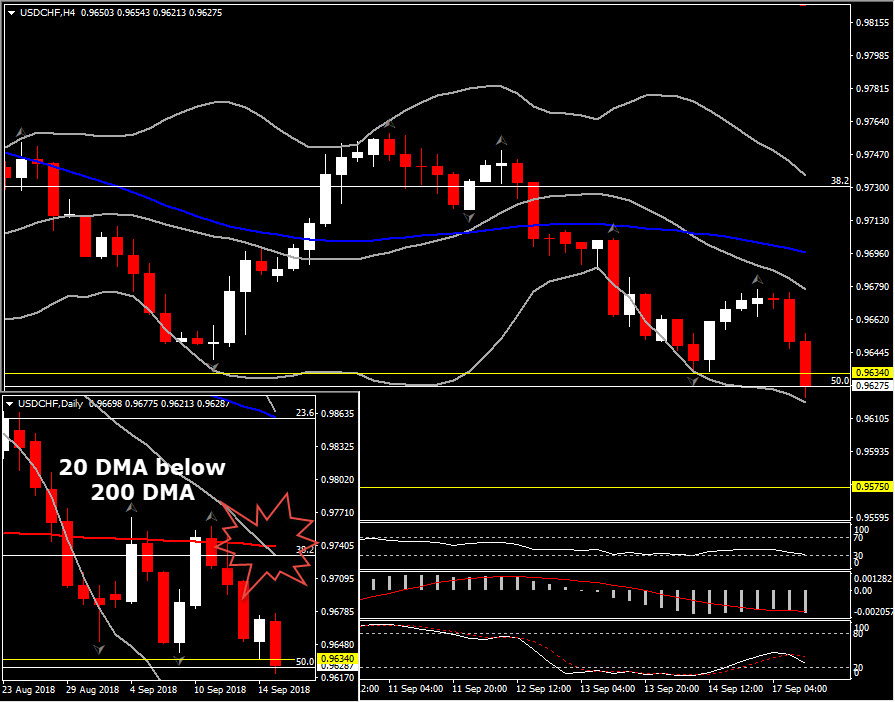

USDCHF, H4 and Daily

USDCHF fell to 0.9636 from session highs of 0.9677, unable to sustain Friday’s gain. The cross has been trending downwards since mid August, while during September it has been showing more of a ranging market as it bounces from 0.9634 to 0.9767. Today’s price action suggests that the downtrend remains in play, as the pair broke below 5-month low at 0.9634

Technically-wise, the 3 consecutive bearish candles last week along with the failure on Friday to return at least 50% of the losses, is further increasing the negative bias of the pair. In short-term, RSI and Stochastics suggest that the price is losing positive momentum as both signal that the price is moving lower towards oversold barrier, with further space to the downside; the former has drifted near 31, while the latter is also just a breath before entering oversold area, with the white %K line at 24. MACD lines are increasing below signal line. Nevertheless, the recent downwards move combines the break of the latest down fractal and the extension of the lower Bollinger Bands further to the downside, something that strongly supports the bearish intraday outlook for USDCHF.

Should the session candle close below the 50% Fibonacci retracement of the upleg from 0.9186 to 1.0067, the price might find immediate support at the mid of 50.0% and 61.8% Fib. level at 0.9575, in which the price found Support in the mid April. Below that comes the 0.9500-0.9520 area, with the latter the 61.8% Fibonacci of 0.9520.

Alternatively, a reversal to the upside could retest today’s peak at 0.9677 before targeting the 38.2%% Fibonacci of 0.9730.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/18 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.