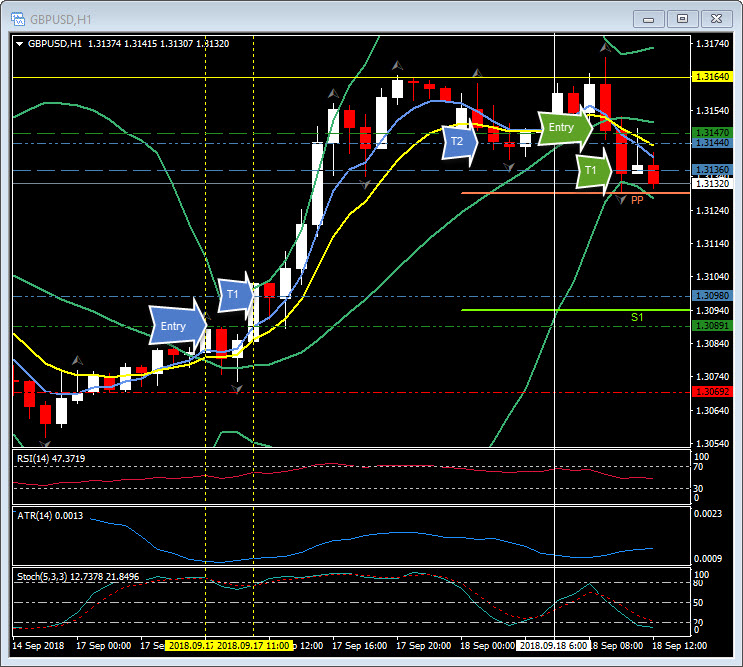

GBPUSD, H1

The UK will cave into EU demands at its “darkest hour”, which will be when Britain reaches the point of staring at the reality of a no-deal departure, according to EU diplomats cited by the Guardian newspaper today. This comes ahead of Thursday’s leaders’ summit in Salzburg. A source cited in the article said “we need a substantial change in the UK red lines still,” with another saying that the UK “needs to have a ‘darkest hour’ moment before they will shift position” and that they “will have to shift their position.” The major stopping point is the Ireland border issue, which looks increasingly likely to mean that the UK will have to accept the backstop plan (which would shift the EU border to the Irish sea post Brexit), which is politically problematic for the UK. The British government will have to concede on its proposal for an EU-UK single market for goods and agricultural produce, which has been a no-go for the EU from the get go. There will probably not be much progress on these points until after the Conservative Party conference later in the month. It’s six months this week to the UK’s scheduled departure date and with both the UK’s major political parties deeply divided on the issue, investors are pressing the sell Sterling button on every negative nuance that relates to Brexit. Today has been no different; the rally from yesterday (09:00 and 11:00 AM GMT) for Cable ran into resistance at 1.3164, before eventually turning lower at 10:00 AM GMT. Initial Support at the daily pivot is around 1.3130 and then the key 1.3100 zone.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/18 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Head Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.