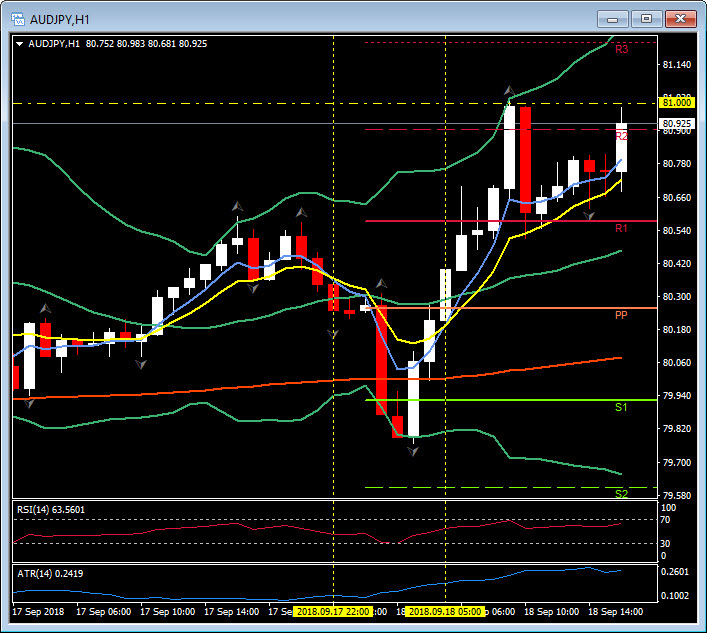

AUDJPY, H1

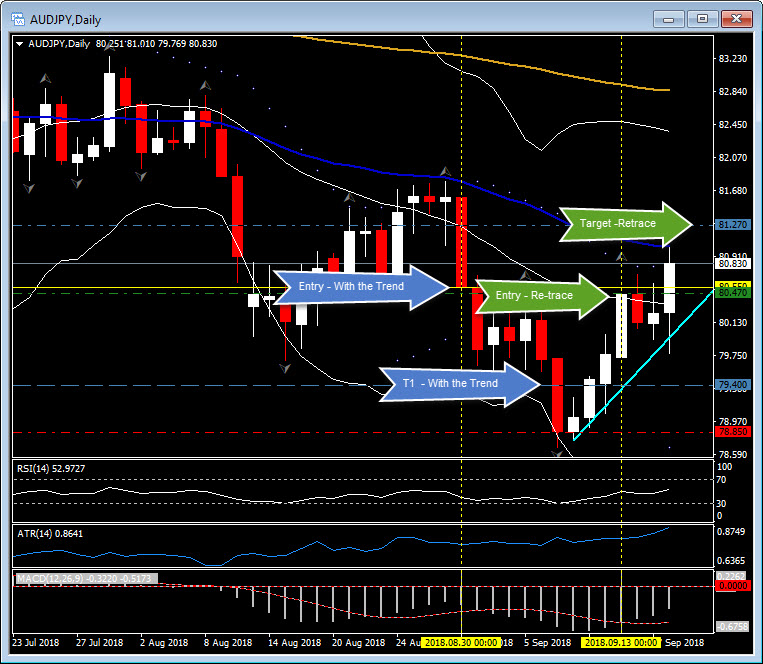

AUDJPY is the biggest gainer on the day out of the main dollar pairings and associated cross rates, (as we discussed in today’s webinar, and clear from the Trades Board) about 25 pips off its highs but still showing a 0.5% gain. The high, at 81.01, is a three-week peak. A risk-on tone has underpinned the relatively high-beta cross. Beijing’s pledge to adopt a more pro-action fiscal policy saw the Shanghai Composite close with a 1.8% gain, offsetting the announcement of the widely anticipated new US tariffs, which will be at a lower than expected rate of 10%, at least for a time before rising to 25% on January 1.

China responded with a tariff list effective September 24 in sync with the $200 bln round of US tariffs, planning to levy new tariffs of 5-10% on $60 bln in US goods on 5,207 US products, in line with initial plans. It will also tariff liquid natural gas (LNG) on the list at 10% vs the 25% initially proposed, similar to other products. China vowed to respond to any new US tariffs forced by “US unilateralism and trade protectionism,” but also hopes to stop US trade friction and maintain a mutually beneficial trade relationship via “dialogue of mutual respect and equality.” Yet, as NEC director Kudlow has said, “Just say ‘yes’ to something and we’ll cite progress and move on to the next issue.”

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/19 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Head Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.