Last time I commented on the trade balance and its effects on currency markets, the idea was that a trade surplus is usually good for the currency while a trade deficit is usually bad. Given that most of these effects are anticipated, then what matters is the extent that the data release differs from forecasts. To that end, an example using the Japanese trade balance was used.

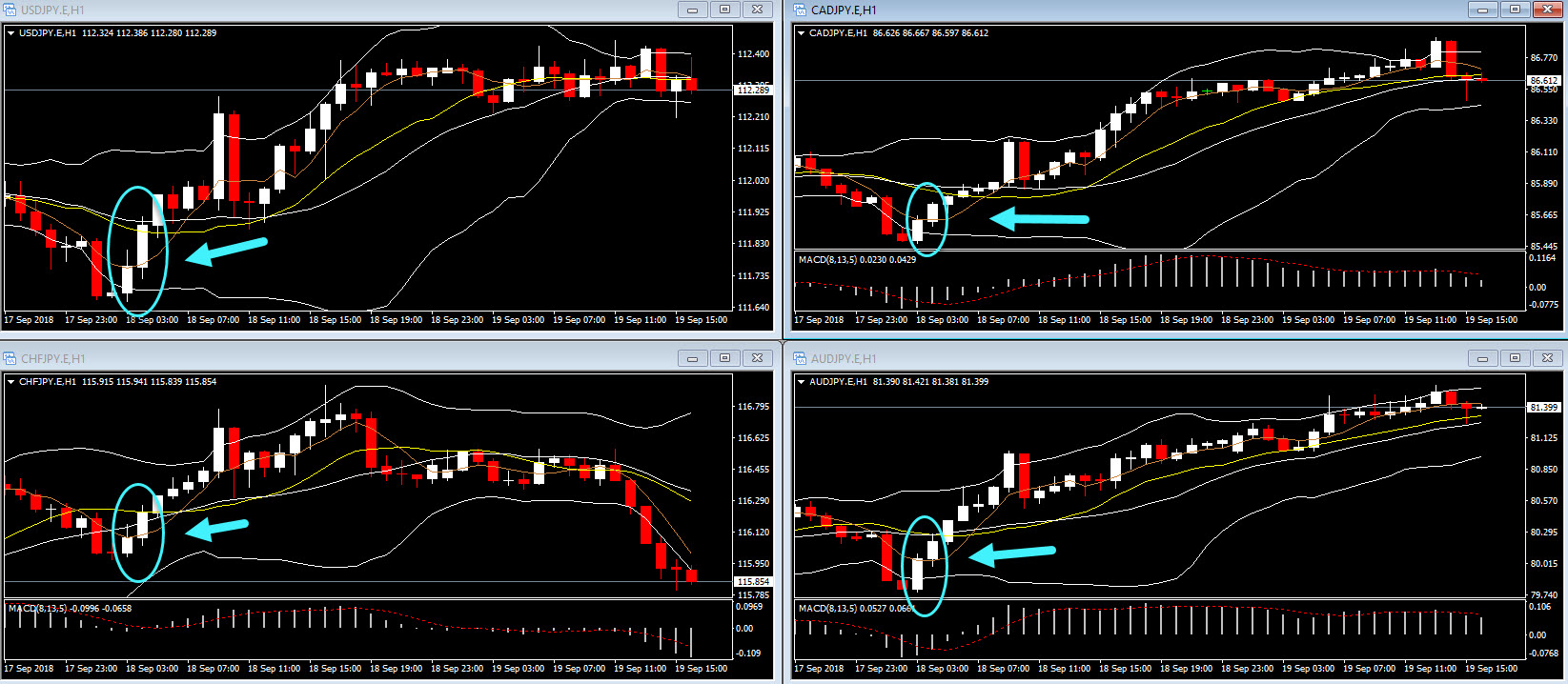

Earlier today Japan published its August trade balance data. Given that the last post examined the reactions of major currencies, now we will deal with some lesser-traded JPY pairs, as well as the USDJPY. As the image suggests, the market response is large and immediate across all currency pairs. In particular, USDJPY rose by 20 pips, CADJPY surged 26 pips, and CHFJPY increased by 22 pips, while AUDJPY jumped by 42 pips. Overall, the reaction was as predicted last time.

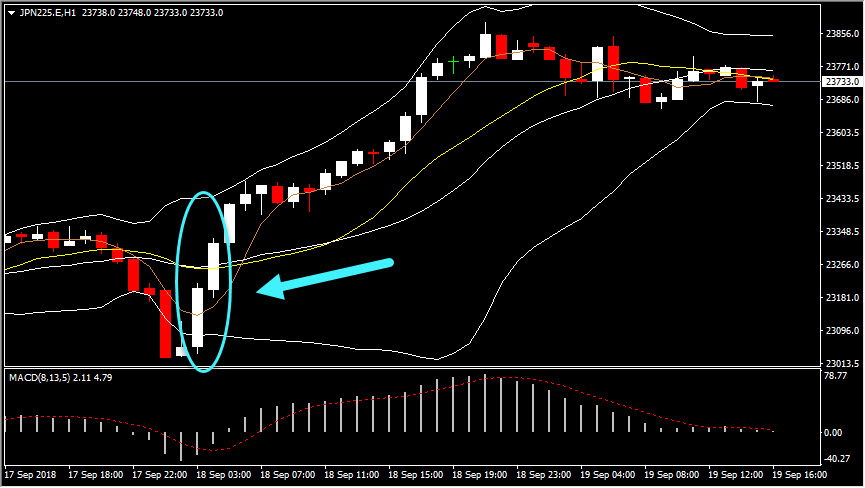

Last time, the post also suggested that a trade deficit is usually good for the stock market as it suggests that consumer spending has increased and thus firm profitability will follow. The JPN225 increased by 1.14% around the announcement time, also abiding theory.

Overall, the trade balance appears to once again meet the criteria of being one of the most reliable predictors of currency movements and one which deserves to be in a trader’s arsenal.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/19 15:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.