FX News Today

Asian Market Wrap: Stock markets continued to rally during the Asian session after a record close on Wall Street yesterday. Risk appetite is back after robust US data yesterday added to hopes that the fallout from the latest round of US-China tariffs can be contained and that there will eventually be deals on trade and Brexit, despite little progress at the informal EU summit yesterday. Improvements in emerging market assets have also helped to underpin confidence with investors buying back into the rout. 10-year Treasury yields moved up 1.3 bp to 3.076%, 10 year JGB yields jumped 1.6 bp to 0.125% and 30-year yields rose 4.4 bp as BoJ cut bond purchases. Topix and Nikkei are up 1.01% and 1.06% respectively underpinned by a weaker Yen, the Hang Seng has gained 1.13% so far and the CSI 300 is up 1.80%. US stock futures are equally broadly higher, Oil prices are slightly lower and the November WTI future is trading at USD 70.25 per barrel. Today’s calendar includes Eurozone PMI readings as well as public finance data for the UK.

FX Action: USDJPY has lifted to a fresh two-month high at 112.80 amid a backdrop of a coursing risk-on theme in global markets. The USA30 and USA500 hit record highs yesterday, and Asian stocks have rallied robustly across the board. JP225 hit a 4-month high, and the Shanghai Composite a two-week high, with both showing gains of 1% or more. Expectations for China to turn the fiscal stimulus tap, among other measures, have been helping underpin sentiment in Asia, while the unexpectedly low starting tariff rate of 10% in Trump’s latest move on Chinese imports this week, along with tech sector exemptions, have helped buoy sentiment Global fundamentals are otherwise solid, despite the threat from the trade war escalation (with Beijing not expected to negotiate until after the mid-term elections in the US).

Charts of the Day

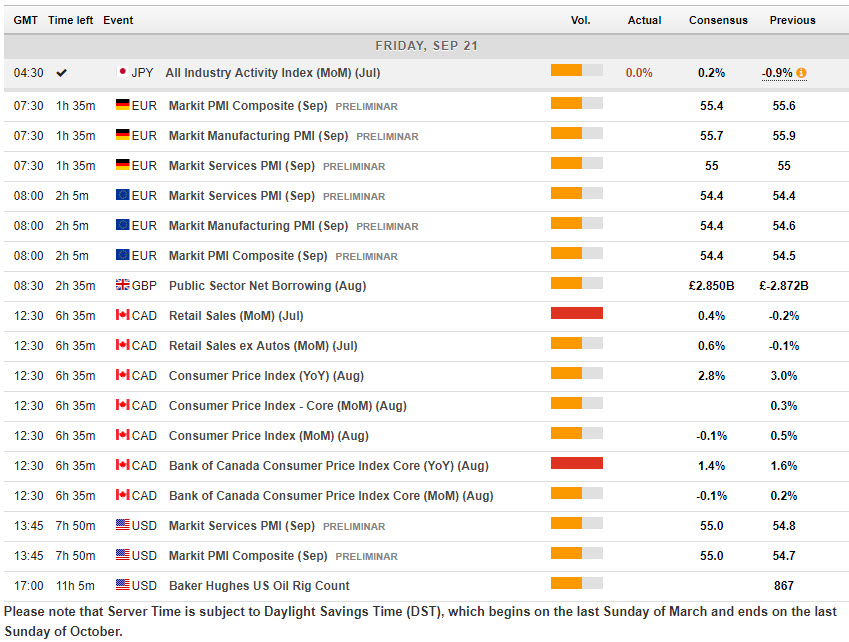

Main Macro Events Today

- Eurozone Sep. PMI – Expectations – The Eurozone manufacturing PMI is expected at 54.5, down from 54.6 in the previous month, and expect the services reading to improve slightly to 54.5, which should leave the composite unchanged from August at 54.5. This still suggests ongoing expansion, but would also confirm the decelerating trend.

- Canada CPI & Retail Sales – Expectations – CPI is expected to hold steady in August after the 0.5% surge in July. The CPI is projected to grow at a 2.9% y/y pace in August, easing slightly from the 3.0% pace in July that was the top of BoC’s 1-3% target range. Canada retail sales values are expected to rise 0.5% in July after the 0.2% drop in June.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/25 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.