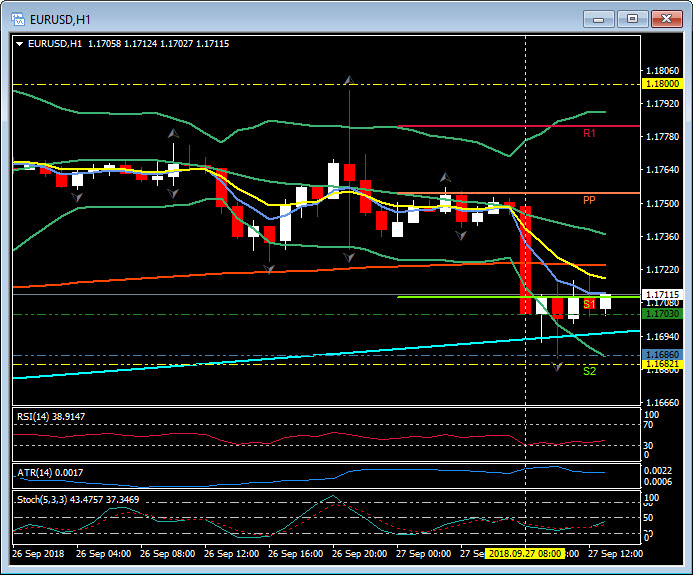

EURUSD, H1

EURUSD found its feet after posting a one-week low at 1.1682 and daily S2, settling back in the lower 1.1700s. There had bee a flurry of euro selling a the European open, though the common currency is presently showing modest gains versus Sterling and the Swiss franc, while showing modest losses to the Dollar and Yen. The September Eurozone ESI economic confidence survey fell back to 110.9 from 111.6 in the previous month. This was a stronger than anticipated correction and reflects declines in consumer and manufacturing sentiment. The services reading actually picked up and rose to 14.6 in September, from 14.4 in August. The business climate indicator held steady at 1.21. A similar picture then as in the PMI readings, with services sentiment improving, but the manufacturing sector increasingly feeling the chill from trade tensions and the decline in external demand. Consumer sentiment was also hit over the summer by negative trade headlines, but today’s German GfK reading actually showed an improvement, so there could be a stabilisation ahead, even if the pick up in fresh food prices as the result of the summer heatwave is likely to register more strongly than the overall impact on headline inflation rates would suggest. The ESI averaged 111.53 in Q3, down from 112.5 in the previous quarter. PMI readings had suggested growth around 0.5% q/q for Q3, but annual trend rates are decelerating, which ties in with the downward revision to the German growth forecast by leading economic institutes today, with trade jitters increasingly leaving their mark.

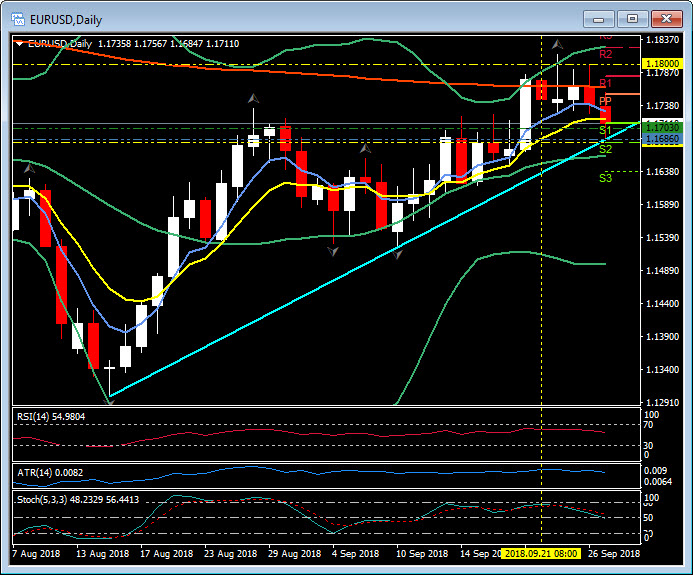

Resistance to a move higher today is the 200 moving average at 1.1725 and the daily pivot point at 1.17550. Support is the Daily trend line and the S2 low, with S3 down at 1.1640. So with lots of US data later, patience is key.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/27 15:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Head Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.