FX News Today

FX Action: USDJPY rallied to a nine-month high of 113.63 amid a bout of post-Tokyo Yen selling, which built on the broad gains the Dollar saw. The strong 4.2% y/y outcome in US Q2 GDP, which backs the Fed’s guidance for continued gradual tightening, has continued to resonate in market narratives. The Yen, meanwhile, has risen amid a backdrop of rising stock markets. Wall Street closed higher, led by a rebound in FAANG stocks after a two-week slump, while Asian markets are up, with the Shanghai Composite gaining more than 1% in the first hour of post-lunch trade. USDJPY strength has facilitated the outperformance of the Japanese stock markets, where the Nikkei has been trading up 1.3% in the last half hour of the session in Tokyo. A 1 bp rise in the JGB benchmark yield, ahead of the BoJ announcement on bond buying plans for October which is speculated to suggest a tapering of long-end purchases, had little impact on the Yen. A reportedly positive meeting between President Trump and Prime Minister Abe also cast little influence.

Asian Market Wrap:10-year Treasury yields are down -0.4 bp at 3.048% after erasing earlier gains. 10-year JGB yields are up 1.0 bp at 0.116% ahead of the BoJ announcement on bond buying plans for October amid speculation of a tapering of long-end purchases. A strong session for Asian stock markets added to pressure, with a weaker Yen helping Japanese indices outperform. Topix and Nikkei are up 0.80% and 1.1% respectively. The Hang Seng has gained 0.59% so far, CSI 300 and Shanghai Comp are up 1.08% and 0.91%. The ASX also moved higher, while Taiwan and Korea are among today’s underperformers. Overall Asian stocks ended a volatile month on a positive note, even if the MSCI Asia Pacific Index is still heading for a weekly loss. US futures are also moving higher after a positive close yesterday, while Oil prices are slightly higher and trading at USD 72.26 per barrel.

Charts of the Day

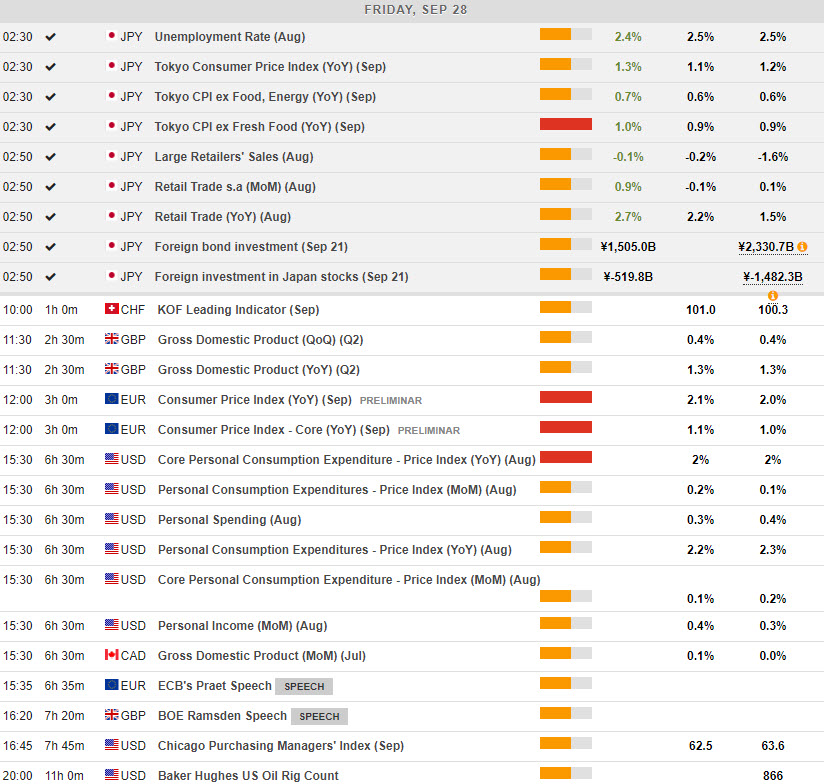

Main Macro Events Today

- Euro Area Consumer Price Index – Expectations – Euro Area CPI for September is expected to come out at 2.1% compared to 2% last month. However, higher than expected German inflation data could suggest that overall Euro Area CPI may actually be higher.

- UK Current Account – Expectations – The UK Current Account balance suggests whether the country has been importing more than exporting. The current account deficit is expected to have worsened in the previous quarter given the persistent Sterling depreciation and despite the appreciation in September.

- US Personal Consumption Expenditure – Expectations – The US PCE Index, the Fed’s favourite inflation measure, is expected to come out at 2% for August, same as in July.

- Canada Gross Domestic Product – Expectations – Canadian GDP is expected to have increased by 0.1% m/m in July compared to 0% in June.

- Chicago PMI – Expectations suggest that the Index will continue to indicate expansion, albeit at a slightly lower extent.

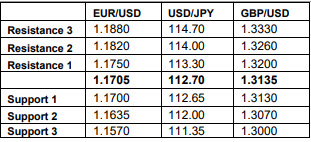

Support and Resistance Levels

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/02 15:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.