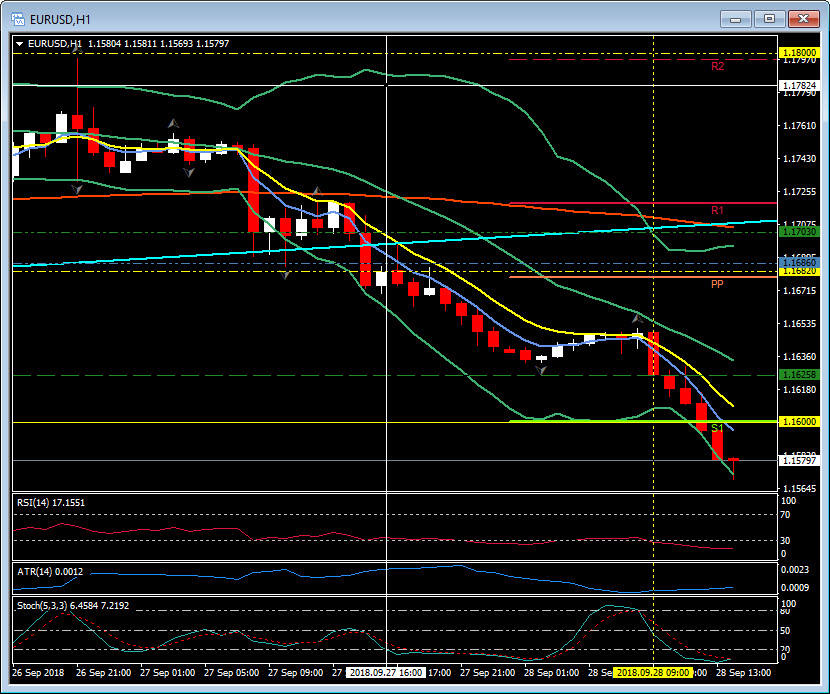

EURUSD, H1

Eurozone HICP inflation rose to 2.1% y/y in September, from 2.0% y/y in August. A higher reading than initially expected, but no total surprise after the acceleration in German inflation yesterday. And like in the German number, higher food prices were a key factor and the core rate actually fell back to 0.95 from 1.0% y/y in August. The heatwave across Europe over the summer has been impacting harvests and is not translating into higher food price inflation. So Draghi can point to the dip in the core rate to justify the ECB’s accommodative policy stance, especially as food consumption is relatively price inelastic, which means consumers are more likely to cut back spending elsewhere. At the same time though, the ongoing improvement on labour markets is increasingly translating into higher wage deals and with negotiated wages generally a lagging indicator this trend is likely to continue and accelerate for a while yet, even as there are first signs that uncertainty about the outlook is hitting hiring intentions.

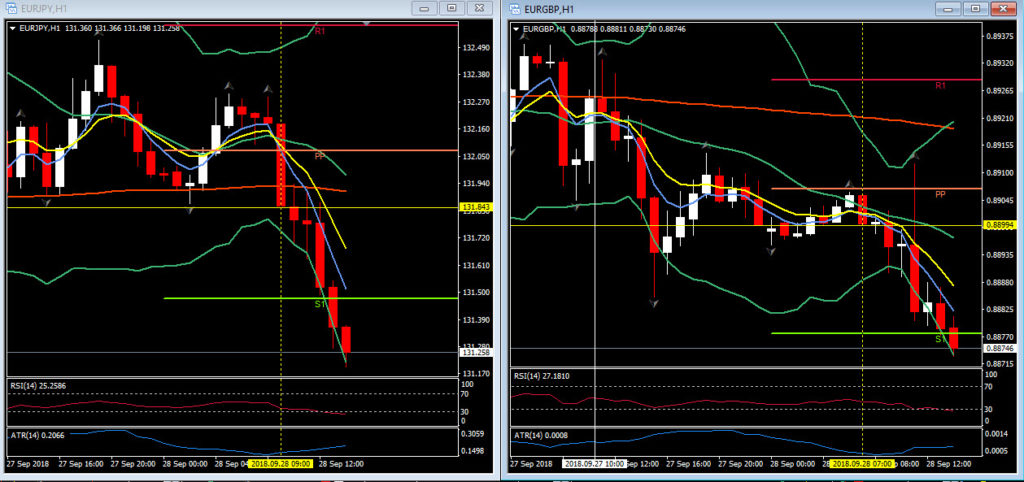

The miss in the core figure and concerns over the political turmoil in Italy has weighed on the EUR. EURUSD breached the key psychological and daily support at 1.1600, to post a 15 day low at 1.1570, EURJPY broke below the 200 moving average at 18:00 and moved down to daily S1 posting a low of 131.275. EURGBP too followed suit even with the downward revisions for UK GDP, the pair broke lower at 08:00 and also sank to the daily S1 low at 0.8877.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/02 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Head Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.