FX News Today

FX Action: The Euro lifted across-the-board on a report commenting that the Italian government is now planning to cut the budget deficit to 2% of GDP in 2021, following deficits of 2.4% in 2019 and 2.2% in 2020, which sparked a bounce in the euro. The Italian government had previously been planning a 2.4% deficit through to 2021. EURUSD gained nearly 0.5% in making an intraday high at 1.1592, extending the rebound from yesterday’s six-week low at 1.1505. EURJPY, EURCHF and other Euro crosses have also gained. Elsewhere, the Dollar has traded steady, with a firming tilt after Fed Chairman Powell made upbeat remarks on the U.S. economy, although conceding that inflation pressures haven’t been seen “yet”. UUSDJPY lifted out of a three-session low at 113.52 to an intraday high of 113.82.

Asian market Wrap: 10-year Treasury yields are up 0.9 bp at 3.037%, the 10-year JGB yield gained 0.8 bp and is at 0.131%, despite a mixed session on stock markets. Fed’s Powell said the outlook for jobs and inflation is “remarkably positive”, which underpinned a pick up in yields. Chinese stock markets rallied after yesterday’s holiday, with CSI 300 and Shanghai Comp up 1.04% and 1.06% respectively. Topix and Nikkei meanwhile are down -109% and -0.77% respectively, while the Hang Seng is down -0.26% after swinging between gains and losses following yesterday’s slump. European politics and global trade developments remain in focus, while concern in India and Indonesia over commodity prices remains as oil prices continue to hold above USD 75 per barrel.

Charts of the Day

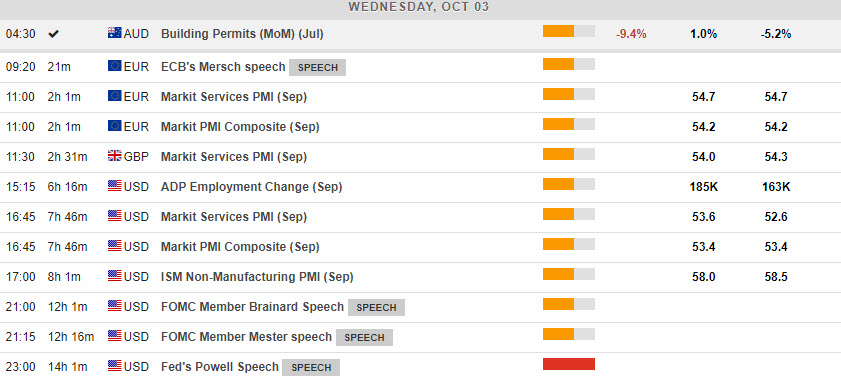

Main Macro Events Today

- Euro Area Services and Composite PMIs – Expectations – The September PMI is expected to come out similar to the previous month both for indices, at 54.7 and 54.2 respectively, remaining strongly above the 50 threshold.

- GBP Services PMI – Expectations – The Services PMI in September is expected to come out lower than last month’s, also following the reduction in the September Construction PMI.

- US Services and Composite PMIs – Expectations – The Services PMI for September is expected to grow in September while the Composite PMI is expected to remain at the same levels.

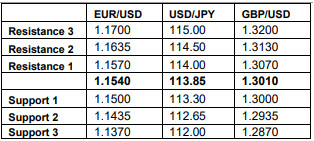

Support and Resistance Levels

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/03 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.