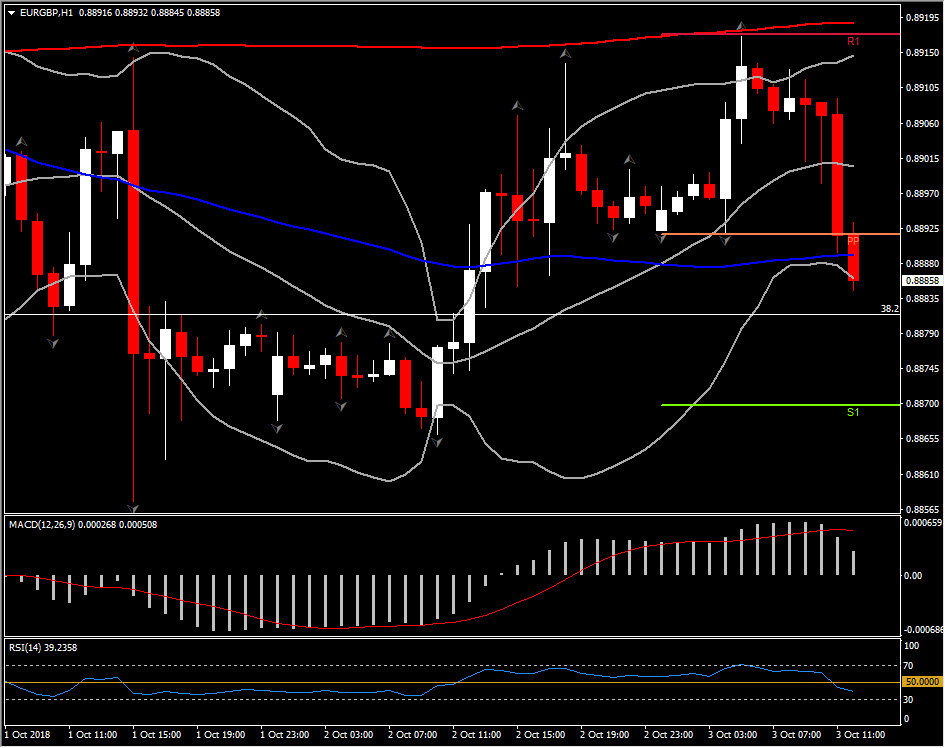

EURGBP, H1

Eurozone services PMI confirmed at 54.7, as expected and up from 54.4 in the previous month. The composite reading meanwhile was revised slightly down to 54.1, versus 54.2 in the flash reading and down from 54.5 in August, as manufacturing sentiment declined. The still robust composite reading marks mixed developments then with the manufacturing sector increasingly hit by falling export demand amid geopolitical trade tensions. By contrast services activity accelerated in September and the composite PMI still suggests solid, albeit slightly softer growth at the end of the third quarter. Markit also reported further evidence of capacity pressures, with the backlog of work increasing for the fortieth consecutive month, while employment continued to pick up – stretching the current expansion to just under four years.

Cost inflation remained sharp and output price inflation picked up, most notably in Germany. However, the survey also highlighted geopolitical worries and ongoing concerns over trade tensions. So while Markit suggests that data points to growth of almost 0.5% in Q3 and that growth rates for the first quarters may be revised higher, it also projects a slowdown in Q4 with the most worrying signs coming from exports. The steady erosion of order books meanwhile will eventually impact the labour market and hiring is likely to stop. And “with business confidence about the outlook running at one of the lowest seen over the past two years, companies are clearly not expecting any such imminent turn-around in demand”.

The Euro has remained settled in the upper levels of the day. EURUSD gained nearly 0.5% in making an intraday high at 1.1592, extending the rebound from yesterday’s 6-week low at 1.1505. Other Euro crossed have also gained, except of EURGBP which is sharply lower the last hourly session, despite the slight miss of UK September service PMI number. UK September services PMI underwhelmed at 53.9 in the headline reading, down from 54.3 in August and the median forecast at 54.

EURGBP could find Support at 0.8870, while Resistance remains at the peak of the day at 0.8917. However, the Brexit concerns and heighted economic uncertainty remained the main constraint on growth.

The focus now turns on PM May’s speech at the Symphony hall at 10:00 GMT.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/03 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.