FX News Today

FX Action: USDJPY has been trading flat-to-softer amid a backdrop of continued risk aversion, albeit to a less acute extent than yesterday as the approaching release of the September US jobs report casts a subduing influence on trading activity. US Treasury yields are up, but below the seven-year highs seen yesterday, while Asian stock markets have ebbed. USDJPY settled around 113.85-90 after registering an intraday high of 114.10 in Tokyo. The pair has remained below yesterday’s 11-month high at 114.55. In other news, the US and Japan agreed to hold talks on trade in mid-November. Japanese data today were mixed, relative to expectations. The preliminary August leading indicator lifted to a reading of 104.4, up from 104.2 in July, while household spending data jumped 2.8% m/m, well up on the 0.1% expected, despite the disappointing wage data, which showed that the inflation-adjusted figure contracted by 0.6% in August. Regarding the US jobs report, we expect a strong reading, seeing upside risk to our forecast for a 195k headline rise (median 190k), despite a likely 15k negative impact from Hurricane Florence. A strong outcome should keep USDJPY underpinned, although any pronounced declines in global stock markets could spark demand for the Yen’s safe haven credentials.

Asian Market Wrap: 10-year Treasury yields are holding below yesterday’s highs, but are up 1.0 bp from Thursday’s close at 3.197%, JGBs have moved up from yesterday’s lows and the 10-year rate is down -0.6 bp at 0.142%. Not everyone is convinced that the most recent steepening has run its course yet, but some are already advocating renewed flattening trades. Stock markets meanwhile continue to be pressured by yields that are holding at high levels, with markets being cautious ahead of US payroll data. A Bloomberg report suggesting that China infiltrated US companies with hardware hacks has added to pressure on tech stocks, with Lenovo Group down more than 20% in Hong Kong and the Hang Seng down -0.25%. while Topix and Nikkei are down -0.09% and -0.46% respectively. Chinese Markets are still closed. The ASX outperformed with a gain of 0.19%, but elsewhere markets were under pressure. US futures are moving higher after yesterday’s sell off and ahead of today’s data. The front end Nymex future is trading at USD 74.81 per barrel.

Charts of the Day

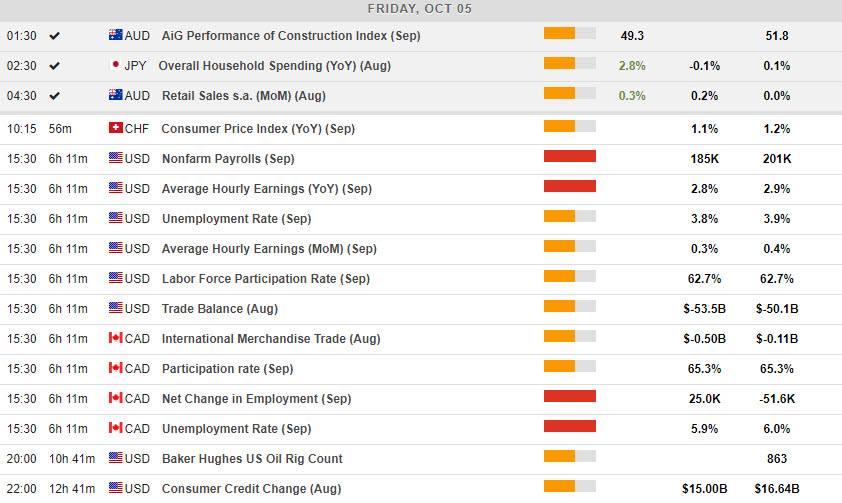

Main Macro Events Today

- Swiss Consumer Price Index – Expectations – The September estimate of the Consumer Price Index is expected to come out at 1.1%, compared to 1.2% in August.

- US NFP, Unemployment, Earning, Participation, Trade Balance Releases – Expectations – Important data releases for the US today, with NFP in September expected to have decreased its growth to 185k, compared to 201k in August. The unemployment rate is expected to have decreased to 3.8% compared to 3.9% in August, while Average Hourly Earnings are expected to have grown by 2.8% in September. The trade deficit is expected to have widened in August.

- Canada International Merchandise Trade and Employment Data – Expectations – Canada’s international trade is expected to have continued its deficit in August, reaching $0.50 bln. The unemployment rate is expected to have declined to 5.9% compared to 6% in August, while the next change in employment is expected to have been positive in September.

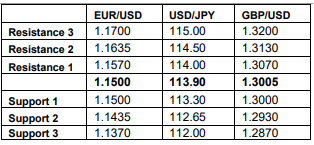

Support and Resistance Levels

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/03 15:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.