The Producer Price Index (PPI) measures the average change over time in the selling prices received by domestic producers for their output. In other words, the PPI measures the prices offered to manufacturers of goods and services, in contrast to the CPI which measures the prices consumers (end-users) pay to obtain the good or service. The prices included in the PPI measure the first commercial transaction for products and services. This was the main reason for compiling such an Index in the first place, i.e. to measure price changes in goods sold in primary markets before they reached the final stage of production at the retail market level. Overall, the PPI is another indicator of the purchasing power of money and is an important tool in the design and conduct of monetary and fiscal policy.

As you can guess, an increase in the PPI would signal that sellers are obtaining higher prices for their products and services and as a result, producers have either chosen to increase their price margins or they are witnessing higher demand for their products and services. To confirm which of the two holds we need to observe the CPI inflation over the past months. If the CPI inflation is in line with the PPI inflation, then we can confirm that price increases are due to higher demand and not because of higher margins.

Even in the case of higher margins, the PPI serves an important cause: if producer prices have increased due to higher margins then we can expect that CPI prices (i.e consumer prices) will also be increasing in the future. Hence, the PPI can also serve as a proxy of future inflation.

The rationale in regard to how the PPI affects stock and currency markets is similar to the usual CPI. If the PPI figure is higher than expected then firms are expected to generate higher profits, hence the stock market should rise. In contrast, if the PPI is lower than expected, the stock market should drop. Regarding the stock market, if the currency market expects a high PPI growth rate, then the currency should depreciate. Otherwise, if PPI is higher than expected and abides with the CPI path the currency should rise. Note though that the reactions should be much smaller compared to CPI ones, for the simple reason that the PPI is viewed as a precursor of the CPI.

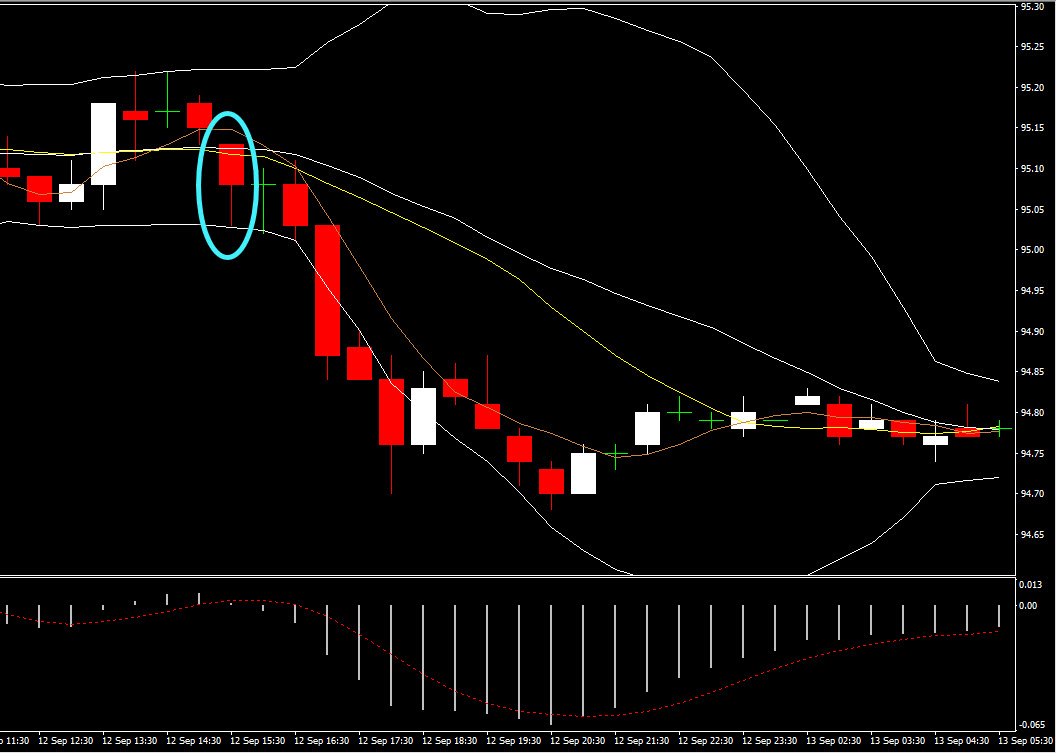

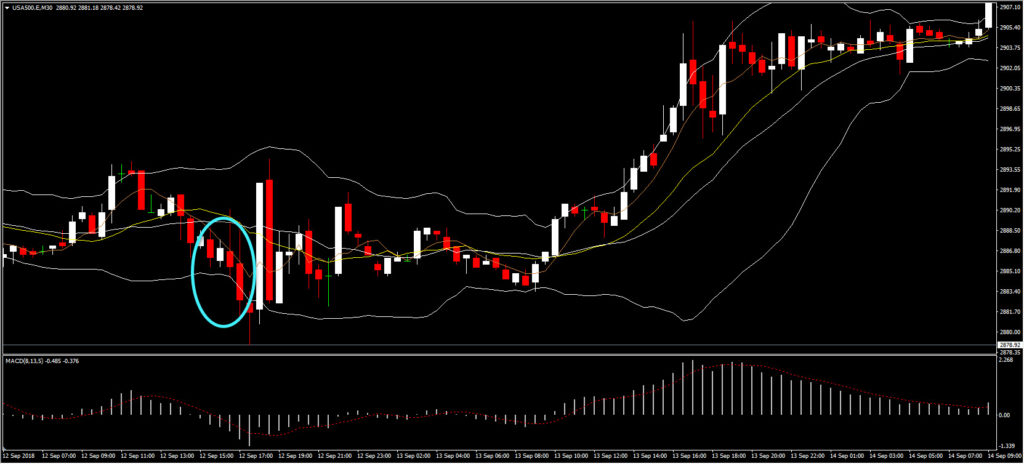

This prediction is supported by the market behaviour on September 12, 2018. The PPI came out less than expected, at 2.3%, compared to expectations of 2.7%. This prompted a negative reaction in the FX market, as the Dollar Index dropped by 5 pips. Similarly, the USA500 also dropped by 1 point on the announcement. While the market moved in the expected direction, the price volatility was not as large as in the CPI case.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/10 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.