XAUUSD, H4 and Daily

Gold prices peaked at $1,230.51 breaking 1-month range but most importantly breaking Thursday’s high at $1,226.31, which was one of the most volatile days since April, with close price $30.00 above opening. Flows into the yellow metal kicked in from the Asian open, as falling global equity markets, the US/China trade war, and most recently, tensions between the US and Saudi Arabia have seen gold revert to its traditional safe-haven role.

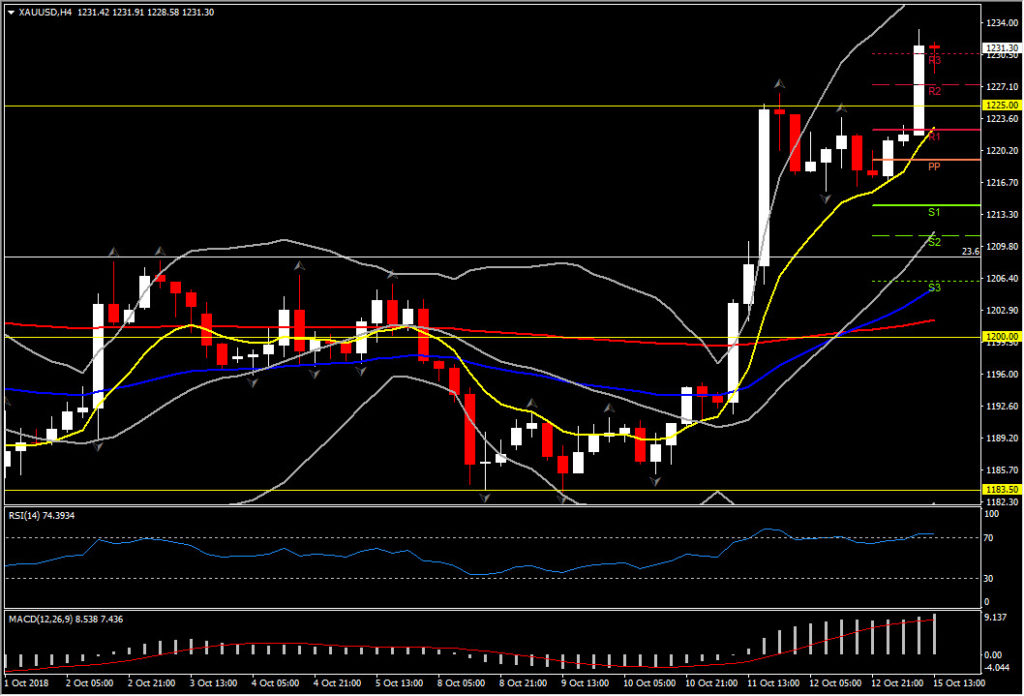

Gold was moving within the $1,180.00- $1,208.00 range since mid-August. Therefore, the hold above this range for a third consecutive day is significant for the future performance of the commodity, as it presents bullish sentiment. But is this sustainable enough?

In the near term, the commodity seems already overbought, as the price is moving around the R3 level set from Pivot Point analysis. In the 4-hour chart, the Bollinger Bands have expanded due to the recent high volatility. The Bollinger Bands expansion could signal that the asset is trending in the direction of the expansion overall (i.e. to the upside), but could also suggest small pullbacks in the near term. Therefore, in the short-term, corrections to the downside could be seen.

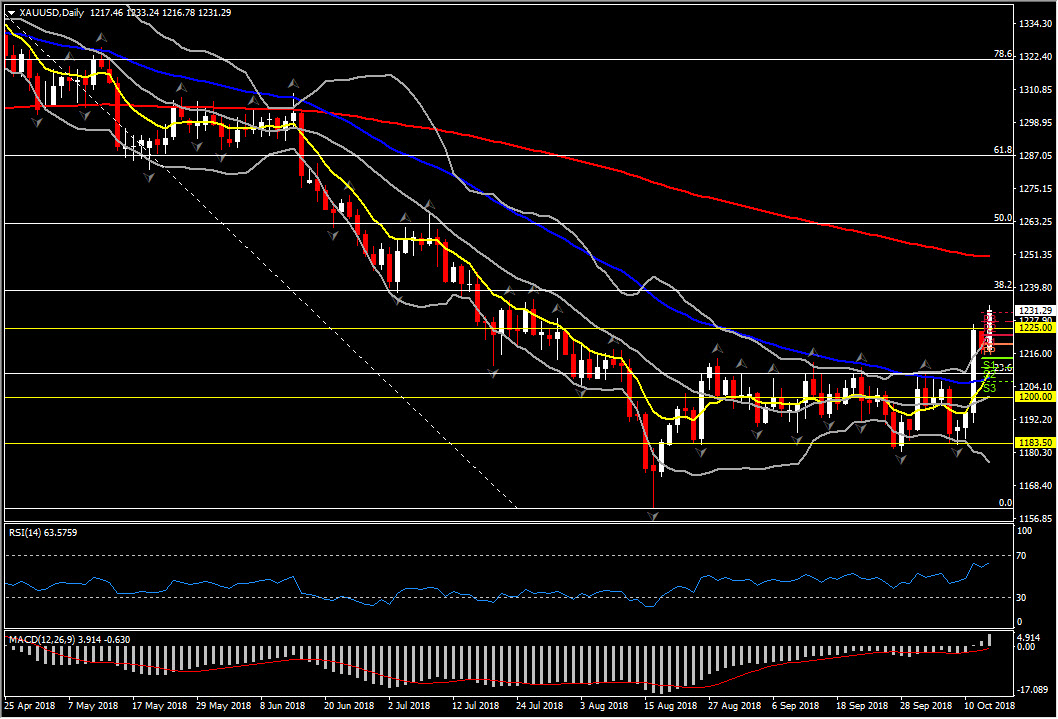

Momentum indicators are presenting increasing bullish bias for XAUUSD, with RSI consolidating around overbought barrier, while MACD surpassed its signal line, amplifying further bullish bias towards the next Resistance level. The next resistance level is set at the 38.2% Fibonacci retracement, at $1,238.00 from $1,365.00 peak down to $1,173.78. A jump above this hurdle would be a surprise that could boost the market to the next key level at July’s high at $1,265.88.

The daily momentum indicators also support the positive outlook for gold, as RSI crossed the neutral zone, currently it is at 63 and still sloping positively. MACD turned into positive above its signal line. However, the bullish outlook for gold is still uncertain as the asset needs to build a strong support area around the $1,210.00- $1,214.00 area, in order to claim that this 4-month drift has reached an end.

Nevertheless, fundamentals are still in play, as the Fed rate increases are yet to come, which should support the Dollar; further gold price declines can be expected.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/16 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.