The US fiscal deficit for the fiscal year 2018 was just reported to have increased to $779 billion, or approximately 4% of GDP for the period. As Reuters notes, the deficit has been the largest reported since 2012, during a time when elections were coming up and the economy was still at a low interest rate environment and perhaps also in need for more government spending. It is known that bond traders keep a close eye on fiscal and monetary developments. In the latest post on Fiscal Policy, I have commented how interest rates affect government finances but I have left one important piece out of the equation: how Fiscal Deficits themselves affect bond yields.

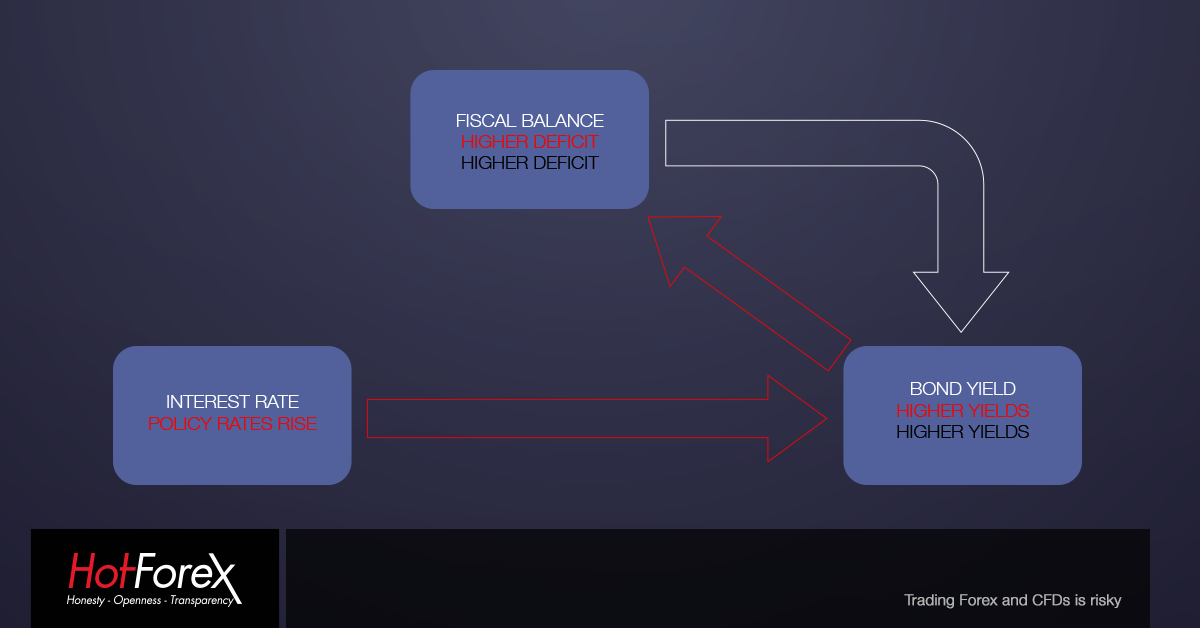

Overall, recall that higher interest rates, or even expectations of higher interest rates, cause bond yields to rise, given that investors demand higher compensation for their money as interest rates increase. This leads to raising the cost of borrowing for the government, which in turn leads to higher deficits, all else equal. Naturally, it could most likely be the case that interest rates have increased because of improved economic conditions and hence more taxes will be flowing in to cover for the raise in the bond yield.

Another important point is that fiscal deficits tend to also increase bond yields simply because there is more debt running for the same amount of investor funds. As such, investors can potentially gain higher compensation as demand for their funds has increased. Furthermore, the higher the deficit, the more unlikely it is that the state will remain able to meet its repayments. Consequently, higher, persistent deficits are indicative of higher risk in the economy as potential fiscal actions would need to be taken in the future, i.e. increases in taxation or spending cuts. This surge in non-payment risk is bound to increase yields as well.

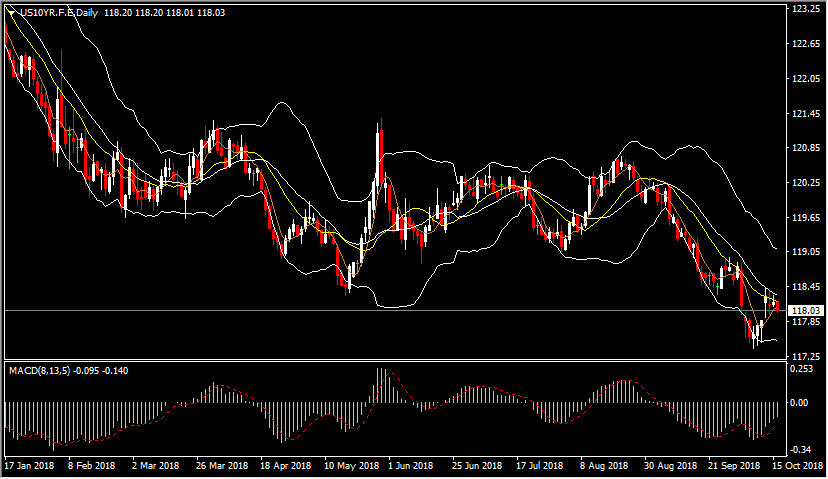

In the case of the US, the current situation is indicative of both happening at the same time: the government keeps maintaining a large fiscal deficit and the Federal Reserve is on a bout of interest rate increases which should not end soon. The policy-important question is what happens to the economy when the government is forced to slash spending or increase taxation in order to maintain a sustainable fiscal position. As studies have shown, drops in spending can result to approximately one-for-one reductions in the GDP growth rate, although this effect is mostly observed in periods of recession. Still, in the US case, even a 0.5% drop in GDP growth for a 1% reduction in government spending could have important effects on its growth potentials, especially if it also constraints fiscal space during a recession. The US bond yield has been reflecting these developments as its price has been declining, which suggests that the bond yield is increasing. In fact, the combination of the two effects has sent the yield at more than 3% in September, for the first time since 2011.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/16 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.