FX News Today

European Fixed Income Outlook: The December 10-year Bund future opened at 158.89, down from a close of 158.16 yesterday. Hawkish Fed minutes put pressure on bond, as well as stock markets, and the 10-year cash yield is trading above 0.46% after closing at 0.459% yesterday. UK100 futures are moving higher, while US futures are heading south, following a weak session in Asia. Confirmation that EU-27 leaders didn’t see sufficient progress in Brexit talks in order to schedule a November summit to sign off a deal, put fresh pressure on the Sterling. Elsewhere in Europe, though, risk aversion is likely to hit stock markets, especially as the US singled out Germany’s trade surplus with the US at a course for “significant concern”. Brexit jitters, aside Italy’s fiscal problems, also remain in focus. The data calendar holds Eurozone Balance of Payments data, as well as UK public finance data.

FX Update: The Dollar has traded mostly firmer in the wake of the release of the Fed minutes to the late-September FOMC meeting, which revealed policymakers remaining committed to gradual tightening. The USDIndex has printed an eight-day high at 95.75, and is now up by just over 1% from the three-week low that was seen on Tuesday. EURUSD has concurrently posted an eight-day low, at 1.1482, and USDJPY and eight-day high, at 112.71. Moderate demand for the Yen amid a souring in risk appetite across Asian stock markets has seen the USDJPY ebb back some. The US Treasury declared that China was not a forex manipulator (no doubt to the chagrin of President Trump), which prompted fresh weakness in the Yuan today. PBoC set the reference rate for USDCNY higher, at 6.9275, up markedly from 6.9103 yesterday, before the Yuan extended declines, putting the Chinese currency at its lowest levels since January 2017. The Yuan has declined by just over 10% versus the Dollar since April..

Charts of the Day

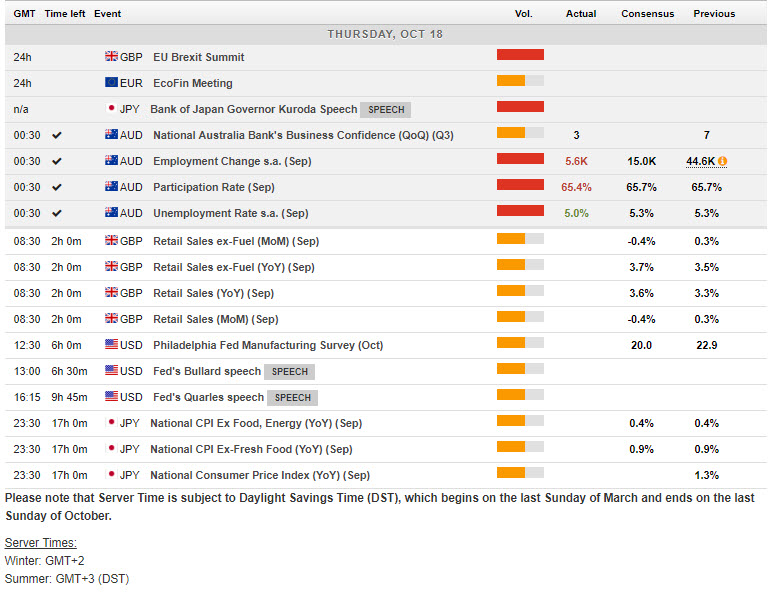

Main Macro Events Today

- UK Retail Sales – Expectations – The September retail sales expected to reach 0.3% m/m contraction (median -0.4%) after 0.3% growth in the month prior, with the y/y rate seen lifting to 3.7% y/y from 3.3%.

- Philly Fed Manufacturing Index – Expectations – It is expected to ease to 21.0 from 22.9. This compares to the already released Empire State measure which posted a climb to 21.1 from 19.0 in September. More broadly, we expect to see a slight easing in producer sentiment in October with the ISM-adjusted average of all measures easing to 58 from 59 in both September and August.

- US Unemployment Claims- Expectations – Claims data should post a 6k increase to 220k from 214k last week and 207k in the week prior to that.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/18 15:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.