Focus turns on September Canadian Inflation and Retail Sales data tomorrow:

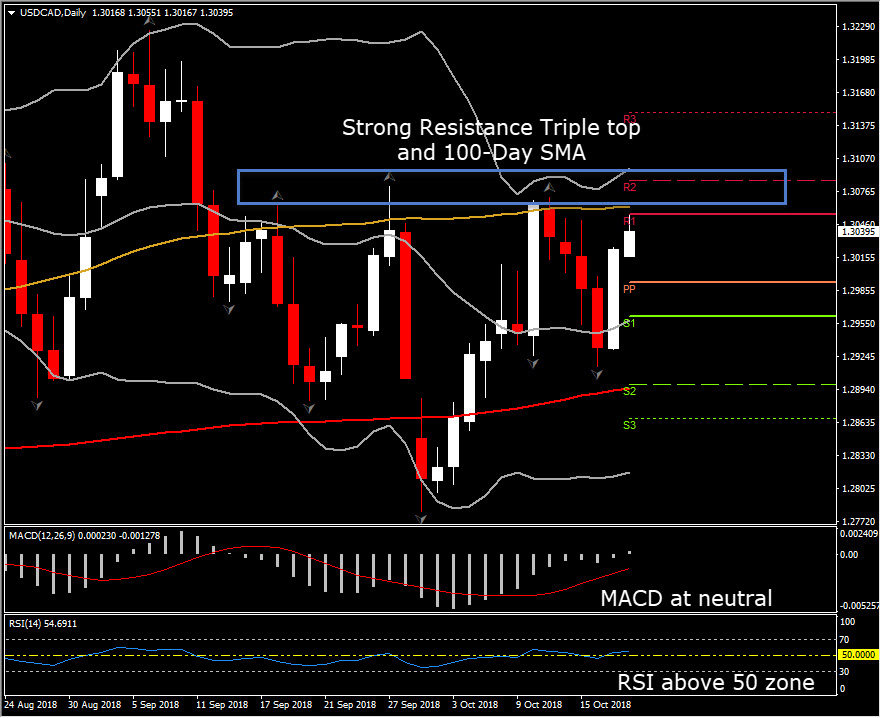

Canada’s top tier releases book-end this week’s docket, with the BoC’s Business Outlook Survey on Monday and the September CPI and Retail Sales due Friday. Ahead of tomorrow’s announcements, loonie currently retesting a key Resistance area at 1.3060-1.3080, which coincides with triple top since September 18 and the 100-day SMA. A Failure to break above this strong area, could suggest near term weakness. The Daily Support holds at 20-day SMA, at 1.2960.

Meanwhile, as seen on Monday, BoC’s autumn Outlook Survey revealed robust near term business prospects. The future sales indicator improved to 15.0 in Q3 from 6.0 in Q2, as firms expect sales growth to continue improving. The investment indicator “rebounded to a high level” while hiring intentions have eased but are still positive. Capacity pressures remain elevated, reports of labour shortages have intensified and reached near-record levels. Inflation expectations remain in BoC’s 1-3% band, with a majority of firms expecting inflation in the upper half of the band. The survey was conducted before the USMCA agreement on September 30. Hence, firms outlooks were upbeat going into the agreement, suggesting that sentiment will add on to an already positive outlook. The survey adds further support to the already strong case for a 25 bp rate hike from the Bank on October 24 and ongoing policy normalization through next year.

The 2nd highlight for the Canadian calendar is tomorrow’s release on Inflation and Retail sales.

Canadian CPI:

- CPI is expected to rise 0.1% in September after the 0.1% decline in August. The CPI is projected to grow at a 2.7% y/y pace in September, easing slightly from the 2.8.% pace in August and the 3.0% rate in July that was the top of BoC’s 1-3% target range. This could add further support to the Bank’s view that the run-up in CPI through July was due to temporary factors that are now unwinding.

- Forecast Risk: Gasoline prices were little changed in September, which should restrain the index. But tuition costs, which enter the calculation every September, rose 3.3% for the 2018/19 school year, a a bit stronger than recent years. Mortgage costs were on the rise amid higher interest rates, although declining housing prices could provide some offset. Rising tobacco/alcohol prices could also be a factor.

- Market Risk: In the September announcement, BoC said the jump to 3% CPI in July was “higher than expected” but “in large part because of a jump in the airfare component” of the CPI. Their expectation is for CPI to move back to 2% by early 2019. And the core measures remain “firmly around 2 per cent.” As long as the core measures hold close to 2%, a still firm total CPI will not be interpreted as hawkish for BoC policy outlook. Moreover, a realized 2.7% pace in September, while elevated, would continue the moderation from July’s 3%.

Canadian Retail Sales:

- Canada’s retail sales values are expected to rise 0.6% in August after the 0.3% gain in July. The ex-autos sales aggregate is projected to expand 0.3% in August after the 0.9% run-up in July.

- Forecast Risk: CPI dipped 0.1% in August after the 0.5% m/m surge in July, suggesting that prices will play little role in retail sales values during August. Indeed, gasoline prices fell 1.6%, which should be a modest drag on total and ex-autos sales values. Vehicle sales are expected to improve in August after falling June and July, supporting total retail sales.

- Market Risk: While a pick-up in retail sales values would support widespread expectations for a 25 bp hike from BoC next week (economy at full potential, core CPI at 2% drives rising policy rate) the details of this report may throw the bond market a bone in the form of a weak (or negative) real sales change. Notably, CPI surged in July and saw only a modest slowing in the annual rate during August. Hence, the risk on this report is for a mix of respectable value gains but decline in volumes. The hike-in-October outlook is unlikely to be altered by this report, but a drop in volumes would support the gradual hike scenario.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/23 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.