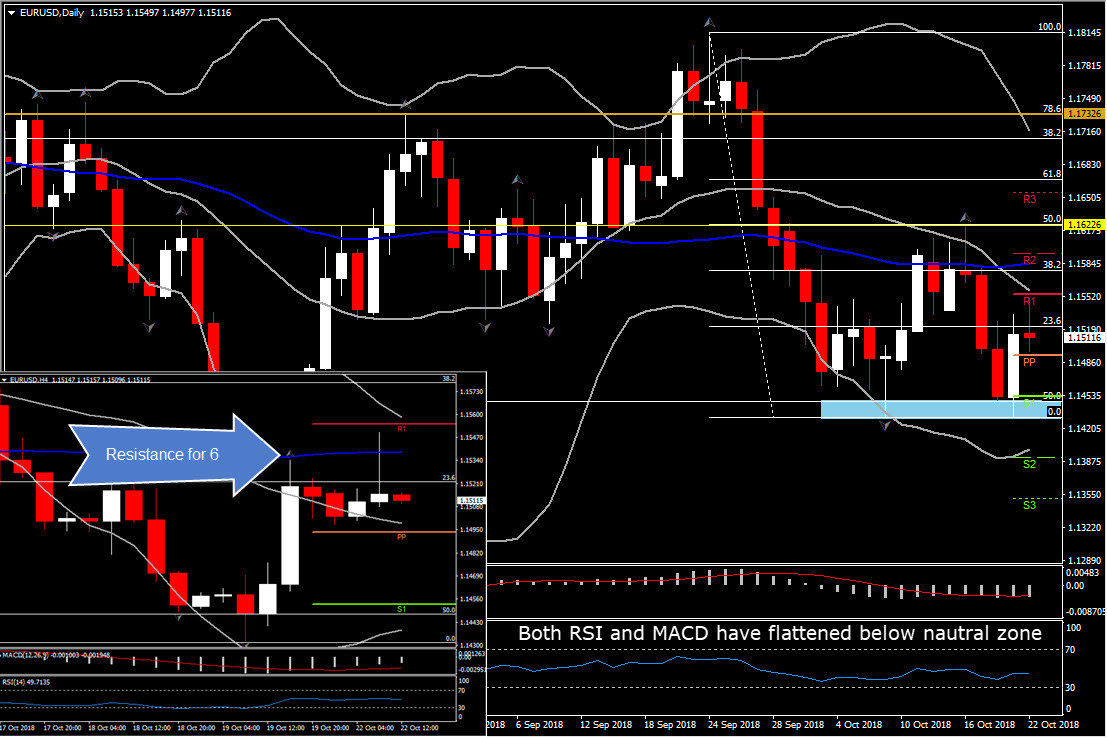

EURUSD, H4 and Daily

European stock markets are moving higher after a positive close in Asia overnight where hopes of more stimulus measures in Asia underpinned a rally on mainland China bourses. Italian assets are outperforming this morning as concerns over the fiscal plans and the tensions with the EU ease slightly, hence Italian 10-year yields are down -14.0 bp at 3.33% so far, something that provides support to the Euro.

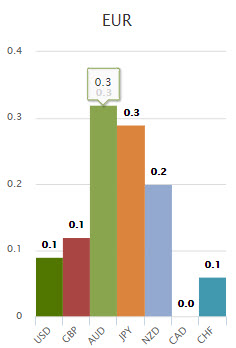

EURUSD, meanwhile, has lifted to a 3-day high at 1.1549, driven by broader Euro gains, and reverting more than 23.6% of October’s losses. EURCHF and EURGBP have also lifted, however EURJPY, EURAUD and EURNZD are the ones to see the highest extent. EURJPY has edged out a 6-day high, as the Japanese currency underperformed amid a China-led rebound in stock markets in Asia following a fresh turn of verbal interventions from Chinese officials, with President Xi pledging to support the private sector, employing cuts in personal income tax rates, among more measures.

Euro outlook, though, remains on the negative side, especially against the US Dollar, despite the rebound from 1.1430 low seen on Friday. This rebound helped the strengthening of the Support at this level. Meanwhile, the negative momentum still holds, as the pair moves within the lower Bollinger Bands area, whilst a bearish crossover has been confirmed with 20-day SMA crossing below 50-day SMA. From a technical perspective, daily momentum indicators comply with the negative to neutral bias, as RSI and MACD lines have flattened below neutral zone. This implies consolidation intraday, but a continuation of the decline in the medium-term.

Hence in case the pair moves northwards, a break above the immediate Resistance at the confluence of 20-day SMA and R1 intraday, at 1.1555, could suggest the retest intraday of the next barrier at 1.1580-1.1595 (38.2 fib. level and 50-day SMA). In the medium-term, only a rally above the mid-point of the decline seen since September 24, at 1.1620, could boost the price towards August and September peaks, around 1.1730 and 1.1800.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/23 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.