FX News Today

Asian Market Wrap: Markets are firmly back in the grip of risk aversion, and Treasury yields corrected as the stock sell off continued during the Asian session. 10-year Treasury yields are down -2.5 bp at 2.173%, JGB yields dropped -0.4 bp to 0.142%. Asian stock markets meanwhile are a sea of red. Topix and Nikkei lost -2.26% and -2.27% respectively. The Hang Seng is down nearly 2%, and while mainland China bourses are slightly outperforming, they are also down 1-1.5%. US futures are also sliding ahead of key earnings reports this week, which together with political jitters are clouding over the outlook. Tensions surrounding the killing of a Saudi journalist, midterm elections in the US and continuing US-Sino trade tensions are just some of the risks weighing on confidence and leaving Chinese stock markets, in particular, very volatile.

European Fixed Income Outlook: 10-year Bund yields are down -1.4 at 0.432% in opening trade while Treasury yields corrected -3.2 bp to 3.164%. Risk aversion is dominating once again and Italian BTPs is once again under pressure as the EU Commission is preparing the official response to Italy’s budget, while populists in Rome remain defiant. Political jitters ahead of the US midterm elections, and challenges to UK Prime Minister May as well as German Chancellor Merkel that will make it even more difficult to find a Brexit agreement leave markets with considerably more anxiety about the global outlook than central banks that remain on course to take out more stimulus. Released at the start of the session German PPI inflation came in higher than expected at 3.2% y/y, but that didn’t prevent the rise in Bunds. Still to come the calendar features the UK CBI industrial trends survey as well as Eurozone consumer confidence data.

Charts of the Day

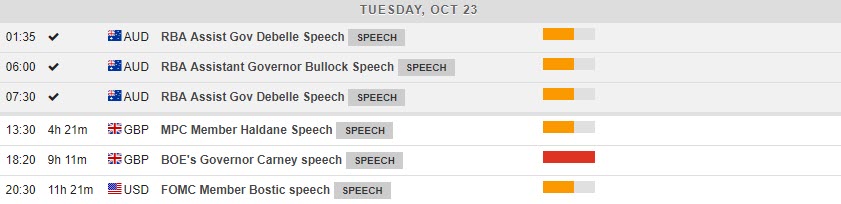

Main Macro Events Today

- Today’s most important events include speeches from Central Bank authorities, namely from BoE Governor Mark Carney, MPC Member Andy Haldane, and the Fed FOMC Member Raphael Bostic.

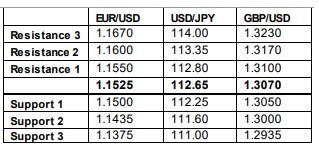

Support and Resistance Levels

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/23 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.