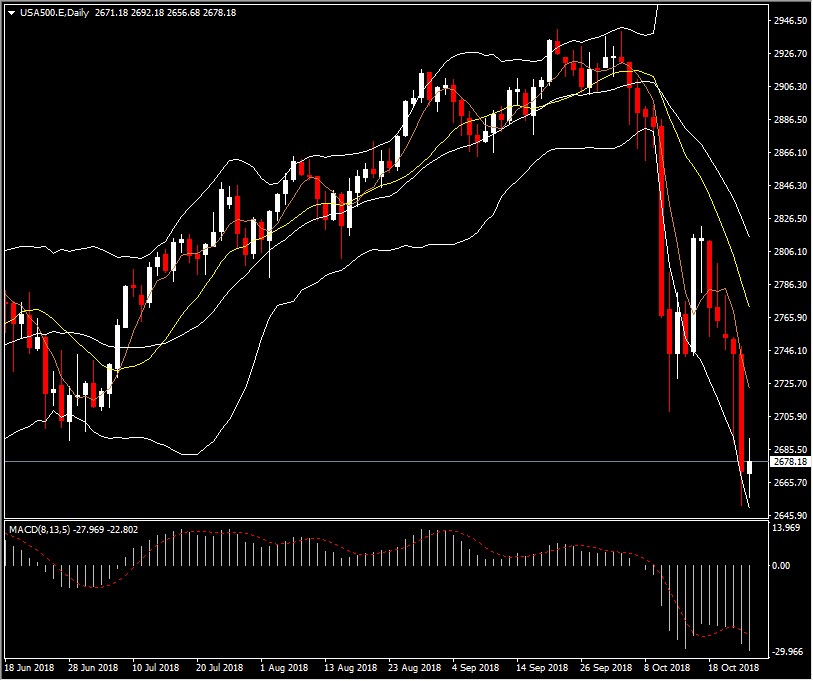

The USA500 has dropped about 8.1% in October, causing a lot of discussions in the investor community. The reasons behind this drop can be found here. The most interesting question, that no-one has bothered answering, is whether the drop in the market has made stocks more or less appealing than before. The answer is that the large correction wave has actually made the USA500 more attractive. In particular, the Price/Earnings (PE) ratio of the Index has declined to 21.68, its lowest level since September 2015. For comparison purposes, the average value for the 2000-2018 period stood at 25.9.

However, before we launch into a buying spree of the index, let’s first examine the underlying fundamentals of the US economy. To begin with, the US has been growing strongly and steadily and across all sectors of the economy over the past years. In response to this, the Federal Reserve has actually started to raise interest rates in order not to allow the economy to overheat. At the moment, the Fed is backing its forward guidance stance, by hiking rates as predicted.

The economy has been behaving a bit strangely lately, though. Manufacturing PMIs came out lower than expected at the beginning of the month, but the Services PMI was positive. Despite the drop in NFPs, attributed to the hurricane season, all other labour market data were positive. Consumer credit has increased by more than expected, hence no impact of the rate hike on financial conditions can be observed, although CPIs and Retail Sales were lower, again perhaps due to the hurricane season. Still, the US economy appears resilient as ever, even though the impact of the China trade war looms over its long-term potentials. In this analyst’s view, as also iterated in HotForex Quarterly Outlook, the US economy is likely to continue to grow at the cost of higher inflation if the trade tensions continue. Politics have been running the show on Wall Street and Main Street and they are not expected to stop any time soon. Kashoggi-Saudi Arabia, China, Russia, Turkey, Europe, Canada, and Mexico are just examples of cases when the US foreign policy provided a backstop to business performance.

Should traders buy or sell then? The answer depends on how much they trust that the policies followed by the administration will not harm business prospects in the long-run, or even if they do, that their effect will not be large enough. It could also be the case that many of these issues will be resolved soon. Until then, we let the trader decide whether it will be profitable to invest or not.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/30 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.