FX News Today

FX Update: The Yen has traded with a firming bias while the Australian Dollar and other Dollar bloc currencies have underperformed amid fresh risk aversion in global markets. USDJPY has drifted to the lower 112.0s, approaching the 11-day low seen on Wednesday at 111.82, while EURJPY ebbed to a two-month low and AUDJPY to a fresh six-week low, reflecting renewed safe haven demand for the Japanese currency as stock markets in Asia, and U.S. equity index futures, flagged soft revenue and guidance from Amazon and Google. USA500 futures were showing a 0.9% loss, nearly halving the regular-session gain the cash USA00 index saw on Wall Street yesterday. The JPN225, meanwhile, closed 0.4% for the worse. The PBoC set the USDCNY reference rate at 6.9510, the highest fixing since 2016 and up from 6.9492 yesterday. In data, the October Tokyo CPI figure met expectations at 1.5% y/y. EURUSD has found a toehold after printing a two-month low late yesterday at 1.1356 following ECB President Draghi’s dialing down of hawkishness at yesterday’s post-policy meeting press conference.

Asian Market Wrap: 10-year Treasury yields are down -2.1 bp at 3.096%, 10-year JGB yields lost a further -0.3 bp and are at 0.102%. Stock markets started mostly higher during the Asian session after a strong close on Wall Street, but many indices struggled to hang on to gains. U.S. futures are also heading south again as Amazon and Alphabet results dented optimism for tech stocks once again. As of 5:20GMT Topix and Nikkei were down -0.05% and -0.16% respectively. The Hang Seng Was down -0.88%, Shanghai and Shenzhen bourses lost -0.46% and -0.21% while the ASX managed a marginal 0.02% gain. Volatility seems to remain the order of the day amid the multitude of geopolitical risks and amid concerns that earnings have peaked and will increasingly reflect the impact of trade tensions.

Charts of the Day

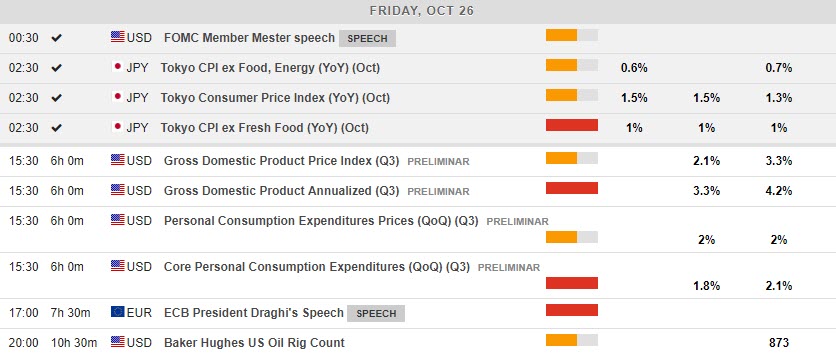

Main Macro Events Today

- US Real GDP – Expectations – The most important figure on the US is expected to come out at 3.3% at an annualized rate, down from 4.2% last quarter, also on account of the Fed rate hikes and the hurricane season.

- US Personal Consumption Expenditures Prices – Expectations – The Fed’s favourite inflation measure is expected to remain stable at 2%, right on the Fed target.

- Draghi Speech – Expectations – The ECB President is expected to speak at the National Bank of Belgium.

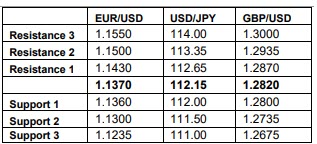

Support and Resistance Levels

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/30 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.