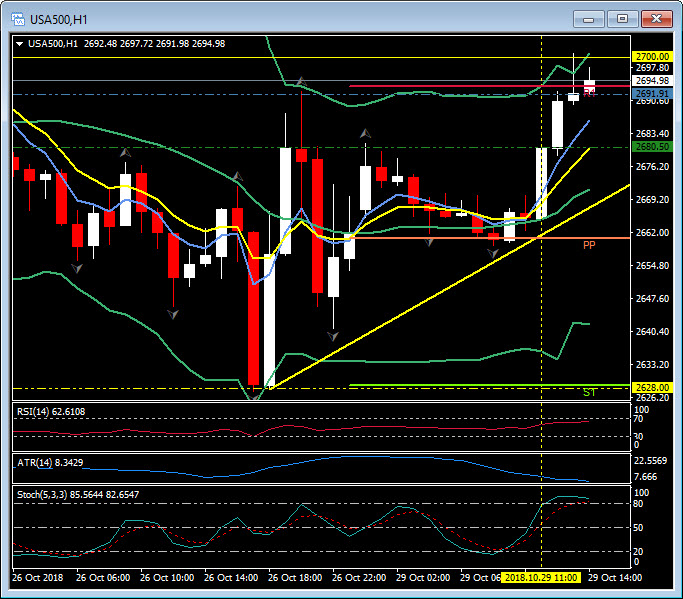

USA500, H1

European stock markets rallied, led by the Italian MIB, which was up 2.64%, earlier after S&P left Italy’s BBB rating unchanged and only lower the outlook to “negative”. Signs that the era Merkel in Germany is coming to an end didn’t seem to phase the GER30, on the contrary, while it may add to political uncertainty, many also see the chance for more fundamental changes and reforms in Germany and the EU and the GER30 managed to gain 2% this morning, outperforming the UK100, which is up 1.6%. The positive session in Europe followed a mixed close in Asia overnight. Topix and Nikkei didn’t manage to hold on to early gains and closed with losses of -0.40%and -0.16% respectively. The Hang Seng meanwhile bounced back from lows and was up 0.38% at the end and while Shanghai and Shenzen bourses lost more than 2%, the ASX rose 1.11%, the Nifty 50 gained 2.2%. U.S. futures are also moving higher, amid the broad rally in Europe. The USA500 recovered from Fridays low at 2628 and ran to 2700 ahead of the PCE data.

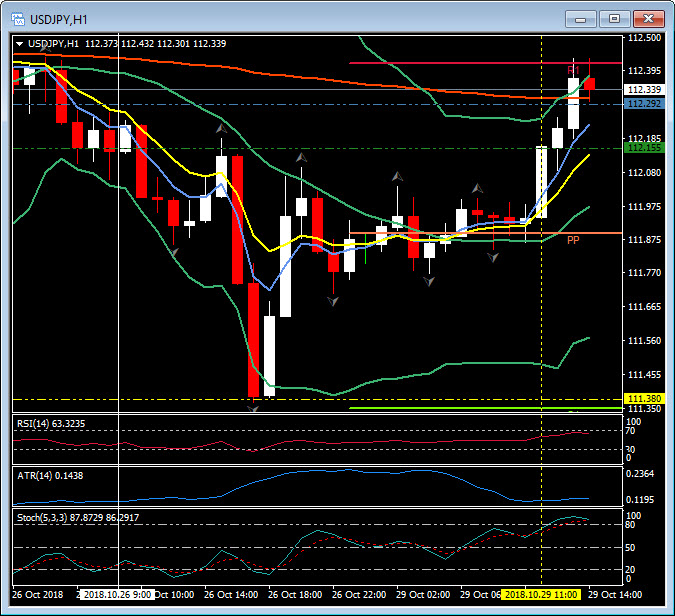

US personal income increased 0.2% in September, with spending 0.4% higher. The 0.3% April increase in income was revised up to 0.4%, while the 0.3% gain in spending was boosted to 0.5%. Compensation edged up 0.2% versus the prior 0.4% gain. Wages and salaries were 0.2% higher following August’s 0.5% jump. Disposable income was up 0.2% from 0.4% previously (revised from 0.3%). The savings rate dipped to 6.2% from 6.4% (revised from 6.6%). The chain price index was up 0.1% in September, the same as August, with the core rate rising 0.2% from unchanged. On a 12-month basis the headline price index cooled to 2.0% y/y versus 2.2% y/y. The core rate was steady at 2.0% y/y. Inflation is right at the FOMC’s goal with the mix of data close to expectations the data has had minimal impact on the USD; EURUSD continues to gyrate around the daily pivot at 1.1385 and USDJPY holds the morning gains North of 112.00 at 112.30.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/30 13:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Head Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.