FX News Today

European Fixed Income Outlook: The December 10-year Bund future opened at 160.23 marginally down from the close of 160.26 yesterday. 10-year Bund yields are down -0.3 bp at 0.380% in opening trade, 10-year JGB yields are down 0.5 bp, while Treasury rates climbed 1.0 bp to 3.115%. The month end recovery on stock markets started to fray at the edges during the Asian session with Japanese bourses under pressure again and NASDAQ futures also heading south. UK and DAX futures are also pointing to a weaker open in Europe despite reports that the UK and the EU have reached a tentative deal on financial services that would continue to give UK banks access to the European market. The report boosted the Pound, which in turn will likely keep a lid on the FTSE 100 as the focus turns to the BoE announcement. The central bank is widely expected to keep policy unchanged, leaving the focus on the inflation report and updated projections. Released at the start of the session, Nationwide house price data was lacklustre and today’s October manufacturing PMIs are also unlikely to be a reason to cheer, with Euro Area numbers expected to confirm weak preliminary readings and the UK PMI seen falling back markedly.

Asian Market Wrap: 10-year Treasury yields moved up 1.0 bp to 3.153% overnight while JGBs recovered early losses and rates fell back -0.2 bp to 0.114%, after Japan tapped 10-year bonds for 2.25 yen. JGBs were also underpinned by losses of -0.85% and -1.06% in Topix and Nikkei, which were led by the telecommunication sector amid concerns over pricing pressures. Signals from China that further stimulus measures are underway helped other markets to move higher, while reports from The Times of London that the UK and the EU have reached a tentative deal on continued access of financial services in the UK to the European market after Brexit, strengthened the Pound and added to the improvement in risk appetite after a strong close on Wall Street yesterday. China’s manufacturing PMI improved marginally to 50.1 from 50.0. Hang Seng and SSE gained 1.42% and 0.13% respectively. The Shenzhen Comp rose 1.08% and the ASX 0.18%. U.S. stock futures are mixed, with the NASDAQ future underperforming. Oil prices are slightly lower and the front end Nymex future is trading at USD 64.93 per barrel.

Charts of the Day

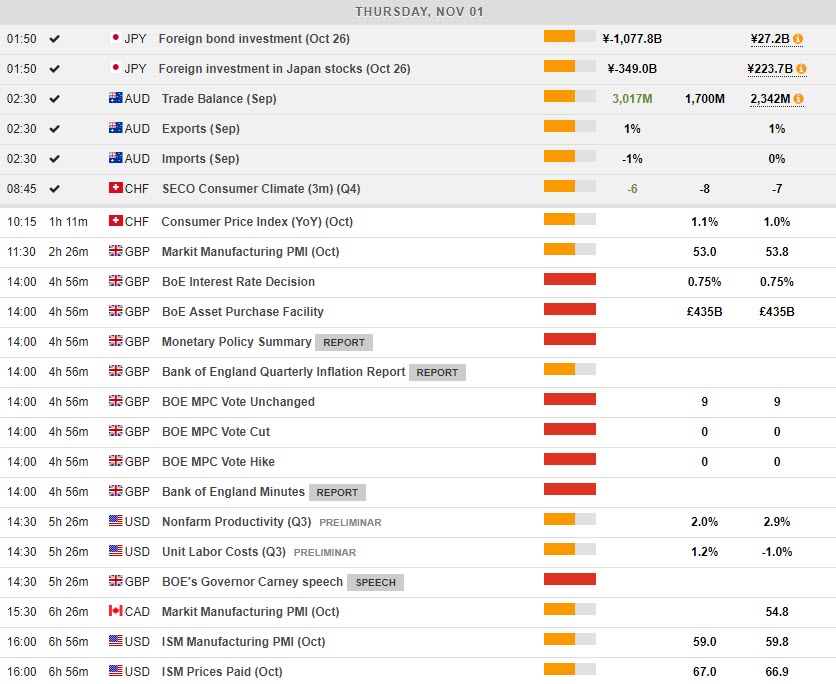

Main Macro Events Today

-

- Swiss CPI – Expectations – Inflation in Switzerland is expected to have stood at 1.1% in October, registering a slight increase from 1% in September.

-

- BoE Interest Rate Decision – Expectations – Brexit news still drive the Sterling with no changes anticipated for either the interest rate or QE. BoE is likely to repeat that a gradual, 25 bp hike per year, policy is what it is currently following.

-

- US Productivity and Unit Labour Costs – Expectations – Productivity is expected to continue its increase, registering a 2% rise compared to last quarter, while labour costs are expected to have increased by 1.2% in Q3.

-

- US Manufacturing PMIs – Expectations – The US PMI is expected to come out at 59, compared to 59.8 last month, still suggesting growth, despite its slight decline.

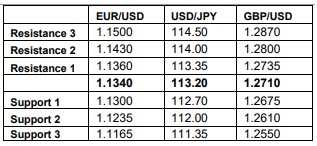

Support and Resistance Levels

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/11/01 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.