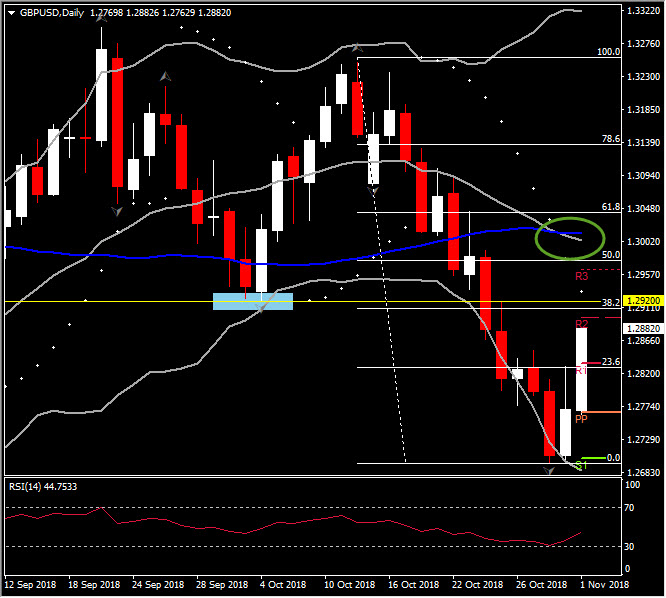

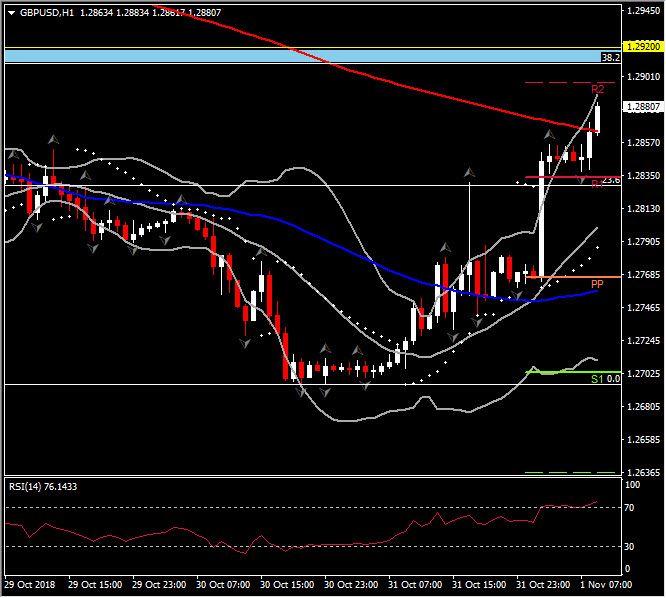

GBPUSD, H1 and Daily

BoE’s Monetary Policy Committee concludes its November meeting today, announcing at midday in London. No changes are widely anticipated for either the repo rate or QE. The Central Bank’s quarterly Inflation Report will provide updated projections on inflation and growth, which it is expect to be little changed from the previous report in August, although an upward nudge in inflation projections seems likely. BoE is likely to repeat its message that a gradual, 25 bp hike, in the repo rate per year policy path is in play. BoE will caveat its forecasts with increased wariness about Brexit uncertainty and risks stemming from what appears to be a worsening in the global business environment (diminishing monetary liquidity, trade protectionism, geopolitical risks).

Regarding Brexit, the EU have stepped up contingency planning for a no-deal scenario, with officials having agreed on Tuesday, to hold a series of seminars over the next month on issues including citizens’ rights, transport, border controls, customs, and financial services. According to reports, both UK and EU officials are still hoping a deal can be reached before December, which would allow time for it to be passed up to both the British and EU parliaments before the deadline on March 29 next year. The sticking point is the Irish backstop issue (the Irish/EU’s insistence for the border between Ireland and Northern Ireland to remain free-flowing in whatever Brexit scenario). Even if a deal is made, however, the divides in the Tory-DUP governing alliance and between the Labour opposition are such that the UK parliament is likely to reject whatever deal might be produced.

Political gridlock would likely lead to a general election or a new referendum. There would be the possibility of an extension of the two-year Article 50 period, even though this wouldn’t really change anything. In terms of public opinion, polls suggest that the country remains evenly divided on Brexit, with a slight, but possibly significant, shift toward those in the call-the-whole-thing-off camp.

The Pound has rebounded from 1.2695 yesterday, and keepS moving today further to the upside, recovering nearly 1-week losses. Cable has lifted to the 1.2880.

Ahead of Brexit D-day next March, markets are likely to start pushing the Sterling lower as the risk of a no-deal Brexit ratchets higher. Hence fundamental-wise but also technical-wise, the Cable remains in a bearish outlook in the long term, as it is moving below all daily SMAs. The 20-day SMA crossed below 50-day SMA, suggesting further weakness in the near future. Intraday, the asset crossed R1 from pivot analysis, just 15 pips away from R2m, while it has trend resistance is at 1.2910-1.2920 ( 38.2% Fib.level and latest up fractal). Next Resistance holds at 1.2975. Immediate Support is set at 1.2765.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/11/01 13:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.