FOMC meets today and will issue its post-meeting statement at 19:00 GMT on Thursday. There will be no Summary of Economic Projections (SEP), and this will be the last FOMC meeting without a post-meeting press conference.

The market consensus is for no change in policy or statement language, since the Fed removed the “accommodative” reference in September, and raised rates to the 2.00%-2.25% range. The September SEP forecast revealed no change in the number of hikes in 2018 (4 hikes) and 2019 (3 hikes).

Some of the relevant economic developments that have occurred since the last meeting, include updates on the labor market, inflation and consumption.

The Labor Market

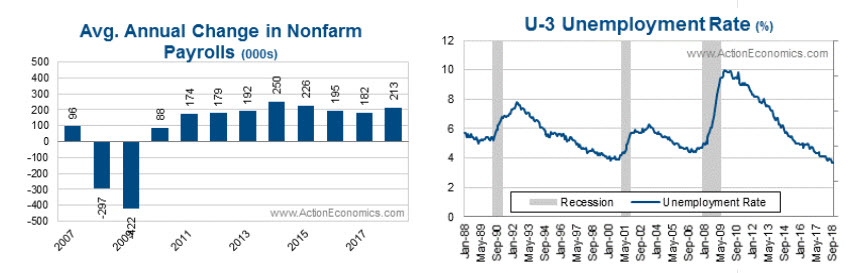

The labor market continues to be strong, with nonfarm payrolls rising at a solid pace and the unemployment rate at a 49-year low. October payrolls rose by a robust 250k, and so far in 2018, payrolls are rising at an average pace of 213k, better than the 182k gain seen in 2017 and 195k in 2016. Measures of unemployment and underemployment as well as the wage numbers also continued to show improvement in October. The unemployment rate was steady at 3.7% in October, a 49-year low.

Wages continue to show a gradual uptrend in recent months. Hence a gradual move up in Labor market is expected over the coming months.

Inflation

Recent inflation figures have moderated a bit, but remain at or above the Fed’s 2% target, in line with market expectations of a pull-back in headline y/y inflation that extends into Q4. The headline and core CPI for September rose 2.3% and 2.2% respectively, compared to 2.2% and 1.7% in September 2017. The Fed’s favoured inflation gauge, the PCE deflator, rose 2.0% y/y in September, slowing from a 6-year high of 2.3% in July, June and May. The core deflator also rose 2.0% y/y, matching a near 6-year high seen over the previous 4 months and in March of this year.

This compares to the FOMC’s latest median forecast for the 2018 PCE deflator of 2.1%. The median estimate for 2018 core PCE inflation is 2.0%. Hence the PCE and core deflator are expected to remain in a 1.9% to 2.0% range over the upcoming months.

Consumption

Consumers continue to drive economic growth. PCE growth in Q3 rose at a solid 4.0%, alongside a 3.5% gain in GDP. The retail sales data disappointed in September, however overall Q3 retail sales rose at a robust 5.1% saar and are expected to post stronger sales for October.

Stronger growth and a solid labor market should continue to support consumption going forward. Therefore PCE is anticipated to rise at a more modest but still-strong 2.9% pace in Q4 and a GDP growth rate of 3.0%.

Based on the September FOMC statement, which stated that “the labor market has continued to strengthen and that economic activity has been rising at a strong rate” ad as developments related to the labor market and inflation are broadly in line with the Committee’s expectations, the FOMC’s policy is expected to keep gradual stance.

Therefore, no policy change is expected, while another 25 basis point hike in the target range is expected in December, to 2.25%-2.50%, assuming economic and financial developments continue to line up with expectations.

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.