FX News Today

European Fixed Income Outlook: The December 10-year Bund future opened at 159.29, down from a close of 159.50 on Wednesday. 10-year Bund yields are up 1.5 bp at 0.459% in opening trade, after already moving markedly higher yesterday, as risk appetite returned and stock markets rallied following the US midterm election. US markets may hope that the split congress will reduce the chances of further fiscal stimulus and thus reduce the pressure on the Fed to hike rates again, but for Europe the impact on bond markets, at least for now, doesn’t seem clear cut. Italy will also be in focus today as the European Commission’s updated forecasts are said to put the deficit to GDP ratio at a whopping 2.9% in 2019, clearly above the government’s 2.4% target. ECB’s updated economic report is also due today and already released German trade data showed a narrowing in the sa trade surplus not just in monthly data, but also for Q3, which ups the odds of a negative Q3 GDP number next week.

FX Update:The Dollar has rebound from declines seen yesterday as the US midterms election results spelt out policy gridlock. The re-ascent of the Greenback coincided with strong Wall Street gains, where the S&P 500 closed with a 2.1%, which is the best gain seen for the day of a midterm election since 1982. The USDIndex has gained 0.3% so far today, and is now up 0.6% from yesterday’s two-week low, while EURUSD has concurrently posted a two-day low at 1.1412. The Cable and AUDUSD have seen similar price actions, while USDCAD lifted back above 1.3100. USDJPY has remained buoyant amid the backdrop of rising global stock markets. The pair posted a high of 113.73 to extend the recovery from yesterday’s brief foray below 113.00, though has remained below Tuesday’s 1-month peak at 113.81

Charts of the Day

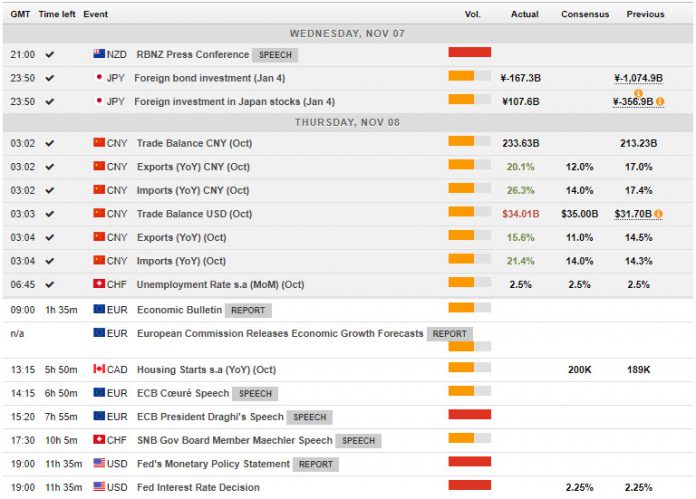

Main Macro Events Today

- ECB’s economic report – Expectations – It is unlikely to be ground breaking, with the editorial likely to be a close repeat of Draghi’s introductory statement from the last press conference. However, the report could lay the ground for downward revisions to growth projections with the updated set of ECB staff forecasts in December.

- Canadian Housing Starts – Expectations – October housing starts are seen edging higher to a 195.0k unit pace from 188.7k in September. The new home price index is projected to rise 0.1% in September after the flat reading in August.

- Fed’s Monetary Policy Statement – Expectations – FOMC is universally expected to keep policy unchanged at this week’s meeting, while reiterating “the Committee seeks to foster maximum employment and price stability”. See our report.

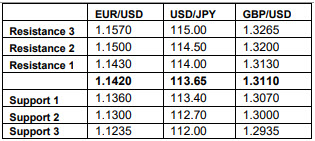

Support and Resistance Levels

Click here to access the HotForex Economic Calendar.

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.