Put simply, perhaps the most important reason for the US trade deficit is the US government itself. Allow me to elaborate: bank lending has been growing by about 4% in the past year, while the savings rate and money in circulation have been stable over the past year.

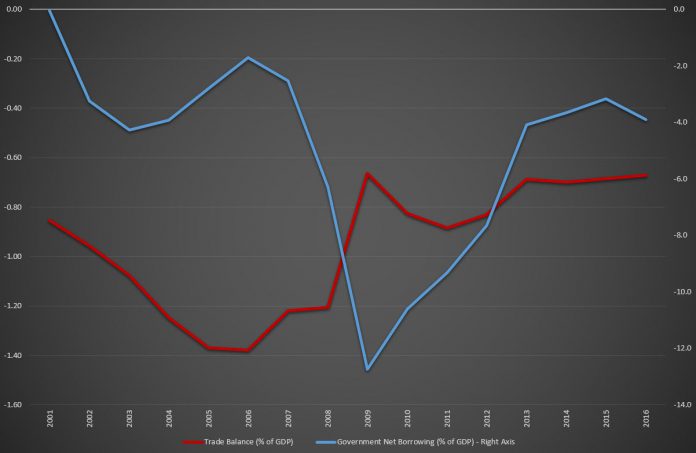

What is left is just government spending. The graph on the top of this post shows evidence of this relationship, supporting the view that a higher deficit (as a percentage of GDP) would be associated with a higher trade balance. The reason is straightforward as higher spending means that more goods and services will be consumed. Many of these goods and services actually have a large percentage of their value imported, a common practice across many companies. In a similar manner, even if the increase in spending goes to social benefits, the argument still remains.

In a simple exercise using data from the Federal Reserve of St. Louis, imports account for about 19% of private consumption, investment, government spending, after adjusting for the import share of exports, suggesting that for a $1 increase in the economy, 19 cents leave the country. If we data just for consumption then this percentage will increase, but let’s keep it on the conservative side.

On the basis of the above, of the $740 billion of government deficit in 2017, approximately $141 billion affect the trade deficit directly, as the government does not really export much. Given that the net trade deficit in 2017 stood at $552 billion, then having just one economic sector accounting for 25% of it is quite much isn’t it? The US should focus more on dealing with the mounting government debt problem than with constraining the economy via trade tariffs.

Click here to access the HotForex Economic Calendar

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.