XAUUSD, H4 and Daily

As Fed is on Track for December Tightening after Thursday’s FOMC statement, commodity prices shift to the downside with global stocks now declining as well, amid signs of slowing growth and trade/tariff issues beginning to gnaw at corporate balance sheets, if not consumer confidence, which has remained elevated.

FOMC maintained a steady policy stance, as widely expected. That said, there were minor changes in the statement and no new guidance per se. As in September, the Fed noted the economy has been rising at a “strong rate.” The labor market has “continued to strengthen,” and the unemployment rate has “declined,” versus the September assessment of “stayed low.” The Fed noted that “household spending has continued to grow strongly, while growth of business fixed investment has moderated from its rapid pace earlier in the year,” a slight downgrade from the September assessment of “household spending and business fixed investment have grown strongly.” As for inflation, “on a 12-month basis, both overall inflation and inflation for items other than food and energy remain near 2 percent.” The Fed reiterated that it expects “further gradual increases in the target range for the federal funds rate.” Accordingly, a 25 bp hike in the funds rate target is widely expected at the December meeting, to a 2.25%-2.50% band. The policy vote was a unanimous 9-0.

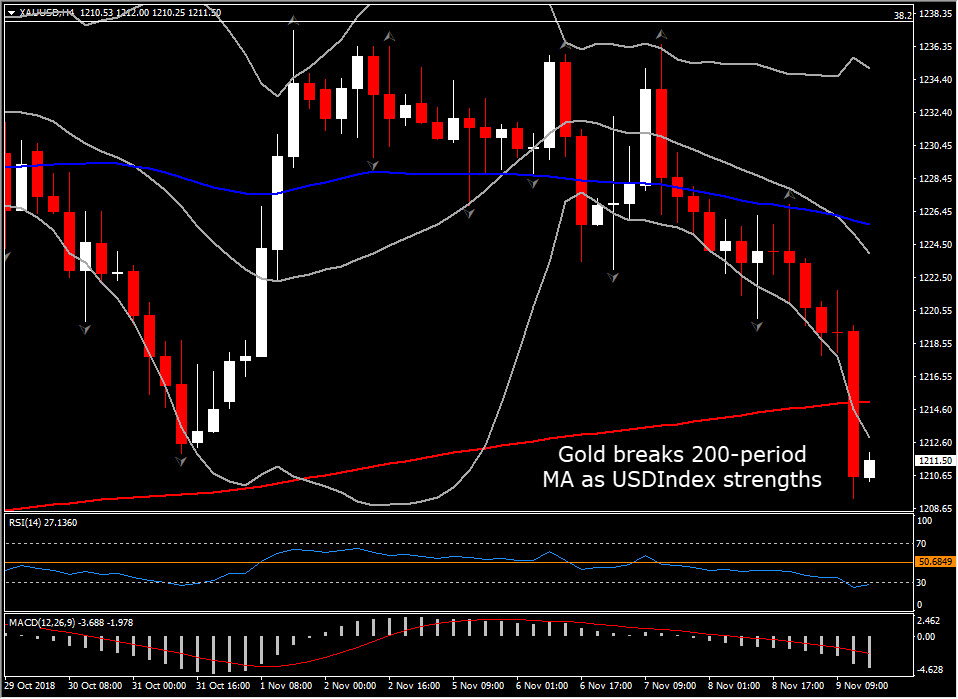

Gold made some inroads to the upside with the rising risk aversion and volatility in the markets, snapping higher from October lows of $1,183 to highs of $1,243.3, before pulling back again today to $1,210, as the USDIndex also launched from 94.00 lows to probe the 97.0 area.

Gold added to earlier losses following the hotter PPI outcome, trading to near 1-month lows of $1,209.25. Firmer yields, a higher Dollar, and expectations for a December Fed rate hike after Thursday’s FOMC statement, have all conspired against Gold prices.

The contract is now under its 230-day MA of $1,226.46, but more precisely within the strong Resistance area seen during August-September, at $1,209.00- $1,214.00. As the commodity falls for 6th consecutive day, with intraday outlook looking strongly negative, the immediate Support level could be noticed at the 50-day MA, currently at $1,209.23. However, the day’s Support holds at $1,208 area which coincides with 23.6% Fib. level since April’s peak and daily up fractal.

Declines below this Support could attract more bears in the market and therefore we could see a retest of year’s low at $1,180.00.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.