XAGUSD, H4 and Daily

Recent US data, such as last Friday’s hot PPI numbers, and the Fed’s policy guidance following last week’s FOMC meeting, have fanned expectations for a resumption in Fed tightening at December’s policy meeting, which has underpinned the US currency. The USDIndex has gained 0.5% in posting a 17-month high of 97.38, while EURUSD has concurrently printed a 16-month low of 1.1268 and USDJPY a 6-week high at 114.20.

This drags commodities to week lows, with Silver futures near $14.10, on USDIndex strength, despite the risk-off theme. The Chinese economy, which is slowing faster than expected amid growing risk that the country will have to backstop its economy with further measures to slow the outgoing tide, risking increased debt to do so, has underpinned commodities as well.

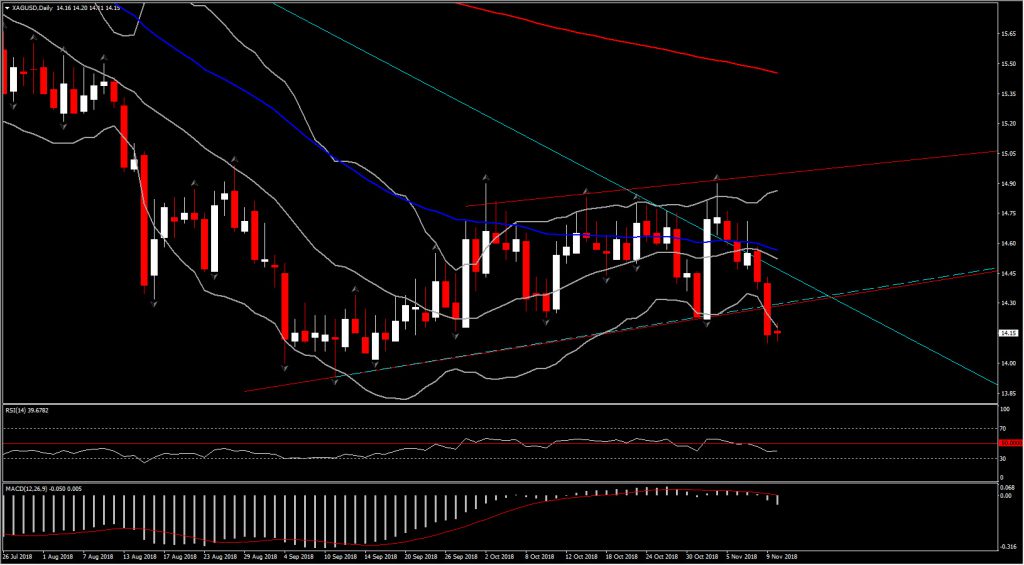

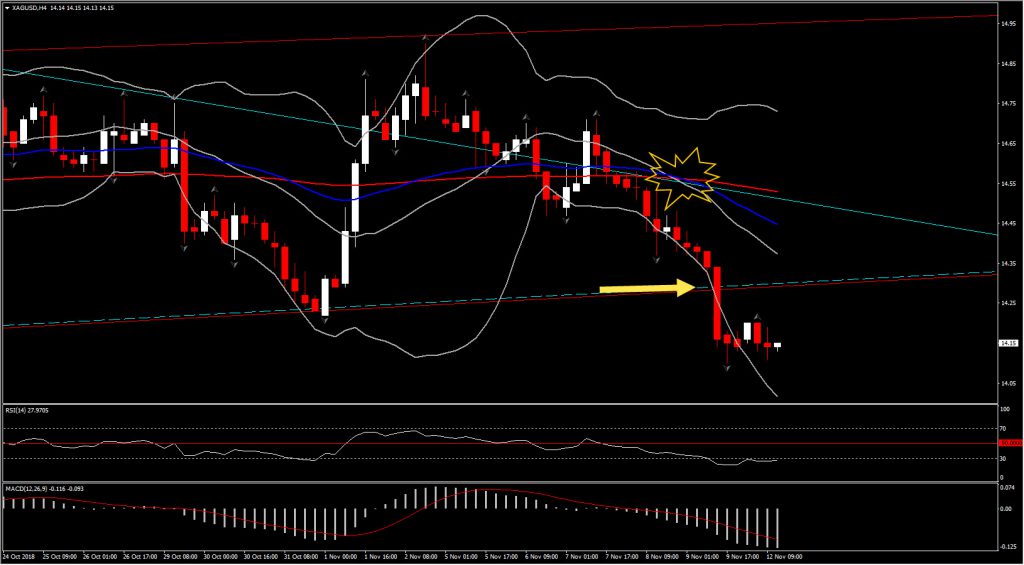

On Friday, the XAGUSD confirmed a close below the descending triangle set since June and the up-channel formed since end of September. This decisive move below the 2-month Support at around $14.20-14.22 area, and as the pair remains below this barrier so far today, assured the switch from neutral to negative outlook.

According to the momentum indicators, the market could maintain negative momentum in the short-term as the RSI flattened below 30, while the MACD oscillator posted a bearish crossover with its signal line in the 4-hour chart. Meanwhile, the MAs formed a bearish cross, with both 20-and 50-period MA crossing below 200-period MA. In the daily timeframe, XAGUSD’s picture is neutral to negative as RSI sloped below neutral, whilst MACD turned negative with signal line consolidating around neutral zone.

As the asset confirmed a leg below $14.20 on Friday, the market could retest the next hurdle at the round $14.00 level, but more precisely September’s low at $13.93. In the wake of more negative momentum, the next level in focus could be at the 2-year low of $13.73. To the upside immediate Resistance holds at $14.22, and the medium term at 20-day SMA at $14.50.

Click here to access the HotForex Economic calendar.

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.