GBPUSD,H1

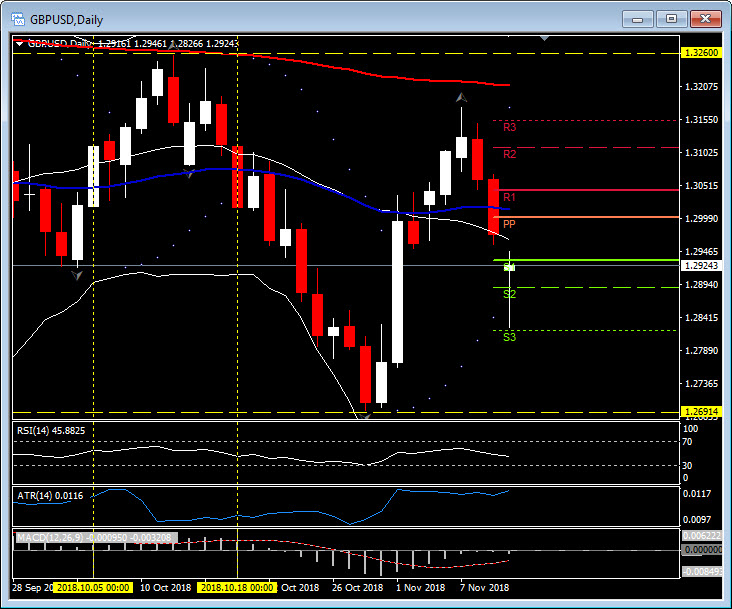

The Dollar rallied across-the-board before giving back some of its gains. The USDIndex (DXY) gained over 0.5% in posting a 17-month high of 97.58, while EURUSD concurrently printed a 16-month low of 1.1240 and USDJPY a six-week high at 114.20. Sterling racked up losses against not only the Dollar but most other currencies too; it declined 1% versus the Dollar, marked a 0.9% loss against the Yen and a 0.4% fall to the euro. Cable pegged a two-week low at 1.2827 around S3. The October low for Cable was 1.2692, the high was 1.3260.

Fundamental pressure hangs on the Euro from the uncertainty swirling around the situation in Italy, whilst a raft of negative Brexit stories continue to dog the pound. Reports from the BBC and Telegraph citing cabinet members suggesting their flagging support for the government’s Brexit plan, coming after Friday’s late resignation of cabinet member Joe Johnson, have rattled markets. Without reassurances, market participants are left with little choice but to increase the Brexit discount on Sterling. Donald Tusk is also reported (in a tweet from the Political editor of the Sun) to have Wednesday (November 14) night as a deadline for Mrs May if there is to be Brexit talks at the November 27 summit. The tweet reads – Tusk has told No10 that a deadline for a November summit is this Wednesday night. But it appears the Govt is beginning to give up hope for one. Whitehall source: “I wouldn’t get your hopes up”.If not then it drifts into the New Year, which in turn will put extreme pressure on the UK Parliament to pass all the necessary legislation in time for the March 29 2019 deadline.

Yet another “interesting” week ahead for Mrs May and Sterling.

Click here to access the HotForex Economic calendar.

Stuart Cowell

Head Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.