FX News Today

Asian Market Wrap: 10-year Treasury yields are up 0.2 bp at 3.14% and 10-year JGB yields erased earlier gains and are now down -0.4 bp at 0.10%. Chinese bonds outperformed and stock markets once again traded mixed, but with mixed roles today. Japanese equities shrugged off the expected contraction in economic activity in the third quarter that was largely put down to special factors. Topix and Nikkei are up 0.17% and 0.16% respectively. Chinese markets meanwhile, which rallied yesterday on hopes of a new round of trade talks headed south on Wednesday and the CSI 300 is down -0.85%. The Hang Seng lost -0.52%. Data releases today showed some glimmers of hope in better than expected production numbers and investment data, but consumer spending remains sluggish. Concern about the strength of the Chinese economy is spreading and has hit Australia’s stock markets. The ASX dropped a further -1.7 bp today as oil prices continue to slide. Without a meaningful catalyst, i.e. a confirmation of fresh US-Sino trade talks, the ASX is expected to remain under pressure. US stock futures are also slightly lower, Oil prices remain under pressure and the front end Nymex future is trading at USD 55.25 per barrel.

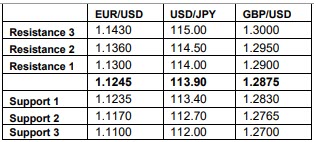

FX Update: Pound extends gains on Brexit hopes, while the Dollar pulled back, amid a backdrop of a mixed stock market performance in Asia. Japanese markets managed to outperform after yesterday’s slide, with a weaker Yen helping to underpin equity markets. USDJPY is trading at 113.88, amid a broadly weaker Yen. Chinese markets meanwhile corrected some of yesterday’s gains as hopes of new US-Sino trade talks started to fade and mixed economic data once again put the spotlight on the slowing Chinese economy. AUDUSD lifted further above 0.7200 due to sliding oil prices and concerns about the impact of a weaker China economy. EURUSD is trading just under 1.1300, amid hopes of a Brexit deal, although it is mainly the Pound that has been benefiting with Sterling rallying up to 1.5% yesterday on the initial headlines. The question remains though as to whether the deal will get through parliament, even if May manages to secure backing from the cabinet today, so there are doubts whether the Pound will be able to hold the strong gains since the announcement of a deal at negotiator level.

Charts of the Day

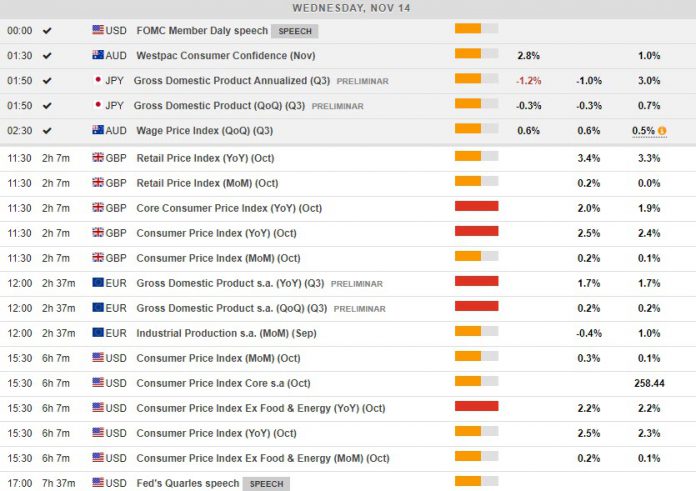

Main Macro Events Today

- UK Consumer Price Index – UK inflation is expected to have increased to 2.5% compared to 2.4% y/y in September, in view of higher than expected earnings and overall better than expected UK economic performance.

- Euro Area Gross Domestic Product – Euro Area GDP is expected to have grown by 1.7% y/y in Q3, at the same level as the previous quarter.

- US Consumer Price Index – US CPI is expected to have stood at 2.5% y/y in October, compared to 2.3% in September, while Core CPI should come out at 2.2% y/y, as was the September figure.

Support and Resistance Levels

Click here to access the HotForex Economic Calendar

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.