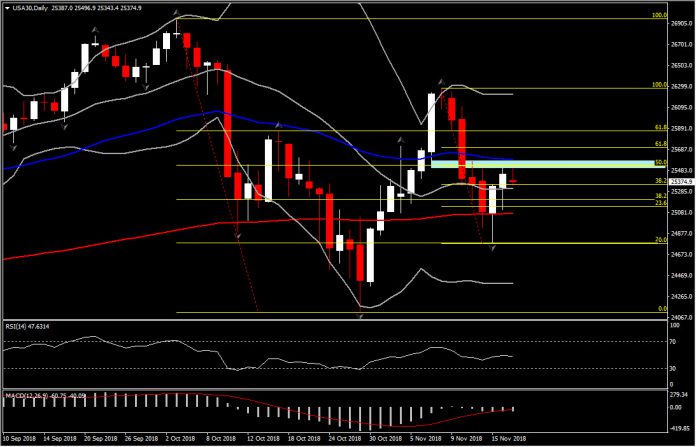

USA30, Daily

US equities are back under pressure after whipsaw trading overnight following a WSJ report that Apple has cut production targets on certain iPhones, along with antitrust accusations levelled at Micron by Chinese authorities (FT) and a frosty dialogue between US VP Pence and China premier Xi at the APEC summit. US Vice President Pence criticized China’s belt-and-road program over the weekend, and pledged to “more than double” tariffs on Chinese goods unless Beijing changes course. This prevailing sense of risk to global growth amid trade tensions weighed on US equities. News of Nissan-Renault CEO Ghosn being arrested and facing tax evasion charges also featured. Renault shares sank 10%. Japanese prosecutors allege that Ghosn schemed to under-report his income by $44 mln, along with personal use of company assets. The USA30 is 53 points lower, USA500 faltered 7 points and USA100 is 30 points lower ahead of the opening bell.

US equities reversed course lower since last week, while on Thursday, we have seen US equities reversing course into the green, in keeping with global growth concerns pared against brighter US prospects. Timing perversely occurred as Fed VC Clarida, like his boss, acknowledged slowing global growth, appearing to revive the “Fed put” and a potential longer tightening pause if the markets deteriorate further. Blue chips were leading the way higher, paced by the Dow, while tech/NASDAQ was lagging after the hammering of the chip sector.

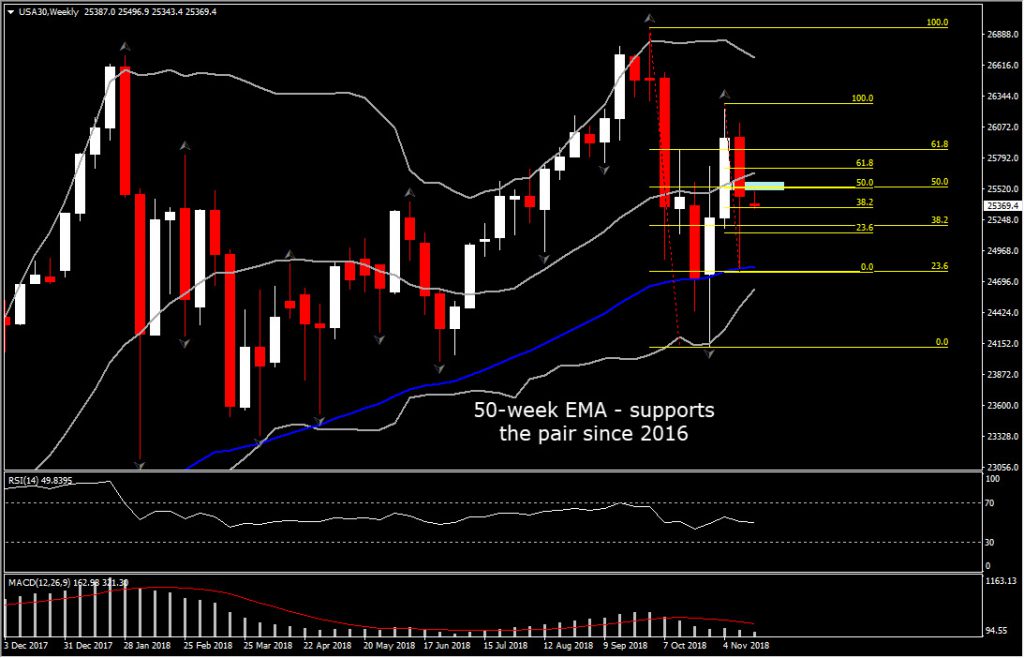

Despite Thursday’s rebound, Dow (USA30) remains below a significant level, at around $25,530 area, which is the mid point of both October’s and November’s decline. Only if the bulls manage to break and sustain a move above this barrier, could we claim the turn into a positive outlook for the asset, after the 284-point decline seen in October. Therefore a 3rd consecutive positive US Session today could leave a strong Support at $24,836.00 (50-week EMA has been providing a strong Support for the asset since 2016) and could alert the retest of November’s peak, around the $26,200 area.

Meanwhile, momentum indicators are hovering a breath below the neutral zone, enhancing the argument for a possible turn of the negative outlook into a positive one. However this has not been confirmed yet, as the RSI has flattened at 48, suggesting near term consolidation. MACD remains in the negative territory below its signal line however momentum is very low, suggesting that negative bias has been decreased.

In the flip lower again, the Dow could find immediate Support around the $24,950-$25,000 area. In case of strong downside moves, the focus will turn to the 4-month bottom of $24,120.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.