EURUSD,H1

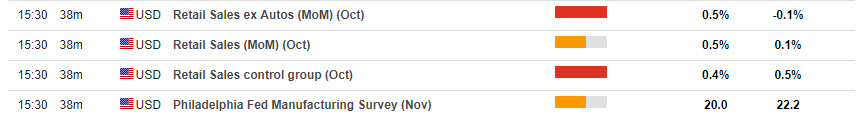

US retail sales are expected to post a gain of 0.5% in October for the headline vs 0.1% in September and 0.5% for ex-autos vs -0.1%. Forecast risk is upward, given continued firm consumer confidence measures. We saw a cycle-high gain of 2.2% in March ’10, and a expansion-low figure of -2.4% in September ’09, with a peak decline in the last recession of -3.7% in both October ’08 and November ’08. The US consumer remains fundamental to the continued growth of the US economy.

The US morning data release also includes the once highly significant “Philly Fed Manufacturing Index”. Although not as significant as it once was to GDP, with President Trump focused on manufacturing and number still carries some weight. The November Philly Fed is seen falling to 20.0 from 22.2 in October. Forecast risk is upward, boosted by tailwinds from tax reform. This compares to a cycle-high of 36.4 in March ’11, and an expansion-low of -19.6 in August ’11.

Other US data today includes the weekly initial jobless claims, trade prices, the NY Empire State data and later the weekly Oil inventories.

Click here to access the HotForex Economic calendar

Stuart Cowell

Head Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.